Once named Penn West Exploration and a pariah in the oil patch after losing millions for investors by overly aggressive debt financed expansion, the new Penn West now named Obsidian Energy has a new management team with a discplined approach to righting the ship. And, their work is paying off.

Debt is now down to manageable levels, production is increasing and the company is on a sound financial footing. In my opinion, the market is not yet appreciating the value of Obsidian’s Cardium assets and (like rival Bonterra Energy) seems undervalued.

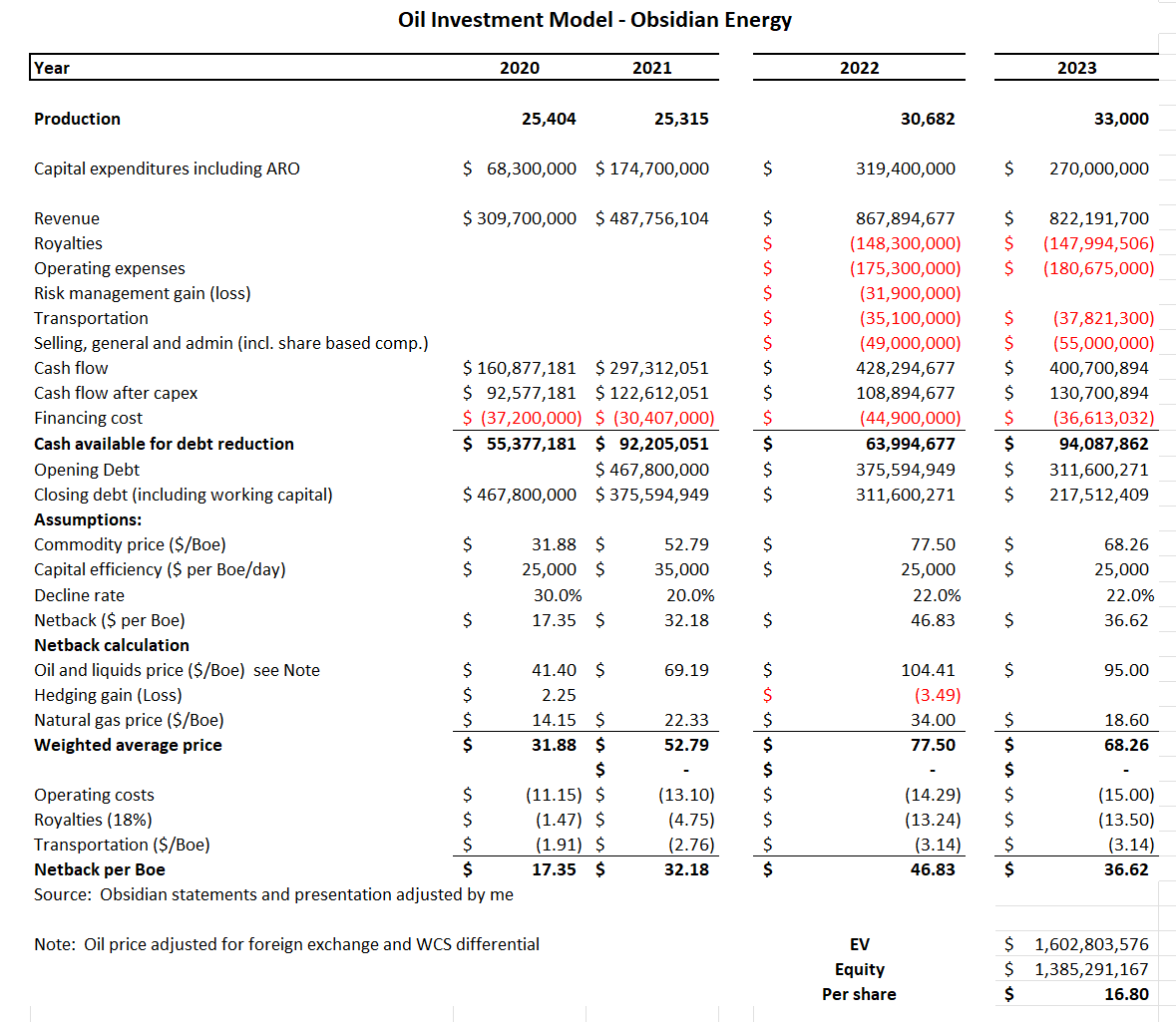

Obsidian just reported a successful 2022 and guidance for 2023. Based on the reports, I have updated my own model of the company’s operations and from what I can see the shares look undervalued by half. Here is my model:

The market values OBE shares at about CAD$9.00. I see a value closer to CAD$17.00. A lot depends on the oil price, of course, but in my opinion the risk of lower prices is high in the short term as North American economies slow or even enter recession but in the medium to longer term I see higher oil prices owing to a global shortage exacerbated by stupid climate policies that pretend CO2 causes climate change and a resulting absence of a supply response to the shortage. Expect volatility for the next few months as central banks keep tightening the screws on interest rates and the economy stumbles into recession, but don’t panic. The shares may come cheaper in a recession but are investable today at current prices, as I see it.

What do you think of their billion dollar ARO costs - any concerns or tomorrow's problem?