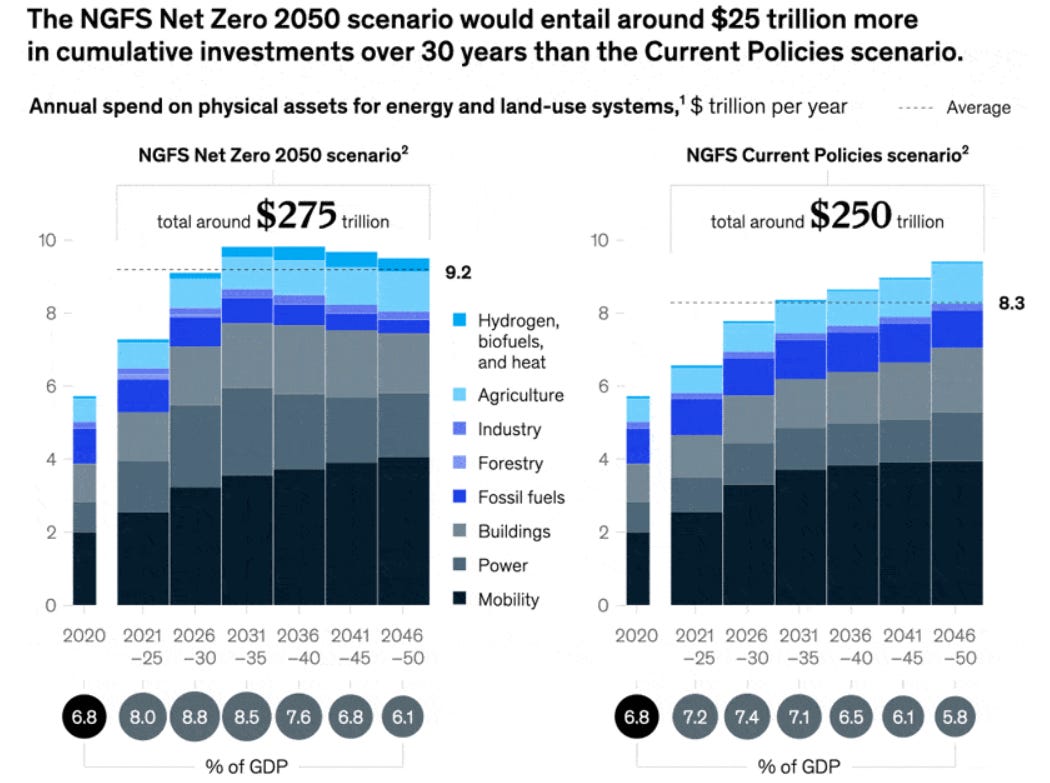

McKinsey & Company, Inc. projects the cost of Net Zero policies as between $250 and $275 trillion by 2050.

As I have pointed out in an earlier article, achievement of Net Zero risks the end of humanity, regardless of its economic costs. The pretense that CO2 is harmful is more dangerous than CO2 or any other risk facing Earth. Policies that promote Net Zero are equivalent to war crimes and other atrocities. As Voltaire once wrote: “If you can convince people of absurdities, you can make them commit atrocities”.

NGFS is a network of 83 central banks who have bought into the climate change charade, not out of any deep understanding of the laws of physics or the complex, chaotic climate system of Earth, but out of the desire to promote banking services to an eager population willing to set aside common sense and join the religion called Anthropogenic Global Warming (AGW). NGFS stands for “Network for Greening the Financial System” but like most ideas emerging from banks, the “Green” refers to Benjamins, not climate or CO2, and promoting the pretense that CO2 is harmful is a doorway to major profits for banks.

It is also a doorway to the collapse of the global financial system as financial decisions begin to be evaluated based on CO2 emissions rather than the tried and true financial analysis of borrowers plans and capability to repay their loans. That has already started with so-called “green bonds” where lenders are accepting low and even uneconomical terms for the “feel good” virtue signaling that they are contributing to an effort to “save the planet”. At the same time, professional money managers who are paid millions to manage our pension funds are accepting lower returns by focusing investments on ESG (Environment, Social, Governance) investments rather than trying to earn the best returns for the beneficiaries of those funds to whom they owe fiduciary duties. Accepting lower returns for taking higher risks leads to calamity, not utopia. It is interesting to compare the outcome of managed money focused on returns on investment (becoming passe it seems) and those money managers who have embraced ESG and “stakeholder capitalism”.

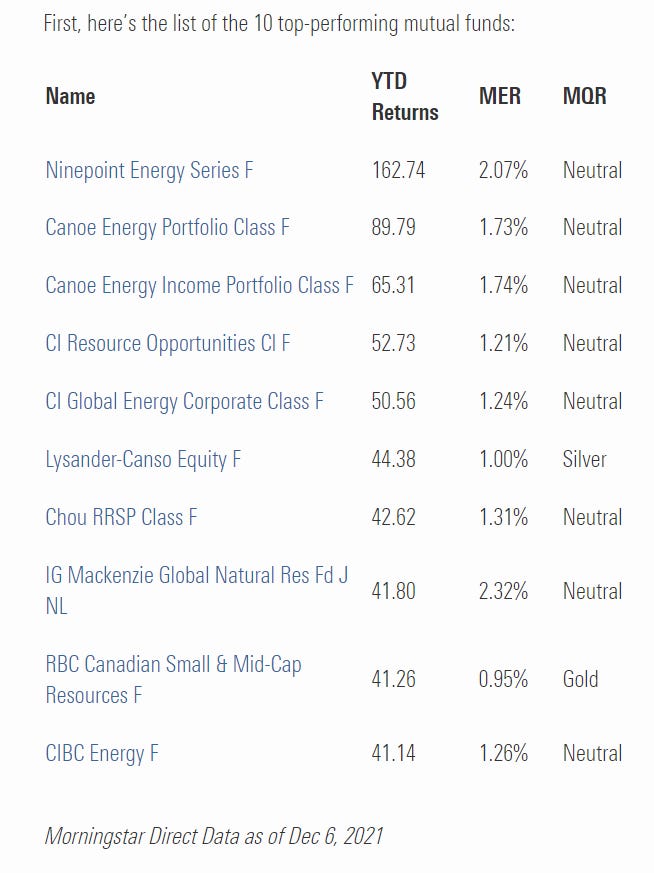

The 10 top performing mutual funds in Canada in 2021 have one thing in common - the absence of any ESG focus and the embrace of natural resource investments, oil & gas in particular.

By contrast, the Ontario Teachers’ Pension Fund, the Canada Pension Plan Investments and the Caisse de Depot et Placement (all of whom are taking pains to tout their ESG focus) earned returns that are abysmal by comparison.

The OTPP has not yet reported 2021 returns for the full year but earned 3.8% for the first half of 2021 and returned 8.6% in 2020;

The Canada Pension Plan earned 20.4% for 2021; and,

The Caisse de Depot earned 13.5% in 2021.

I may be old fashioned but I prefer returns in the 41.14% to 162.74% range to those in the 8.6% to 20.4% range. In all cases, the returns are nominal and not adjusted for inflation now running at over 5% in Canada and taking a bite out of those returns.

The financial case for ESG turns on the claim that investors will pay a premium for companies with high scores on ESG metrics (whatever they are) and enjoy a resulting lower cost of capital. Sound good? Not if you are an investor. A lower cost of capital means a higher share price and a lower return on investment. Investors that pay a premium for ESG will earn less both as a result of overpaying for the economic benefit of the operations of the investee and as a result of the costs of the ESG compliance by the company that do not result in higher returns on capital. So will their pension funds who are run by managers who seem to have failed their university finance courses but still command million dollar salaries and bonuses.

The promotion of Net Zero policies largely by left wing governments (Biden in the USA, Trudeau in Canada) has caused investment to flee the oil & gas industry, lowering global oil and gas output. That may lower the rate of CO2 emissions (which are harmless) but it also results in a supply shortage of fossil fuels which is evident pretty well everywhere today. Natural gas in Europe today costs about $60 per million BTU’s (about twelve times what we pay in Canada) forcing many Europeans to choose between heating their homes and having enough to eat. The term “energy poverty” has become mainstream in the United Kingdom. Oil prices are at decade highs and rising. Gasoline prices (which in Canada include a senseless carbon tax) are approaching $2.00 a liter and increasing the cost of everything that is shipped by truck, rail or air. Fresh produce is imported to Canada throughout the winter months and is burdened today with shipping costs more than double a year ago.

The energy shortage worldwide is affecting emerging economies more than developed ones, causing hardship for millions of people and contributing to starvation and disease for those rendered unable to satisfy even basic needs like electric power, clean water and transportation. That is the hidden cost of Net Zero - a virtue signaling buzzword that will have no effect on climate. Claims of millions of new jobs during the energy “transition” have evaporated into smoke, but most of that smoke still comes from fossil fuels which are an essential element of the global energy mix.

The cost of Net Zero is not zero.