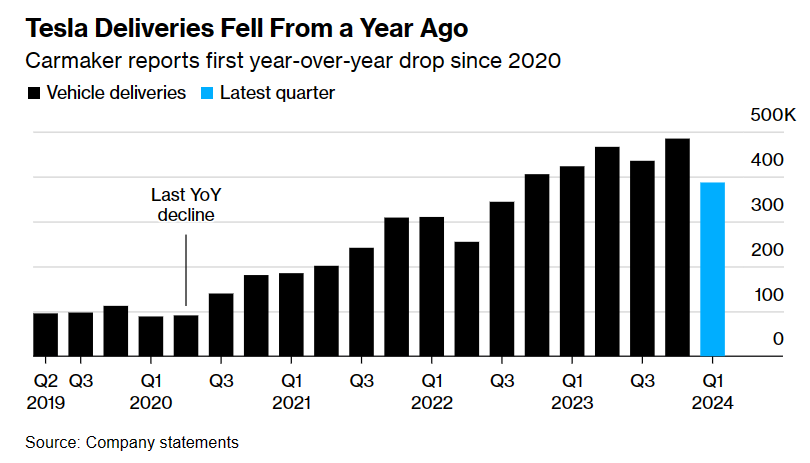

Tesla deliveries have fallen year over year and quarter over quarter. Not a good sign.

Tesla’s shares have dropped 65% from 2021 high, painful for Tesla bulls like Cathie Wood, but remain ~45% higher than the December 2022 low of $100 a share.

Tesla is moving quickly to react. Workforce cuts may hit 20,000 of the company’s 140,000 employees with the reduced costs flowing directly into margins, and Tesla’s plans for a lower priced vehicle have advanced by a year.

As history has shown, it is dangerous to bet against Elon Musk. The question is whether a lower priced Tesla can be built at a cost that makes it a profitable vehicle, since I have little doubt it will be a popular vehicle, and it will need differentiation from the current models to avoid cannibalism.

A Tesla concept for a $25,000 car looks promising and could be a head to head battle with Volkwagen’s EV line in my opinion. The similarity to the VW Beetle is striking.

A compact Tesla should appeal to younger buyers in U.S.A. and in Europe, India and China. A $25,000 price point for a four door sedan is competitive with all Hyundai EV models and a compelling alternative to pretty well all U.S. domestic entry level sedans.

To be a major contributor to Tesla profits, the new vehicle will have to be built for ~$20,000 a unit, a challenge for sure. A lighter vehicle than full-size Tesla’s, reasonable performance and range can be achieved with a 60 KwH battery similar to the Tesla Model 3, and costs for lithium cobalt nickel manganese (NCM) batteries have fallen to the $113 per KwH range, so battery costs of less than $7,000 per vehicle are possible without compromise of performance. An even smaller battery is an option given the lower weight compared to the Model 3.

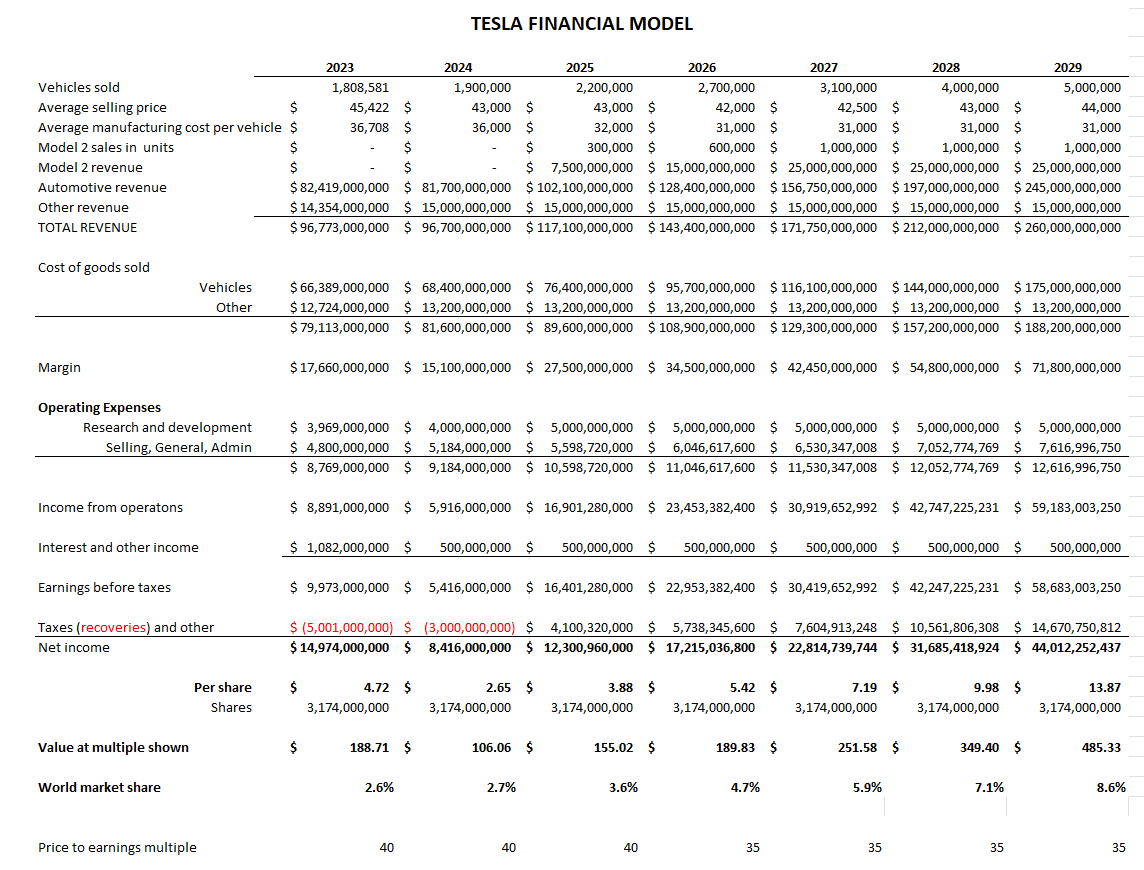

That suggests it is possible to produce a one motor rear wheel or front wheel drive vehicle at the $20,000 cost level. It is not hard to imagine volume of 1 million units a year of a well-designed entry level sedan for world markets. The popular VW ID4 model sells for almost $40,000 and would have comparable performance. My financial model of Tesla assuming a well-received Model 2 with sales growing to 1 million annual units by 2027 and produces a current value close to market at a 40 times price-to-earnings multiple and a 2029 value approaching $500 a share at a 35 times multiple.

Even at a market multiple of 20 times earnings, the 2029 value would be over $270 a Tesla share based on this model, providing a 12% annual return from today’s share price of ~$150.

Negative market sentiment today may make Tesla a decent short for a few months, but longer term there is at least a business case for a higher share price. The risk reward picture is too rich for my blood so I will stay on the sidelines.