Intel may be the best play on AI

AI's rising tide will lift all semiconductor boats and the largest boat will displace more water

Intel Corporation (I NTC) has been out of favor for over a year with the stock of this extraordinary company falling as low as $25 from its all-time high of almost $70 a share only a couple of years ago . The best time to buy into a top-notch semiconductor manufacturer is when it is decidedly out of favor, in my opinion. Intel's stumbles are investors' opportunities.

Artificial Intelligence (AI) has been around for decades but has become the flavor of the day since the launch of ChatGPT which put an AI screen in front of anyone interested and demonstrated the power of large language models to write essays, create poetry, solve problems or create art (not a complete list by any means) . That excitement drove up the shares of key suppliers and users of AI technology almost immediately with few investors paying attention to the fundamentals. NVidia (NVDA) had the best run, touching the trillion dollar valaution based on its excellent graphic chips with a used widely in many AI applications. Other companies that benefited included Microsoft (MSFT), Apple (AAPL), and Amazon (AMZN) to name only three. Excitement over a new development often sees investors flock to stocks they dream will fly based on the news.

Serious investors avoid the excitement. Investors benefit from lower stock prices, not higher ones. To benefit from a run-up in your favorite stock you have to sell it, pay trading fees and commissions and find another place to invest that is at least as good as the one you sold. In an efficient market, that is quite a chore, and the evidence is clear that as a group traders underperform the market indices (as they must) since trading is not free and no wealth is created by trading, only redistributed. Everyone thinks they can pick stocks better than others but few have succeeded. The key to success is to buy into well-managed companies with long track records of success at depressed prices and wait patiently for them to revert to returns on capital consistent with their history. It is tautalogical that if you can buy into the same earnings stream at a lower price you will enjoy a better return.

In Intel's case, the company will benefit from the increased demand for semi conductors arising from rapid application AI technologies in all areas of the market. AI will find its way into software applications, search, cars, trucks, appliances, art, music and health care. In fact, it already has.

AI is not magic. It is a network of computers linked together in a server farm running sophisticated software. Many call server farms the "Cloud" and it seems certain that demand for servers will gro w. AMD (AMD), ARM (ARM), Intel, Taiwan Semiconductors (TSMC) all supply key products for server farms but Intel is the leader in terms of volume if not profits at this point in history, with a market share close to 80% in server CPU's. Sure, Intel has been losing share to AMD among others, but the company remains the largest supplier in terms of Fab capacity.

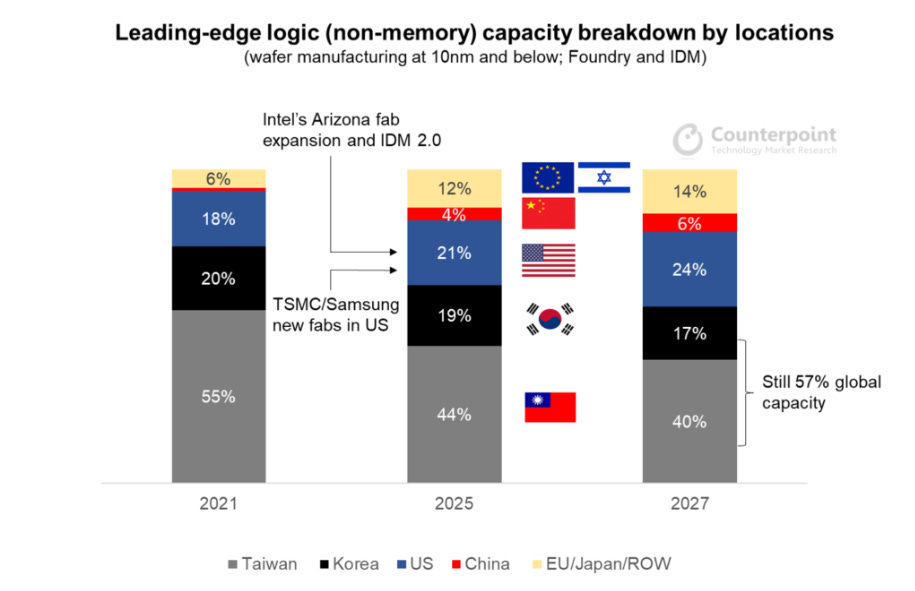

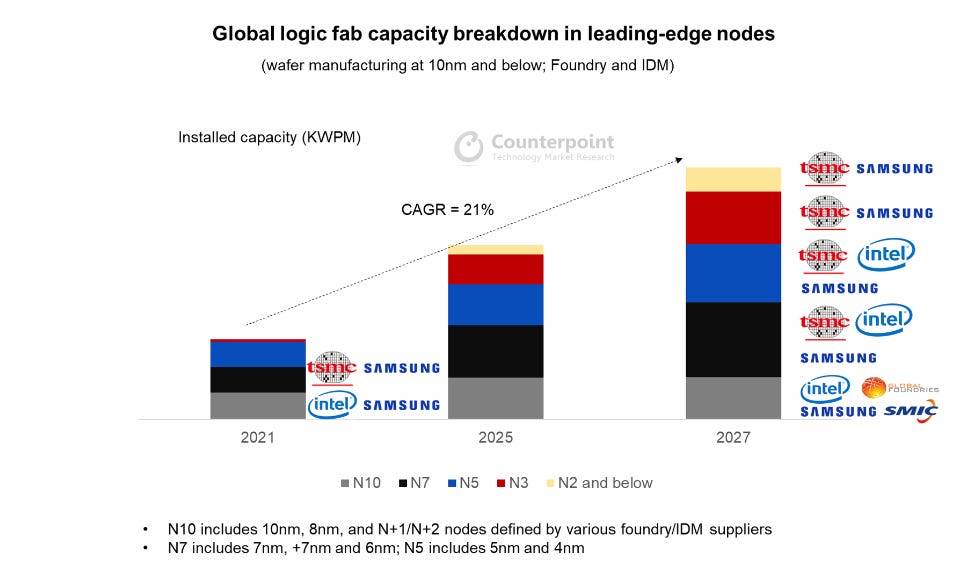

Source: Market Share (Counterpoint)

In fast growing markets, the tide of growth lifts all boats and the winners will be those that can expand their foundry capacity fast enough to keep up with demand. TSMC and INTC are in the midst of rapid expansion with new FABS under construction. Intel and TSMC are the only pure play semi-conductor manufacturers in the fray and in my opinion the geopolitical risk makes TSMC less attractive than INTC to capture value in this growth, in addition to the relatively depressed price of Intel stock

Source: Expansion plans (Counterpoint)

Choosing individual stocks based on their use of AI applications in their businesses has already seen the obvious candidates (MSFT, NVDA, META, etc.) enjoy major gains but the source of the chips to power that use has left Intel behind and without much logic. Fabs that turn to AI chips which use up capacity and create a shortage of Fab capacity for all chips, not just those directly related to AI. Intel will benefit more than most not only for the next generation chips it will produce in its new Fabs under construction but also for the coming shortage of chip capacity worldwide. TSMC will be another beneficiary but has not suffered the investor malaise that has seen Intel stock plummet.