Is NVidia undervalued?

Short term, likely not. Long term, almost certainly

The dramatic growth of NVidia in recent quarters reflects demand for its data center AI chips which offer unparalleled performance in a the burgeoning AI segment of the technology industry. In 2022, AI data center chips comprised most of the growth in NVidia revenue, according to some analysts, with the estimated numbr of 7nm data center chips shipped by NVidia that year approximating 1.5 million at an average price of about US$10,000 per chip. NVidia reported data center revenue of US$15 billion for fiscal 2023, and total revenue of $27 billion for that year with the balance coming from gaming (US$9.1 billion) and other applications. NVidia’s fiscal years end in the month of January.

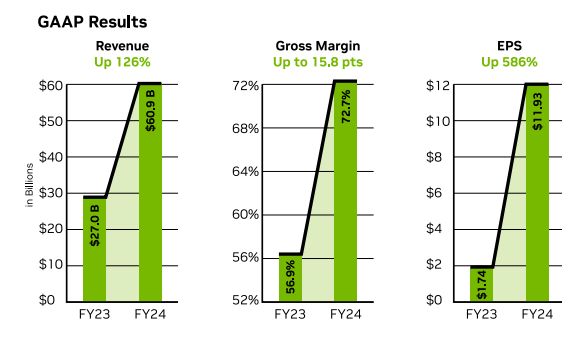

In fiscal 2024, which ended January 28, 2024, NVidia revenue soared to US$61 billion and margins expanded to 72% of sales. The bulk of that growth arose from higher prices with the key H100 chips selling for between US$16,000 and US$100,000 compared to about US$10,000 for the predecessor chip.

US$32 billion of the increased revenue came from data centre AI chips which rose from US$15 billion in fiscal 2023 to US$47 billion in fiscal 2024, while the other NVidia lines added only US$1 billion to the higher revenue.

Since TSMC reports its shipments of high performance chips rose by 24% in its first quarter of 2024, it is reasonable to conclude that volume growth comprised less than US$4 billion of the US$32 billion jump in NVidia data centre revenue in its fiscal 2024 results, suggesting higher prices made up US$28 billion of the rise. TSMC reports it has sold out its capacity for 2024 so volume growth for NVidia will be nominal this year.

The valuation issue for NVidia turns on how long the company can charge prices that yield 72% margins. It seems likely in the face of strong demand that NVidia prices will remain high for a few years (say five years) while competitors and customers alike try to develop competing chips that provide similar processing power. If they succeed, competition will drive prices lower in my opinion.

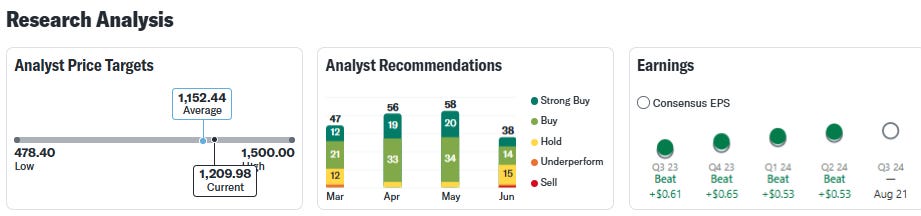

Famed valuation expert Aswath Damodaran published a June 2023 article grappling with the question of NVidia valuation. Damodaran concluded that NVidia shares had a value of about US$409 per share, and were 72% overvalued by the market at that time. NVidia shares have risen further since last June, and now trade at US$1,210 per share more or less. Many Wall Street sell-side analysts have jumped on the NVidia bandwagon and see higher share prices in the cards, with “price targets” in the range of US$1,150 to US$1,500.

I am skeptical of the bull thesis. High prices attract competition. The technology that allows NVidia to build 7nm and soon to be 3nm chips is not owned by NVidia but is owned by its supplier, Taiwan Semiconductor, and other customers of that company are working feverishly on their own designs of AI data center chips. Apple, Microsoft, Meta, Alphabet and Amazon are rumored to be pouring resources into proprietary chip designs.

Given its momentum and lock on the high end data center AI chip market for at least a few years, I will not be surprised to see NVidia shares trade higher, but the irrational exuberance of the market for its latest darling has a dark side when the thesis is overtaken by events and the shares can drop just as fast as they have risen.

On balance, NVidia is too rich for my blood and I own none.

Hi Michael! I think the title and the subtitle don't really match the content of your piece?

Without massive inflation its hard to justify the price, supply and demand should reduce demand. Unless huge $ are being earned in AI the money or need to acquire more of the high end product will reduce. Many purchases were made in desperation. They may think twice about buying more.. of course maybe with the halving of bitcoin, and the ETFs it's the only game in town.