Is the big money made in oil?

Or is it made by math wonks on the CME?

A few days ago I wrote about how management matters in energy companies pointing out those who took a bath on “hedges” and those who made their money drilling for oil & gas and getting it to market. I have updated the chart to include Vermillion (VET.TO) now that it has also reported its Q2 results:

I have given the chart some thought. Oil & gas companies on average have been trading at stock prices equivalent to an enterprise value of more or less 4 x EBITDA. EBITDA is not shown on the chart but “hedge book losses” go directly to EBITDA. What is clear is that the bottom eleven companies gave up $7.3 billion x 4 = CAD$29 billion of market value for their “insurance” agains the calamity of lower commodity prices, despite the reality that the globe has a growing energy shortage and most of the companies and the analysts that follow them were pointing to the likelihood of firm prices throughout the next few years for oil and at least the winter for natural gas.

The following table sets out the EV of those companies and what it might have been if they kept their fingers off the keyboard linked to the CME or whatever counterparty they had for their hedges Value lost to ill-timed “hedges” adds up to CAD$26 billion with the destruction of market value ranging from 10% to 42% of the market capitalization of each company. Note the “hedge” losses are for only six months, and are likely to grow as the year unfolds.

Succinctly put, investors have at risk CAD$91 billion betting on the management of these companies whose expertise is geology and petroleum engineering, having suffered a $26 bilion loss in the value of their shares for which the CEO’s and CFO’s of these companies were paid millions. The math wonks on the other side of the “hedge” trades risked their option premiums (they bought calls, the premiums on which comprises their total exposure) which in aggregate I estimate cost less than CAD$500 million and reaped a CAD$6.6 billion gain at the expense of these titans of industry.

Which side of those trades would you rather be on? I don’t bet on commodities but my energy portfolio is heavily weighted towards the group with miniscule hedges and has limited exposure to the bottom group. I sold my ARX.TO in total following Q1 results, switched all my Peyto into SDE.TO and BIR.TO, and hold only nominal positions (through options) in ATH.TO and CPG.TO. I also hold a few shares of BTE.TO bought below CAD$2.00 a share since I think even terrible management can’t screw up those assets any more than they have already. I have owned CVE.TO since they abandoned hedging.

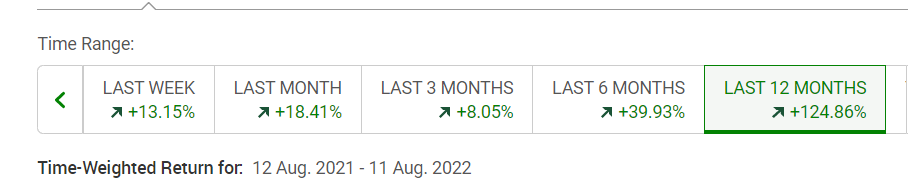

That likely explains why my energy portfolio is up 125% over the past year.

Management matters a lot so be careful who you trust with your money.

If I am reading your sheet correctly, it appears the listed Baytex 1Q22 hedging loss includes unrealized losses on unsettled forward contracts. Baytex realized financial derivative losses of $84 million in Q1 and $124 million in Q2 for a total of $208 million in realized derivative losses for the first half of 2022. Let me know if I am missing something.

The banks forced the companies to buy hedges as condition of loan. Did the banks or controlled companies benefit by selling the hedges??