Perpetual Energy is coming back to life

Watch this micro cap begin to grow profitably

On or about August 1, 2024 Perpetual Energy (PMT.TO) should release its Q2 2024 operating results. Perpetual stock has been under “perpetual” pressure since the lawsuit over its disposition of certain assets to Sequoia became a persistent headache. Whatever the merits of the lawsuit, management made the bold decision to settle the case for CDN$30 million paid over time on a manageable schedule. Had the lawsuit gone the way of the plaintiff, Price Waterhouse who acted as receiver for Sequoia, it had the potential to bankrupt Perpetual, so I thought of the settlement as little more than an insurance premium to avoid needless risk.

Settling for fifteen cents on the dollar of the claim and avoiding the costs and distraction of a few more years of litigation was sensible.

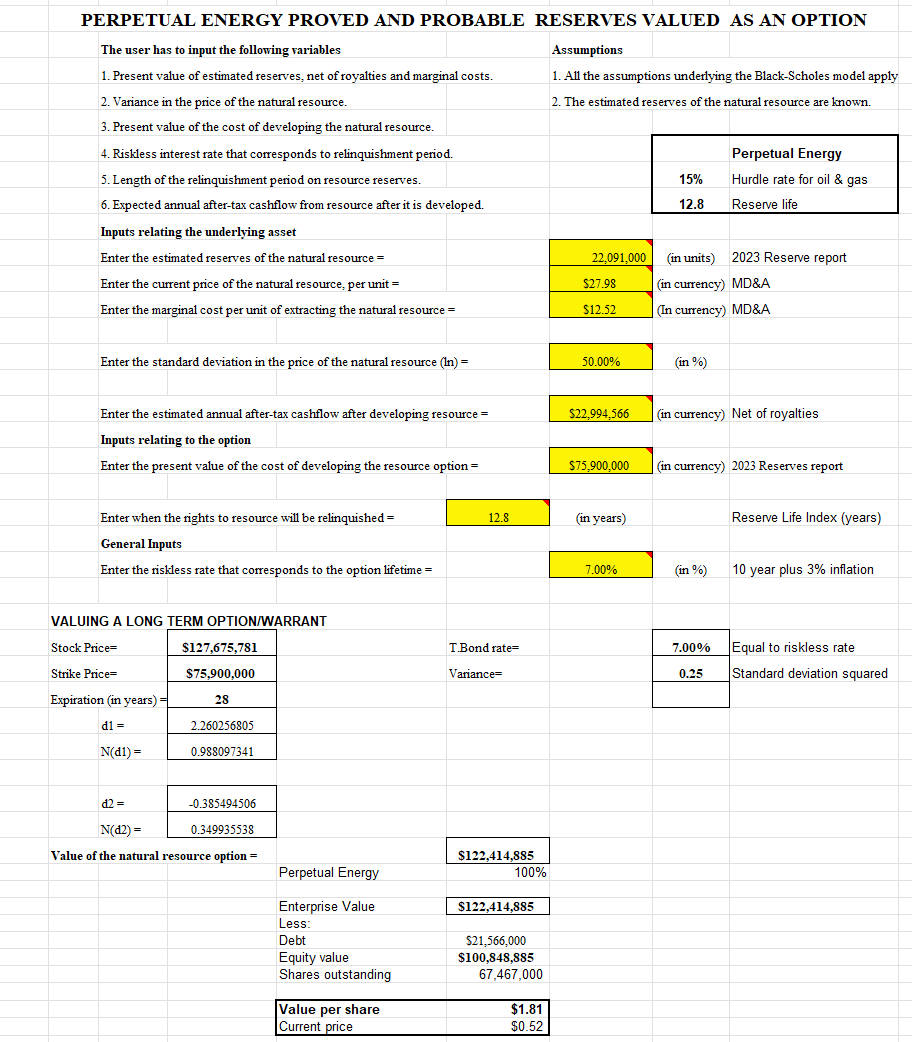

Back to business. Perpetual shares trade at around CDN$0.50 per share and there are 68 million shares outstanding. Valuing Perpetual’s reserves as an option using a modified Black Scholes methodology, I estimate the per share value at CDN$1.80 or so.

Perpetual’s production is 82 % natural gas and gas prices have been low since last year’s warm winter and the resulting rise in storage stocks. I expect gas prices to go even lower later this year during the “head and shoulders” season as the heat of summer lets up but the need to turn on the furnace is still a few weeks away. But the company has over 50% of its 2024 output protected by hedges which, at March 31, 2024, were already “in the money” to the tune of almost $8 million.

Management owns about 50 % of the shares so don’t doubt their commitment to profits. This year will be a tough one with production down to about 4,200 Boe/day and the price environment for natural gas not constructive, but the company should generate more than enough cash flow to fund its ~$8 million capital budget and pay the current portion of the settlement agreement.

I see next year as much better. I anticipate a cold winter with the onset of La Nina (I am often wrong about the weather, so make up your own mind) and in 2025 I expect the Kitimat LNG facility to begin exporting LNG while this November’s election in the U.S. may see Biden out, Trump in, and the barriers to even faster LNG growth in America fall away. As North America becomes a larger exporter of LNG, power needed for data centres experiencing soaring demand and natural gas is the fuel most able to supply low cost and reliable energy for co-generation facilities adjoint to data centres unable to draw enough power from the grid to support their needs.

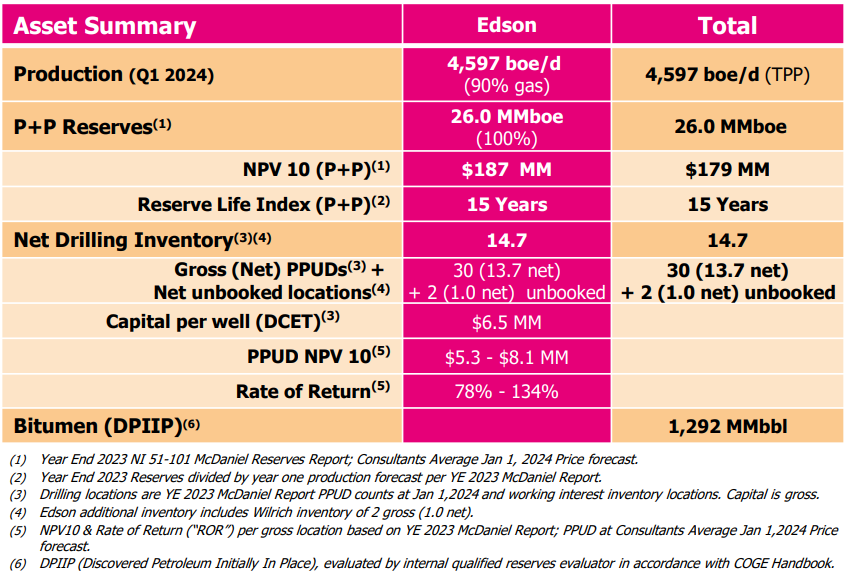

Perpetual is likely to have a 2025 capital program that comprises only two or three wells, but for a company with a market capitalization of only about CDN$33 million, the contribution from that program can be material. Perpetual estimates (using pricing from the 2023 Reserve Report prepared by McDaniel) that its liquids rich

Edson wells produce rates of return from 78% to 134%. Two successful wells could reasonably add CDN$10 million in value to Perpetual, a trivial amount for most E&P’s but a 30% bump for tiny Perpetual.

Perpetual has a strong management team and a clear runway to profitable growth. I like the outlook and own 200,000 shares.