Logan Energy starts trading today

This spin off from Spartan Delta is seems to have potential

As part of the capital restructuting of Spartan Delta (SDE.TO) following its $1.7 billion sale of certain Montney assets to Crescent Point (CPG.TO), Spartan Delta on July 6, 2023 distributed a $9.50 dividend (about one third of which comprises a return of capital free of tax) and both shares and warrants of newly created Logan Energy (LGN.TO) which hit the streets debt free with over $100 million cash and initital production of about 4,500 Barrels of Oil Equivalent (BOE) per day, 24% liquids. Logan has 193,000 acres of Montney lands, is debt free and will generate positive cash flow from the get go. I value the Montney lands at $1,000 an acre (wild ass guess) and the 4,500 boe/day of production at about $110 million (compare that valuation to BIR.TO with 80,000 boe/day and a market capitalization of $2 billion). If those are in the ballpark of the asset values, Logan is worth about $400 million since it will start with no debt and over $100 million cash. [$193 million land, $110 million production, $100 million cash = $403 million). That asset approach puts a value on LGN.TO shares of about $0.75 based on some 540 million shares (fully-diluted) outstanding.

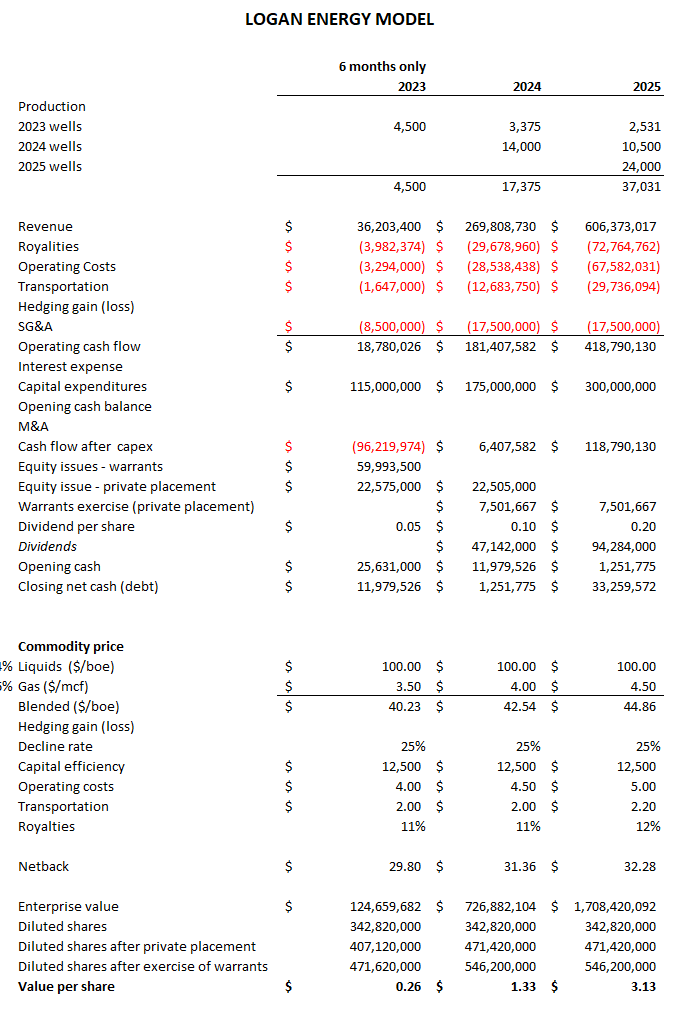

A more formal valuation will require some financial modelling and there is little evidentiary support for a realistic model at this time. Later in this article I posted a “model” making a lot of assumptions, so use it with caution.

Spartan Delta shareholders who receive Logan shares and warrants have some decisons to make. At 1 Logan share and 1 Logan warrant for every SDE.TO share, there will be 171 million Logan shares outstanding on day one and that should double to 372 million within a short time since the warrants (exercisable at $0.35 per Logan share) have a very short life expiring July 31, 2023. In parallel, Logan will issue another 64,500,000 shares and warrants to management presumably at the $0.35 price. When the dust settles, Logan should have a share float of about 546 million shares. Spartan says Logan will start with $108 million cash to begin operations as a standalone company, and I have assumed this includes the proceeds of the private placement and full exercise of warrants as noted in a footnote to the corporate presentation (page 18 footnote number 2). That implies a cash balance before the private placement and warrants exercise of about $26 million.

Sound a bit complex? It is, but don’t be dissuaded by the complexity. To assist readers to think through this new entity, I have developed a simple model of its operations, shown below:

The model makes a lot of assumptions none of which are assured. It assumes all warrants will be exercised, that commodity prices will be firm, that operating cost estimates can be realized, and that an 11% royalty assumption is sensible. Since it comes up with a valuation of $0.26 per Logan share, which compares with the $0.35 valuation disclosed in the Logan spin off announcement) the opening values are in the ball park of reasonability. Assumptions on decline rates and capital efficiencies are best guesses, not founded on any detailed understanding of this reservoir for which little public data exists. The assumption that Logan can complete a $115 million capital program by year end is aggressive, and it may well slip into 2024 pushing out the projected cash flows into later periods. That may change the reporting but will not change the ultimate value.

It looks at first blush that Logan shares have the potential for substantial appreciation and the model I created assumes dividend payouts ($0.10 per share in 2024 and $0.20 in 2025 both covered by cash flow) that comprise relatively high yields. The model is in most respects a wild-ass guess as to the potential, with plenty of room for disappointment, and a better model will await disclosure of quarterly results over the next few quarters. But at this point, I would be cautious about selling the Logan shares immediately following the spin off and would hold them and let the price discovery mechanics of the market work for a few quarters.

Don’t bet your life savings on the information in this article. It is pretty speculative and issued solely to help readers assess risks and opportunities in this interesting spin off and should not be construed as a recommendation to buy or sell.

Good deal all around, both the dividend / ROC return from Spartan and the Logan shares and warrants. Even though your analysis is

a speculative projection Michael which I hope turns out to be true. Both Spartan and Logan have very good management which is focused on shareholder returns which is number 1 in my books.

Not related, but lots of share buybacks for TCW(TRICAN), good prospects, opened a new position on them...