Kelt Exploration is a low risk value play

Kelt shares are largely ignored by the street

Kelt Exploration (KEL.TO) is a virtually debt free oil & gas producer with a strong management team who seem to simply want to build value in the company over time. Bay Street and Wall Street analysts are indifferent to the value of the company’s shares and some say the shares are “overvalued”. Kelt does not pay a dividend, and reinvests its cash flow in drilling, completion, equip and tie in (DCET) expenditures to build production and build reserves. That is a sensible strategy for a well-run oil & gas company regardless of how the street views it.

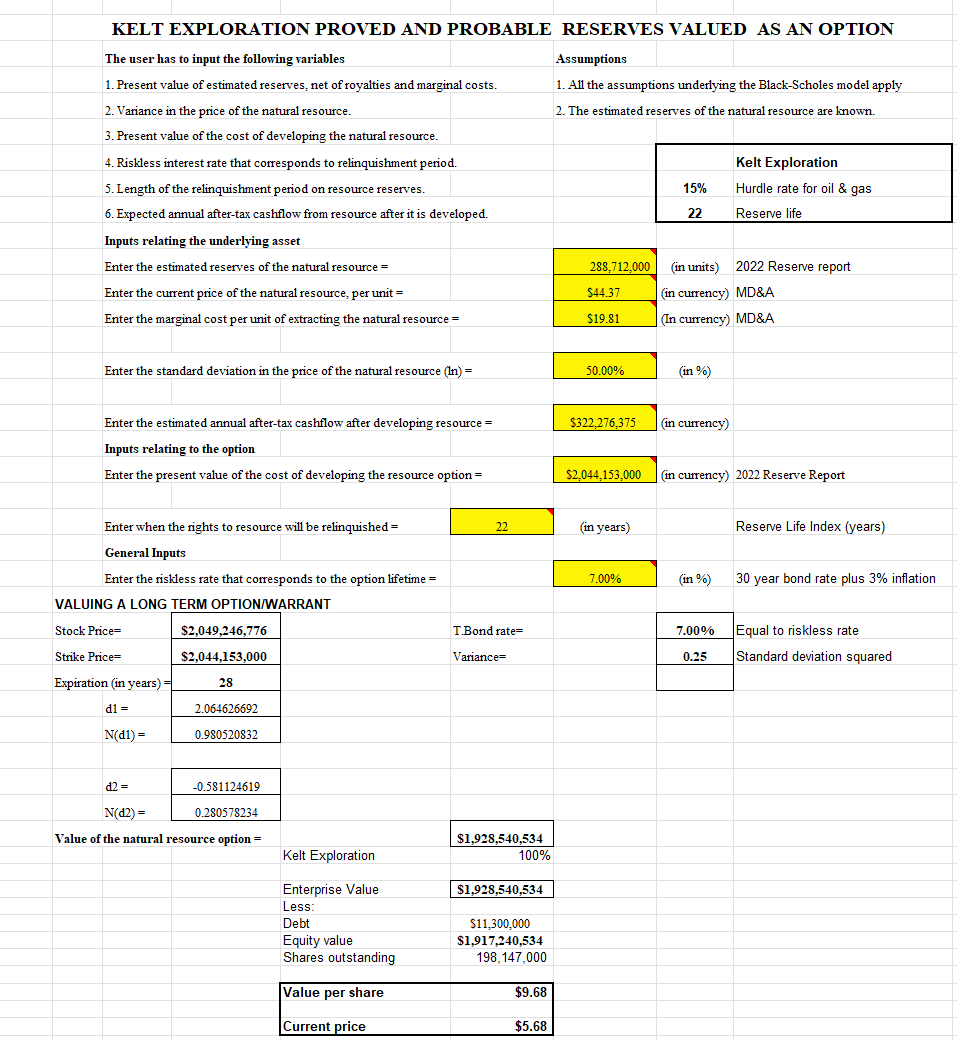

Kelt shares can be valued best in the context of its strategy, avoiding the conventional metrics of multiples of EBITDA, multiples of free cash flow (FCF) or price to earnings since none of these address the value of the company’s reserve base. In my opinion, the correct approach is a modified Black Scholes analysis of the company’s reserves. For Kelt, that analysis surfaces a value of CDN$9.68 a share versus the current trading price of $5.68.

Two things will determine whether Kelt shares produce reasonable returns to investors over the coming decades - the price of the oil & gas they produce and the economics of their drilling and production activities. I expect the company to continue to benefit from competent management and its success at the drill bit in future years to parallel its success in recent years. Similarly, I see no clouds over the company’s operating cost profile. That reduces the analysis to how relatively well or poorly commodity prices affect its output, something the Black Scholes approach includes implicitly.

But for those unfamiliar with Black Scholes and whose confidence in investing in an energy company is based on a view of the direction of commodity prices and the sensitivity of the shares to changes in those prices, here is a review of the intrinsic value of Kelt shares at different prices for natural gas (61% of the company’s production).

Gas price Share value

$3.00 $10.00

$4.00 $11.25

$5.00 $13.00

$6.00 $14.50

$10.00 $20.00

But what if natural gas prices fall?

$2.00 $8.00

$1.00 $6.50

Kelt is a lower risk exploration and development company with very limited downside risk and substantial opportunity for gains. It is a tortoise in a market where sentiment favors hares, but I expect will be a winner just as the tortoise in Aesop’s fable. Investor sentiment might change if the company began to pay a dividend, although the returns from drilling are high enough that would be a mistake, just as stock-buybacks would likely produce a worse outcome despite the undervalue since they company has plenty drilling locations and should not become obsessed with the trading price of its stock.