Market over-react to bad news, under-appreciate favorable trends

Sometimes it makes sense to hedge your bets

One of the major contributions Nobel Prize winner Richard Thaler made to free market societies was his finding (following work of Daniel Kahnemann and Amos Tverky) that investors overreact to negative news and under-appreciate favorable trends. A lot of the volatility in the market (treated by many as “risk”) has nothing to do with the profitability of the companies whose shares and debt securities comprise the “market” and everything to do with fear and greed. Fear of missing out (FOMO) sees trading prices driven up to nonsensical levels and panic selling sees trading prices fall dramatically, frequently when nothing material has happened to the underlying businesses. The Arab-Israeli conflict is a good example. Within a few days of the attack on Israeli kibbutzes by Hamas terrorists, oil prices spiked, then fell, then spiked again. I suggest that the conflict is so small and so geographically contained it will have no material impact on the supply or demand of oil. A global recession is another kettle of fish.

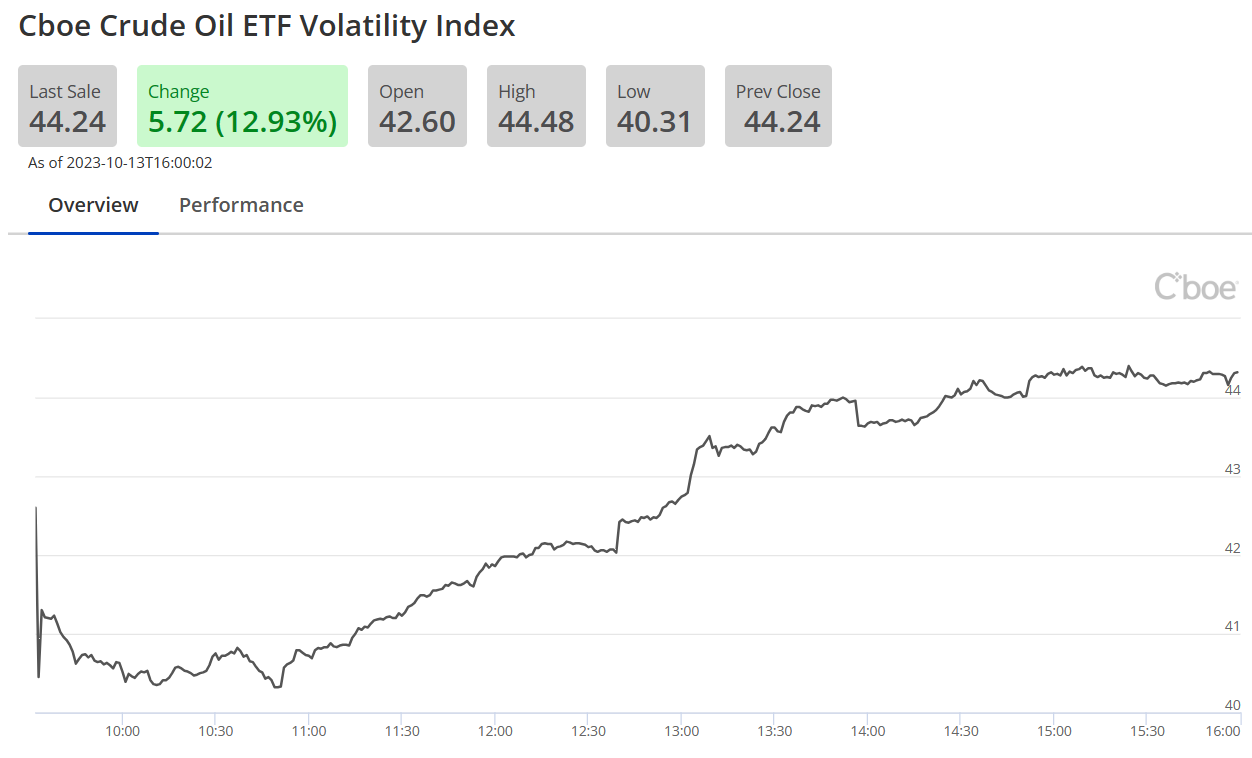

A 7% range in one week is equivalent to a Beta (annual volatility relative to S&P average) of several dozen percentage points. Option premiums should but don’t reflect the higher volatility making it more profitable to use the option market to both hedge against a collapse in commodity prices and take aggressive long positions to capture a rebound from oversold stocks. Volatility in crude oil ETF’s rose sharply on Friday, demonstrating the almost panic trading.

Serious investors don’t get sucked in or join the trading frenzy. Calm, rational and well-invested they realize that all their holdings in Canadian E&P firms will benefit from the average higher price of oil the conflict has spurred and that every day the world price of oil is over US$60 a barrel (it is currently about US$88 a barrel), their investments will generate more than enough cash flow to support capital programs, pay dividends and pay down any debt. Dreams of oil at US$150 a barrel (a forecast by Bloomberg if the mid-East war escalates) and fears of a fall to US$60 if the global economy enters recession are irrelevant to serious investors and should remain the exclusive domain of traders who believe they can time their trades to benefit, only to find that as a group they will lose money. History should be a better teacher.

But some option trades make sense in a volatile environment. I call them “trades” although I don’t suggest trading them. Buying longterm in-the-money options on well-run but deeply undervalued energy names is lower risk than the stocks in some cases and options can be a reasonable place holder for energy investments. For example, I recently sold 20,000 shares of Baytex Energy and bought 200 calls on the stock that expire in 2026 at a CAD$5.00 strike price. Baytex stock is trading at CAD$5.90 and the option premium was CAD$2.20 a share.

The 20,000 Baytex shares (sold at CAD$5.90) became CAD$118,000 and the 200 options cost CAD$44,000 leaving me with a cash position on this holding of CAD$74,000. In January 2026, when the options expire, the outcome will be somewhere within the following parameters:

Worst case - Baytex goes bankrupt and the shares are worthless. I am out a pre-tax capital loss of CAD$44,000 and an after tax loss of about CAD$35,000 but will have earned about CAD$9,000 on the cash so when the dust settles I should have CAD$83,000. Had I kept the stock, my loss would have been CAD$118,000 or about $94,000 after tax.

Likely case - Baytex keeps operating, paying down debt and slowly increasing its production and in three years trades at about CAD$9.00 a share. I exercise my options for CAD$100,000 using up my CAD$83,000 cash and hold shares worth CAD$180,000 less the CAD$17,000 difference or CAD$163,000. Average return on my CAD$100,000 investment is about 16% [calculation is ln(1.63)/3]

Best case - Any outcome better than the likely case. Irrelevant to this analysis.

If I had just kept my 20,000 shares of Baytex and in January 2026 they were worth CAD$180,000, my average annual return would have been about 19% [calculation is ln(1.8)/3]

Given the real risk of recession, the possible risk of a wider and more serious mid-East war, and the geo-political risks of investments in energy, I like the risk-reward profile of the switch from stock to options. Avoiding major losses is a key part of my investment approach.

Well thought out and communicated. I'm just at the beginning of learning options investing and this is a nice clear example of how to do it and the upside downside rewards and risks. Thank you.

Anyone else doing this? I would like to but the rbc site seems overly complicated for my pay grade.