Nickel28 management changes are already adding value

Leverage to nickel prices is the key to how well the company will fare and the shares are not without risk

Nickel28 has an 8.56 percent interest in the Ramu nickel-cobalt mine in Papua New Guinea, which is a well-managed mine with low costs and at least a 10 year life. Output of nickel and cobalt are fundamental to EV battery technology, and the result is that Nickel28 share value is directly correlated with the price of these metals, primarily nickel, at least in the next few years. Eventually, Nickel28’s portfolio of streaming contracts on other deposits will add value as these development stage mines (or some of them) migrate to production, although that seems a few years away.

I like to value mining deposits as a call option on future commodity prices using a modified Black Scholes methodology. In the case of the Nickel28 interest in the Ramu mine, I come up with a value of CDN$1.43 a share based on an nickel price of US$7.80 a pound and Ramu’s reported cost per pound of nickel (net of byproduct cobalt credits) of US$3.00.

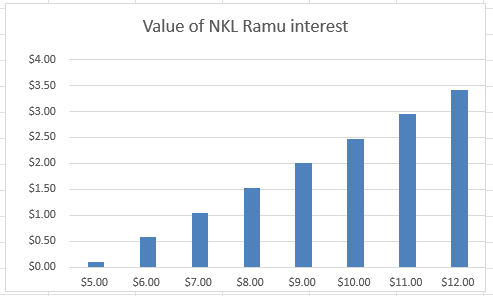

The relationship between the value of NKL’s interest in Ramu and nickel prices interesting in an environment where the odds of an upward trend in nickel prices are bolstered by growing demand for EV’s worldwide. Here is the estimated value of that interest per NKL share at various nickel prices, holding cobalt prices and operating costs constant. At US$5.00 nickel, the Ramu interest is of negligible value, but at US$12 per pound of nickel, the value of NKL’s Ramu holding soars to about CDN$3.50 per share.

Rather than sit on his hands and watch, new Nickel28 CEO Chris Wallace is in the process of drastically cutting overhead costs and has initiated a normal course issuer bid to buy back shares of the company at the current price of about CDN$0.70 per share, less than half their approximate intrinsic value if nickel prices remain in the US$7.80 range. It is a bold bet, since with Indonesia overproducing nickel and effectively “dumping” it on world markets, the short term pressure on nickel prices is down, not up.

The headlines from mid-2023 on Indonesia’s actions give a nickel investor pause.

The real issue facing nickel markets and in turn facing Nickel28 is whether EV adoption will sop up the excess nickel and turn feast into famine. In my opinion, that seems likely but not certain. Indonesia has banned nickel exports and the growth in that country’s nickel producion is felt in nickel products rather than raw metal, with stainless steel the major usage and EV battery applications a fast growing but smaller segment.

My reservation is a result of a concern that EV output is tapering off with China already producing more EV’s than the rest of the world combined and growth in that market more likely to slow than accelerate. In Europe and North America, other than Tesla, EV producers are losing money on every vehicle they sell and may back off from a determined commitment to EV production in favor of profitable ICE vehicles and hybrids. At the same time, EV infrastructure is slow to develop and electrical grids are struggling to keep up with burgeoning demand to power data centres for AI technology. The lack of a robust grid is a serious barrier to EV adoption despite subsidies encouraging consumers to buy these vehicles. Biden’s Inflation Reduction Act directed $7.5 billion to construction of EV charging stations and to date only 8 charging stations have been built. While infrastructure is slow to develop in North America, China as built over 800,000 charging stations which has encourged the rapid adoption of EV’s in that country.

Europe’s plan to ban ICE vehicles by 2035 was seen by many as a bullish factor for EV growth, but already five countries have abandoned that mandate - Italy, Portugal, Slovakia, Bulgaria, and Romania - citing pushback from consumers unwilling to pay the higher prices for EV’s in relation to ICE vehicles. They will very likely suffer the same problems finding ways to deliver enough electricity to support an “EV only” policy as early as 2035, so I expect those mandates to fail coming elections.

After cutting major deals for long term supply of nickel to EV assemblers like Tesla, BHP has decided to shutter its Australian nickel production owing to the current oversupply problems

As far as Nickel28 goes, I continue to believe the shares are undervalued but am less bullish on the next few years where the risks of a mis-step will damage the company’s liquidity and make the “buyback” plan self-defeating. If nickel demand does catch up and outstrip supply, Nickel28 will be a major beneficiary and it is easy to see the shares trade at a multiple of the current price. At the same time, if the EV growth rate falters and there is a worldwide economic slowdown affecting stainless steel demand, lower prices may be in the cards and Nickel28 become vulnerable.

As a result, I have reduced my holding for the time being.