Misguided ideas of risk lead to terrible investment outcomes

Harry Markowitz and his successors led investors down the garden path

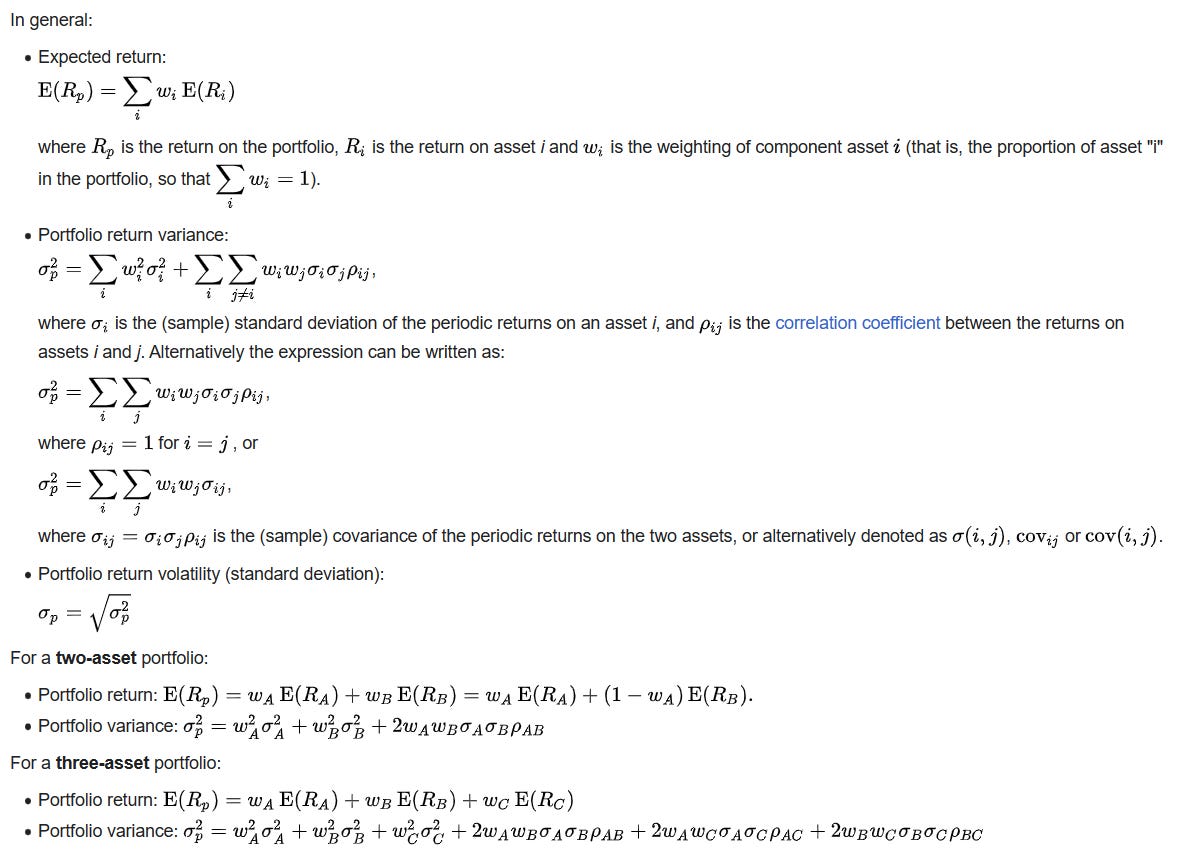

Harry Markowitz conceived of the modern portfolio theory (MPT) in 1952 and was later awarded a Nobel prize in economics for his work, basically demonstrating that properly diversified portfolio could be developed that maximized return for a given level of “risk”. He defined “risk” as variability in returns. That was an error. Markowitz’s math was not particularly complex.

For Markowitz and for many who followed him (including Eugene Fama, James Merton, Franco Modigliani, William Sharpe, Fischer Black, Myson Scholes, and a host of other much lauded economists, risk is defined as variance in returns relative to returns of the market averages. I can’t think of a worse or more useless definition of “risk”. As a former fighter pilot, I attended dozens of funerals for young men who came face to face with actual risk when they climbed into the cockpit of an aging high performance fighter aircraft and never came home. That is risk.

Financial risk deals with the ability or inability of your investments to earn the return you are counting on over the timeframe for which you are invested. Short term volatility is annoying but in essence the relative volatility of the trading prices of shares in those investments to market indices is irrelevant to the value of those investments. Economists often conflate price with value, many arguing that in an efficient market price=value. But sell side advisors and analysts make their living trying to persuade you that the opposite is true and that you can benefit from paying them to tell you what shares are “undervalued” and which ones are “overvalued”. It is often theatre of the absurd.

Risk is not abberrant trading but is the possibility that the business in which you hold your investment suffers some damage arising from a change in technology, in competition, in the regulatory structure, in the tax code, or in the competence or integrity of management. If the business is not affected by some such trauma, it is not exposed to “risk”. Profits will rise and fall with the economy and the work and competence of management and the level of interest rates, but over any long interval dividends will reflect profits and likely rise in line with the economy over time, with some pauses now and then. Investors will earn a return that more or less matches the return on equity of the business in which they hold shares unless they are persuaded by “advisors” who will charge a fee to advise investors to pay a premium over the book value of the equity in the firm based on some theory involving “growth”, “momentum” “unique value proposition” “effective business model” or “sustainable competitive advantage” with many variants in the pitch. Those are sales pitches driven by a desire to earn fees and commissions, and boil down to hype.

You don’t need to pay fees to build a solid investment portfolio. Develop an understanding of the business you are involved in through your share ownership. Attend shareholder meetings, read annual reports, get to know senior managers, and use common sense.

Changes in the market price of the company’s securities are not “risk” unless your investment is mismatched to the term when you must disinvest for some other purpose, something totally under your own control. If you make an investment for your retirement some 30 or 40 years away, checking the trading price of your holdings three times a day and bitching or bragging about whether your holdings are “up” or “down” is a useless passtime which will only serve to raise your blood pressure or trigger a premature heart attack.

If you are investor who absolutely depends on a regular stream of income from your investment, buy the highest grade long term bonds that yield enough income to meet your objectives and stop fretting. Sure, changes in market rates will affect the trading price of the bonds, but you didn’t buy them to trade. If you have made sensible choices of bonds that have a low risk of default, you will get the interest and eventually the principal in accordance with the terms of the particular bonds. Returns on stock tend to be higher than on bonds but stocks are more directly exposed to the actual risks of running a business.

If you make investments to “trade” on the belief that you can time the market, know more than others about the underlying value of the shares but lack any formal education in valuation, or think the latest craze (e.g. crypto, cannabis, AI, etc.) is your ticket to wealth, you need mental health therapy since on balance the secondary market will punish traders with those who do gain doing so at the expense of others who lose and as a group you will all do worse than market averages since trading is not free and for many you are paying someone else to “advise” you assuring that person enjoys a “risk free” income while you don’t.

Investment in shares of public corporations typically produces returns over the long term which outpace those of debt securities but require a combination of common sense and patience. Buy shares in companies you understand with products you use and whose managment teams you trust and you have a decent chance of a successful investing history. Companies like Coca Cola, Pepsi, Microsoft, Apple, Google, Telus, Rogers, Magna, BCE, Bank of Commerce (or any of the big five Canadian banks), Canadian Natural Resources or Canadian Tire are examples of companies pretty well every Canadian is familiar with. They can safely belong to anyone’s portfolio unless the portfolio owner thinks they can “trade” to advantage. Buy small positions, add when they are out of favor, and hold them for decades.

Today’s markets are dangerous owing to excess government borrowing in North America, rampant inflation, rising energy costs, and the prospect of higher taxation to carry the high interest caused by too much borrowing and rising interest rates. It is a time for caution, not speculation. Quality matters. Common sense matters. When people ask me for investment advice, I refuse until pressed and then say “buy canned food and ammunition”. Leftist governments have driven sovereign debt to the breaking point, contributed to rampant inflation making households struggle to make ends meet, and, bond auctions are becoming tenuous as investors eschew treasuries anticipating higher rates down the road. The rubber will hit the road sooner or later and the resolution of the imbalances in the economy will manifest themselves in lower bond prices and lower stock prices with higher unemployment and an inescapable economic downturn.

Good luck with your investments.

Great advice. Totally agree with the bullets and beans part.