Is over-regulation killing public markets?

Are risks becoming too concentrated in private hands?

Public stock markets have been a great boon to the ordinary bloke since they emerged over 100 years ago, letting people put their savings to work to build retirement income while funding entrepreneurs to start and build new companies and expand economic growth. But the benefits of “going public” today are less obvious than they were a few decades ago, with “private equity” and “venture capital” increasingly displacing public markets as the place to raise money. Public markets remain much larger than private equity markets despite the trend.

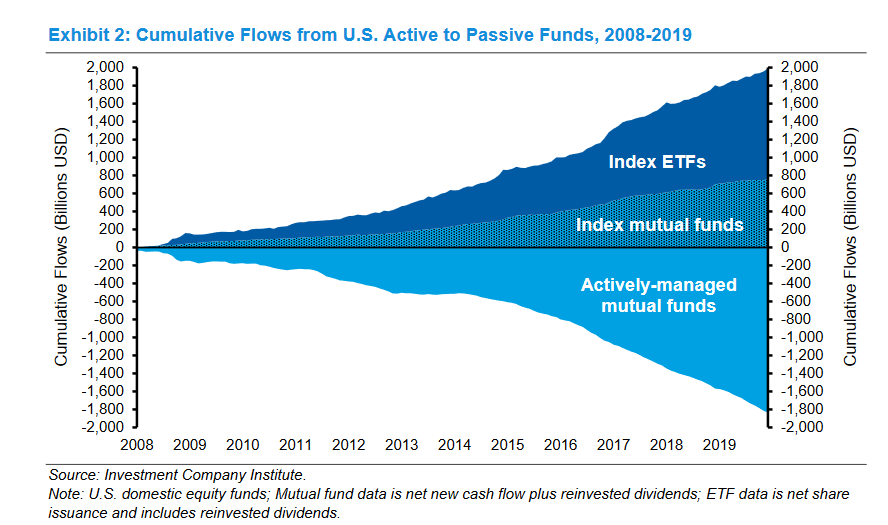

In part, the issue with public markets is a combination of the costs of regulatory compliance (a necessary evil to protect investors from fraud and abuses perpetrated by scoundrels in and outside of management) and the trend towards “passive” investments where the price discovery mechanism of the markets is absent. By “passive investment” I mean exchange traded funds (ETF’s) that mirror one index or another and similarly managed mutual funds. Money is leaving hand which used to make informed decisions on what securities to buy and going to passive funds that simply track a given index. In the United States, since the global financial crisis of 2008, almost $2 trillion has left actively managed mutual funds with a similar amount held in index ETF’s and index mutual funds (data are from a recent article published by Morgan Stanley).

This is a dangerous trend. Absent a robust price discovery mechanism, stock prices can take random swings unrelated to underlying value or intrinsic value of the underlying businesses.

During the past twenty years, the high yield bond market has experienced rapid growth after decades of relative obscurity. High yield bonds present higher risks.

The growth in “alternative investments” results at least in part from changes to the U.S. regulatory environment. Many changes have altered the investment environment. Here are some of them.

The number of listed companies is falling (while the trading value of listed companies keeps rising).

The result is a vastly different investment environment today than 48 years ago. The number of listed companies has fallen by one quarter while the trading value of the remaining listed companies has risen twelve fold and now comprises 176% of GDP (2019) versus 49% in 1976. The concentration carries its own risks - CEO’s major corporations wield enormous economic power and CEO’s of major fund managers like Larry Fink (Blackrock) or Abigail Johnson (Fidelity) can de facto control many large companies by voting the shares owned by their clients for changes they prefer independent of the ideological views of the owners.

Vivek Ramaswamy has detailed those risks in his latest book “Capitalist Punishment” which I think is a “must read” for anyone with a substantial investment portfolio.

Money is a powerful incentive, and control of a lot of money endows the controlling entity a lot of power. Unfortunately, for reasons Ramaswamy argued eloquently in his previous book “Woke, Inc.” the power is being concentrated in the hands of leaders who (wittingly or otherwise) are leading America into socialism with all of its pitfalls. The rise of ESG, DEI, “climate change” rhetoric, and identity politics are all part and parcel of socialist ideology and are being promoted by the CEO’s of America’s largest companies and largest investment fund managers. It won’t end well.

This is the best thing you have written in months! It leads me to want to find smaller,growing companies that aren’t yet in the indexes in order to benefit from the semi-socialist lockstep buying that MUST occur when they are annointed. Recent example…Vistra. I have enjoyed candidate Vivek but now off to the bookstore 😍

Agreed. Both books are very informative too! Vivek is a ray of hope in a world saddled with PC dei, social justice, climate justice and an array of other BS