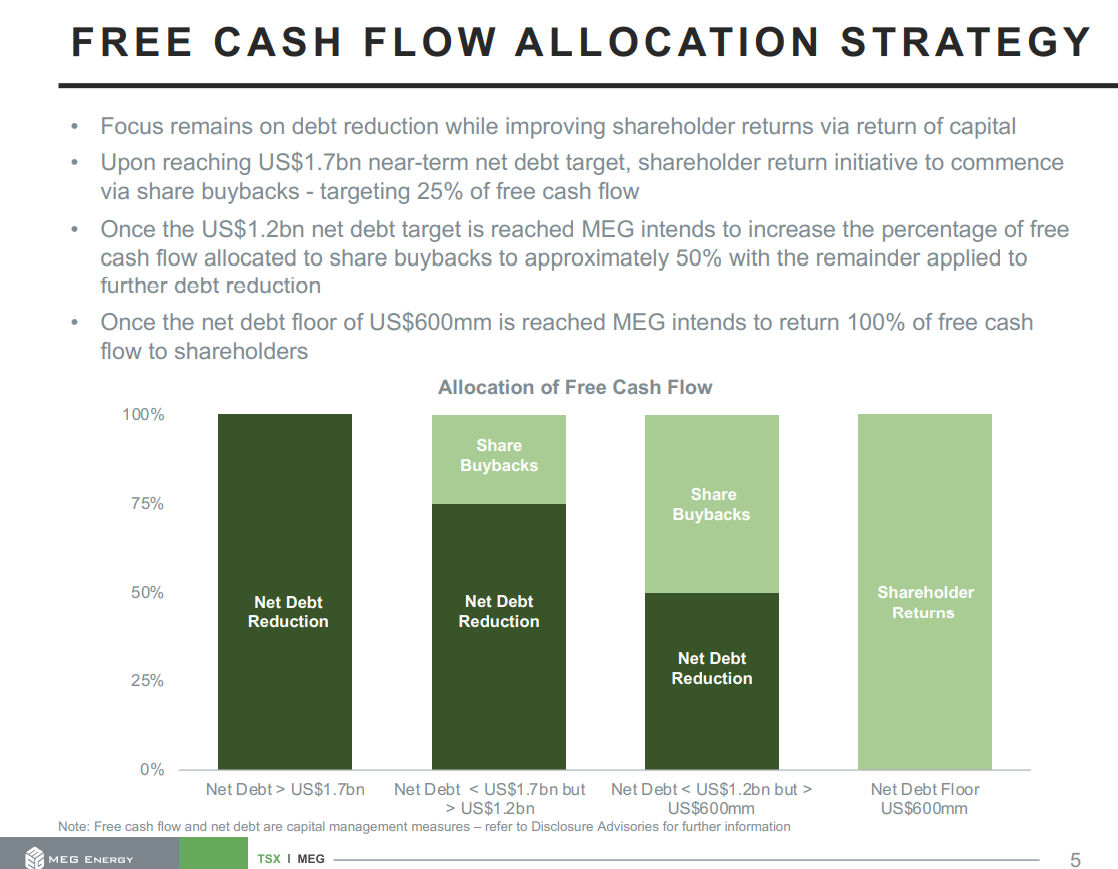

Data in this article are from MEG Energy’s public filings except estimates, which are my own. This article dissects MEG.TO’s “shareholder return” strategy which is set out below:

With MEG’s share price now at ~CAD$16, the company plans to use up to half of its free cash flow to buy back shares. MEG calls this “shareholder returns” but the money is not going to shareholders, only to former shareholders (i.e. those who sell into the issuer bids). What shareholders get is either less cash or more debt, and the soothing words of management that they are buying shares back at less than underlying value.

This underlying value? Would that have anything to do with future cash flows? Is the world economy heading into a recession (as many economists project)? Are interest rates rising?

If management was clairvoyant, they would have been repurchasing shares at $3.00, not $16.00.

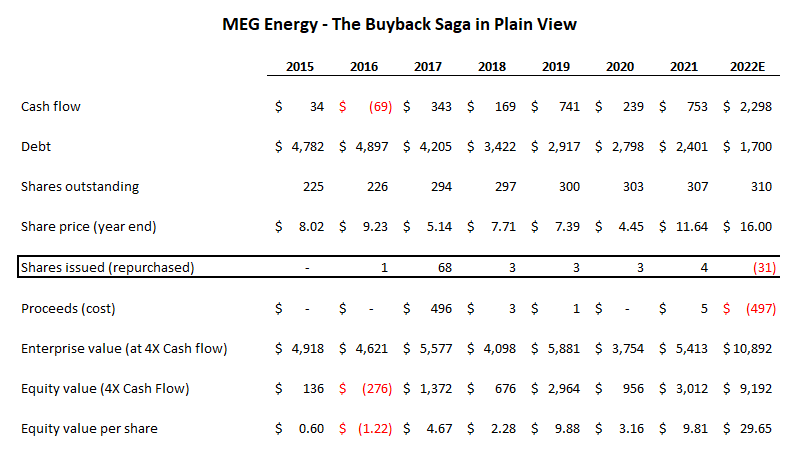

Since 2015, MEG has issued 82 million shares for total proceeds of CAD$505 million. Now management tells shareholders the company will buy back 31 million shares for CAD$497 million (assuming they can be purchased for the current price of CAD$16 a share.

You will forgive me if I conclude shareholders will be worse off after issuing 81 million shares and repurchasing 31 million shares with the company pocketing a cool CAD$8 million net for the 50 million additional shares floating around.

So who benefited from this scheme? Well, Derek Evans and his team for one. They received options and RSU’s for little cost, cashed them out for about $9 million, and bragged about the great job they were doing for shareholders.

MEG has outstanding assets. Rather than buy back shares at the peak of the commodity cycle after issuing them at the bottom of the cycle, MEG could simply repay all of its debt and begin to use its free cash flow for old-fashioned dividends. Shareholders receiving the dividends might decide they want to own more MEG stock and buy shares, or use the money to pay their other bills or make other investments.

At the assumed 4X Cash Flow valuation I have used, there is an appearance that MEG buying back shares “worth” ~CAD$30 a share for a paltry ~CAD$16 a share benefits shareholders. That arithmetic assumes the $30 valuation is both robust and more or less permanent. As the world enters a deep recession, that assumption may be tested. The issue of whether the shareholders who take the CAD$16 a share and run come out ahead or behind those betting Derek Evans and his team will lead the company to greater heights is unknown at this time, but history suggests it is a risky bet.

Just give me dividends and let me decide for myself whether to buy more shares, keep those I own, or sell the lot. I don’t need Derek Evans or anyone else on his team making my investment decisions for me.

I should be clear, I believe MEG is undervalued today and could be a big winner if commodity prices remain firm. But I would appreciate it if MEG management let me decide how much exposure I want to MEG stock instead of substituting their own views of the market and imposing them on MEG shareholders through “buybacks”. Looking back to 2015, they have been wrong more often than right.

Eric Nuttall promotes stock buybacks since they tend to drive short term stock prices upwards, making his assets under management rise and his fee income grow in parallel. It is not hard to see how a money manager benefits but it is difficult to see how a long term shareholder benefits. Long term shareholders don’t receive fees and don’t get a higher share price until they sell, presumably when they believe the market is over valuing the shares. Then they have to find a better replacement.

MEG shareholders would benefit from the world class assets if the company paid a dividend once debt was retired and stopped making plans that benefit Eric Nuttall and Derek Evans at the expense of long term holders of MEG shares.

Great article, here are my 2 cents comment,

"Just give me dividends and let me decide for myself whether to buy more shares, keep those I own, or sell the lot."

On the flip side, there are argument that when corporates do share buybacks, shareholders can

1) do nothing, equivalent to buy more shares under dividends;

2) get synthetic dividend by selling a small portion of holdings, equivalent to keep those I own under dividends;

3) or sell the lot.

Arn't buybacks and dividends essentially the same?

If the two methods are equivalent, if we add in tax consideration, would buybacks clearly come out ahead for shareholders?

Agree, not a fan of buybacks, unless the share price is silly cheap (and there is usually a reason for that).