Major losses on bond portfolios have yet to be noticed by Washington

But a buyers' strike may wake up Biden and his inept team

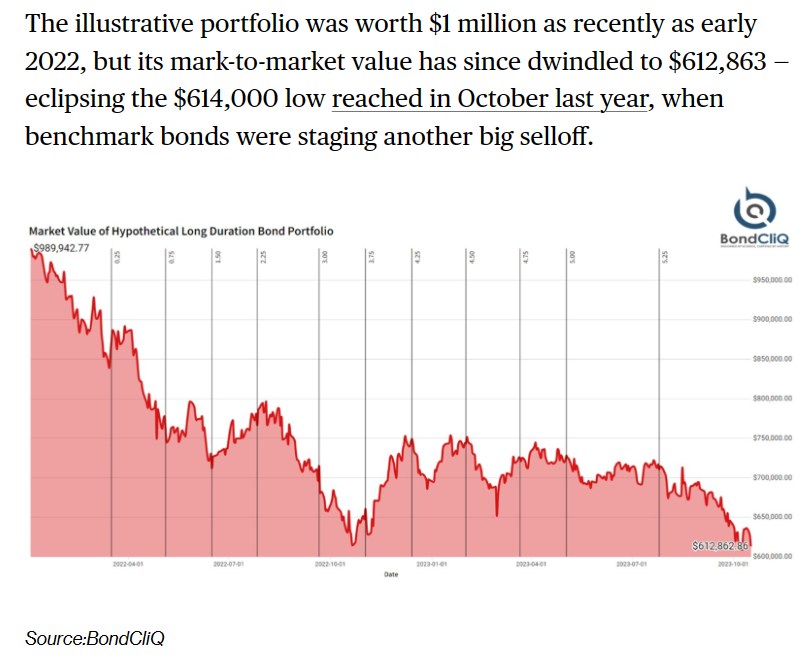

Bond CliQ published an illustrative bond portfolio “mark to market” showing the damage from the past year’s surge in bond rates.

The typical portfolio lost almost 39% of its value in a year. But wait, who has the largest portfolio? That would be the Fed, a legacy of its decade of so-called Quantitative Easing(QE). According to Statista the Fed has over $8 billion in “assets” which, of course, are liabilities largely of the Biden government and mortgagees. Mark those to market and the Fed has unrealized losses of over $3 trillion. “Unrealized” is a euphemism since the odds are high that rates will keep rising and the market for those debt securities isn’t going to get better any time soon, more likely it will get worse.

Selling pressure on U.S. ten year treasuries has seen the yield inch higher and higher, now closing on 5%. That yield was less than 1% a couple of years ago.

Central bankers like to pretend they can control interest rates, but buyers of debt securities hold the hammer. A buyer’s strike can put an end to the illusion of central bank control. As Biden merrily trots along with trillion dollar deficits, more and more treasuries have to find their way into the portfolios of someone. The Fed can’t both buy bonds and increase rates at the same time since these acts are at cross purposes. Foreign investors like China who hold trillions of dollars in U.S. paper might elect to sell their holdings or at least not buy any more. And major money centre banks already have massive bond holdings they call “hold to maturity” assets ignoring the fact that if they had to sell their bonds they would take a bath of enormous proportions. They aren’t likely to throw good money after bad and explain why to shareholders.

At September 30, 2023, Bank America had over $600 billion “hold to maturity” debt securities carried at cost. About $120 billion of that comprises agency bonds and the balance largely mortgage back securities. The “unrealized” losses on that portfolio approximately equals BankAmerica's common equity of $216 billion. By any sensible measure, BankAmerica shares are worthless and on liquidation of the company, common shareholders wouldn’t get a dime. But successful lobbying by the money centre banks resulted in an accomodation in their accounting to carry allegedly “low risk or risk free” assets at cost in a “held-to-maturity” portfolio on the theory that the loans would eventually be repaid.

With U.S. Social Security hitting a funding wall in a few years and no reasonable possibility that the U.S. treasury will have the capacity to fund these “entitlements” through added debt, the shit will hit the fan and United States might well follow Argentina, Turkey, Zimbabwe and other poorly managed economies down the rabbit hole of rampant inflation (which will cure the debt problem) or default (the other option to cure the debt problem).

Progressive governments like Biden’s and in Canada Trudeau’s think there is an unlimited ability for governments to borrow money and that Modern Monetary Theory (MMT) will have a major comeuppance within my lifetime. The eruption of violence in the Mid-East, a resurgence of energy prices after decades of “climate policies” limiting supply which will manifest itself in higher inflation, and fully-stretched sovereign debt capacity point to a serious problem that leftist governments cannot and will not solve. I see no barrier to interest rates in the ‘teens, inflation in double digits, and a plethora of “its not our fault” excuses from leftist governments who no doubt are already working on the propaganda rhetoric to find anyone else to blame for their failures.

Buckle up kiddies, it is going to be quite a ride.

Its woken up Ottawa, they are now blaming in on Galen Weston and the banks..

When I might say that grocery makes 2-4% profit in good times, and they provide competition and good service versus the 13% gst on many products, including most of the food young people eat, pop, chips, etc, never mind the soap, toilet paper etc etc for doing nothing they get angry.

I pay way more on taxes than anything else... gas, alcohol, sales tax, income, etc etc really adds up Governments will be getting lots more tax this year as anyone collecting interest is sending 50% to the Government :(

Thankful that I disposed all my ( limited ) bond holdings years ago.