Look no further than energy prices to explain inflation

Interest rates are about as effective as pushing on a rope

As I have written previously, it is energy prices that determine the course of global inflation, with fiscal and monetary policy just adding volatility by intervening in markets that would produce price stability if left alone. Higher rates slow economic growth which reduces demand for energy and inflation tends to fall, while lower rates fuel expansion increasing demand for energy and both energy prices and inflation tend to rise. But the primary driver of price levels is the rate of change in energy prices, particularly oil & gas prices. The correlation is too clear to ignore and in this case correlation=causation.

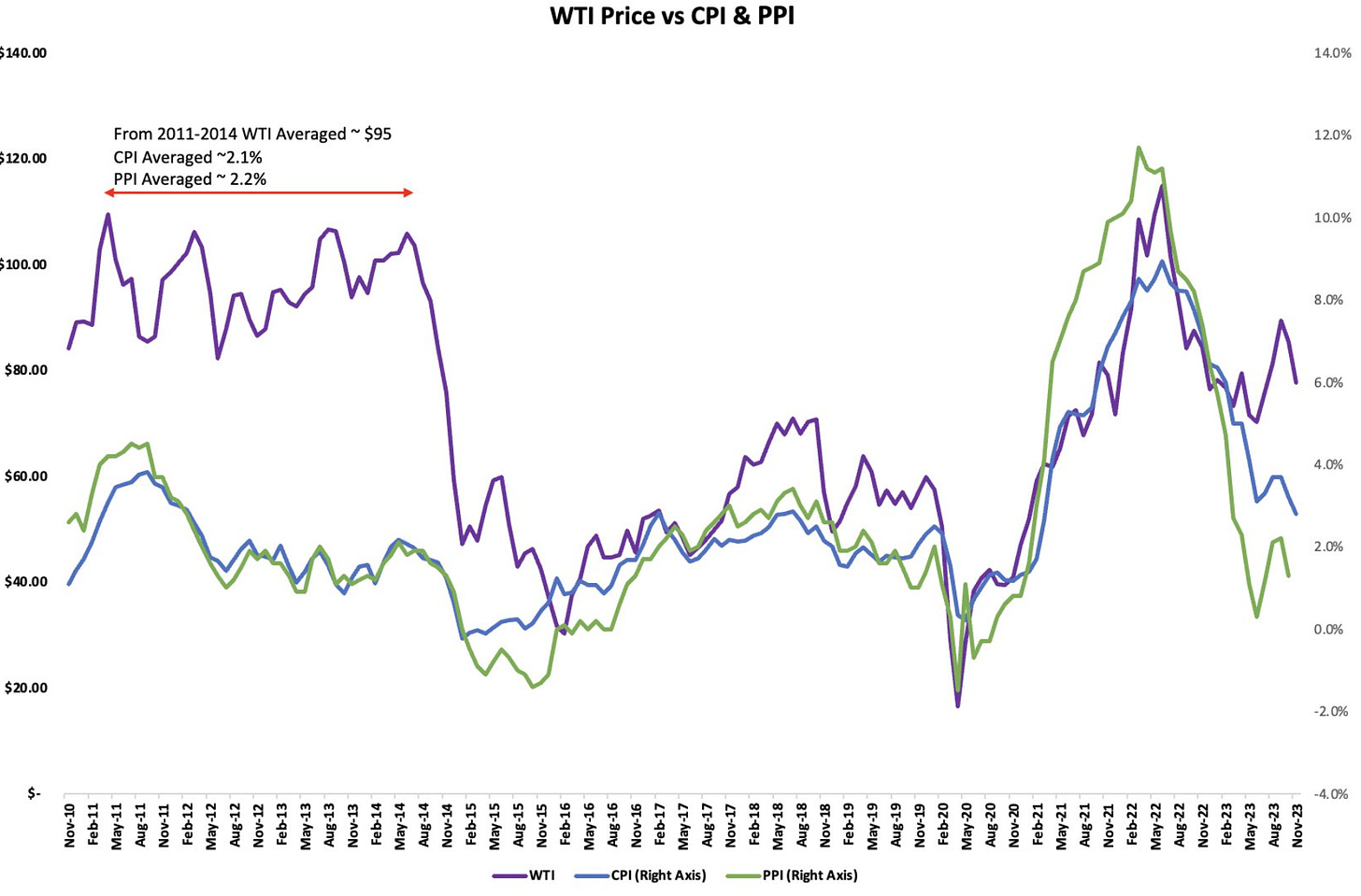

Stable oil prices co-exist with stable consumer prices, as was evident in the 2011-2014 period with minor fluctuations in oil prices paralleled by minor fluctuations in the rate of inflation. Rising or falling oil prices are matched with rising or falling consumer price indices (CPI’s). It is changes in energy prices that fuel inflation with monetary policy lighting the match.

Monetarists persuade world leaders to pretend that interest rates and fiscal policy are the underlying causes of inflation or the cure when inflation is rampant, and to some extent this is the case, but it is re-arranging the deck chairs on the Titanic. Price stability and low inflation result from free markets for energy which results in supply matching demand. In 40 of the past 50 years, there is a one-to-one correspondence between the direction of oil price changes and the direction of inflation changes. The years when the correlation broke down include the 1973 oil embargo, the global financial crisis in 2008-2009 and the pandemic in 2000-2001 or were otherwise exaggerated by government intervention such as quantitative easing (QE) with massive bond buying to drive down interest rates and pump up asset prices.

Government intervention is the cause of economic problems, not the cure.

In the current environment, contractionary government policies will slow economic growth and dampen the demand for fossil fuels which will see softer energy prices and a slow down in the rate of inflation, and central banks and Wall Street will claim victory over inflation. But the softer energy prices will see less capital flow into drilling, shrinking fossil fuel supply and creating the environment for a rapid increase in both energy prices and the rate of inflation as leftist governments can’t help themselves from stimulative monetary and fiscal policy to “recover” from the recession they have created fueling higher demand for energy than the capital starved industry can supply. The next wave of inflation will be higher.

This cyclical charade is exacerbated by policies that pretend CO2 can cause global warming, a physical impossibility but a popular leftist talking point, and the attempts to curb fossil fuel supply growth will simply amplify an already inflationary set of policies that persist despite the obvious silliness of them.

Winter is nigh, and despite El Nino we may see a few seriously cold spells that will expose the shortage of natural gas that Europe has created for itself by directing billions of capital into “renewables” that cannot provide enough power to keep houses warm or the lights on. Europe is likely already in recession and government coffers are over extended now, so the recession may persist despite a return of inflation creating the “stagflation” where both inflation and unemployment are high, considered impossible by Keynsian economists but nonetheless likely according to Alan Greenspan in a recent interview with David Rubenstein.