Is the market right about the risk of recession?

Or is Wall Street a bit too jumpy?

Economist Claudia Sahm is credited with creation of the "Sahm Rule” which says that if unemployment rises more than half a percentage point a recession is imminent. Last Friday’s surprise employment report that showed only 114,000 jobs created was greeted with panic selling across stock markets as traders, typically on the advice of their advisors, brokers or fund managers, ran for cover and sold their shares. Shades of Joe Granville’s famous warning “sell all stocks”.

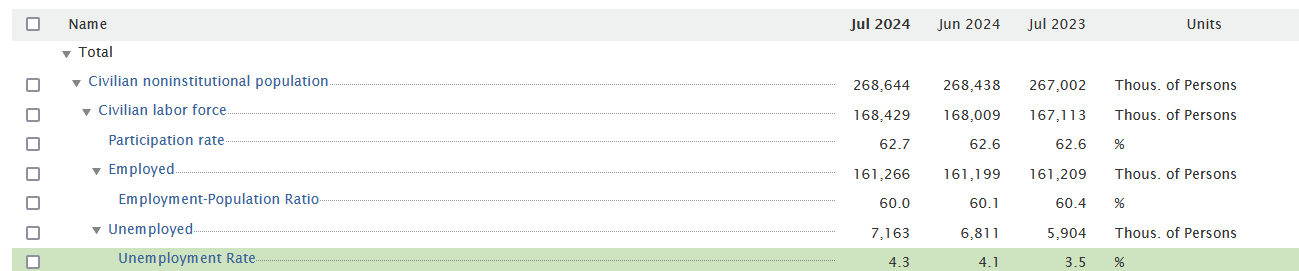

But did unemployment actually rise or is the rise in the “rate” of unemployment merely a higher number of people entering the labor force. Fortunately, we don’t have to guess - the St. Louis Fed publishes the data.

In July 2023, there were 161,209,000 Americans employed and 5,904,000 not employed. In July 2024, there are 161,266,000 Americans employed - 57,000 more than the same time last year and 67,000 more than last month.

No disrespect to the talking heads on Wall Street or BNN or Bloomberg, but it hardly looks like it is time to panic. The rise in the number of people seeking work might have something to do with the 1.6 million person rise in the non-institutional population since last year, most of them the millions of immigrants coming across the Southern border. Many are still receiving subsidies from the Biden Administration as well as health care, a smartphone, and a place to live. Quite likely, many in this group haven’t made any serious effort to find a job just yet, since the handouts from the Democrat administration are more than they would earn at many entry level jobs. After hall, a room in a luxury hotel in New York, free money, free health care and a free smartphone make work a bit of a drag and there is plenty of opportunity to connect with others involved in drugs, crime and schemes to bilk working Americans.

I apologize for the rant which errs by vilifying many immigrants who just came to United States in search of a better life for their family, but the general point needs no apology - Biden molly-coddles immigrants and they need be in no rush to find work.

One thing is certain. Unless there is a drop in productivity, a higher number of people working will manifest itself in higher economic output, not a recession. While the unemployment rate is rising, it is not rising owing to fewer people employed, only to more people seeking work. Slack in the labor force is positive for the economy in that it tends to soften inflationary pressures, and the lower rates that emerged in the bond market Friday (albeit for fear of recession) are stimulative to expansion.

As we enter the age of Artificial Intelligence, and despite the virtual disappearance of actual intelligence on the left, productivity seems more likely to rise than fall and further economic growth a better bet than a recession. Just as lower rates stimulate activity, lower energy prices do the same with even more impact, and the sharp drop in oil prices in the past week will be more of a boost to economic activity than a drag on it.

While I think recession unlikely, fear of recession is going to play out in the November election and Biden-Harris will be blamed for screwing things up. This points to a bit of a tailwind for Trump since there are only 88 days until election day and the two campaigns will spread hundreds of millions to misinform voters, aided and abetted by partisan mainstream media. Volatility in markets is likely and should present opportunities. The sell off in stalwarts like Intel and Amazon on Friday may present opportunity to those with the courage to look ahead, particularly Intel which will emerge from this rough patch with new Fabs and new products within the next few years and, in my opinion, demonstrate a strong recovery as demand for chips keeps rising and Intel develops chips that rival those from AMD and NVidia. We will see of course.

Yen carry trade unwinding ? or no?

Michael, what are your thoughts on Buffet liquidating equities and increasing his cash position to 30% of BRK value.