In a few weeks, Rubellite Energy will report results

Rapid growth in production and cash flow is my expectation

Rubellite Energy (RBY.TO) is a relatively new company, a spin off from Perpetual Energy (PMT.TO) that is exclusively drilling in the prolific Clearwater play. The company has grown from 350 barrels a day at inception last year to close to 2,200 barrels a day in Q4 2022 (based on preliminary company estimates) and is currently producing about 2,700 barrels a day. The blistering growth in Canada’s best oil play makes this company a great speculation on drilling success and heavy oil prices - speculation since drilling success is not assured and oil prices are volatile.

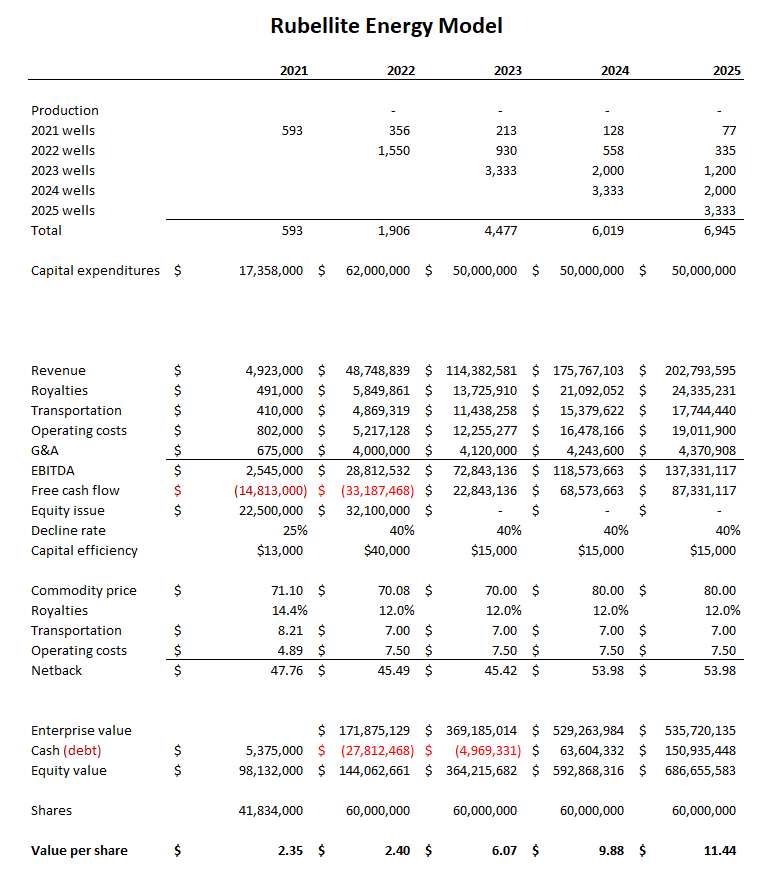

My model of Rubellite’s operations is based on company operating data and an assumption that Western Canada Select (WCS) oil pricing will average CAD$70 a barrel this year and rise to CAD$80 a barrel in 2024 and for a while thereafter. The world oil markets look tight to me, and by late 2024 the world should be recovering from any recession that might happen this year. Right now WCS is priced at ~US$60 a barrel, equivalent to over CAD$75.00 a barrel.

Here is the model:

I have valued RBY equity at five times EBITDA although there is a strong case for a much higher multiple if the forecast growth is achieved. Based on my analysis and assumptions, Rubellite shares in 2023 should trade somewhere around CAD$6.00 a share and by 2025 over CAD$11.00 a share. Oil prices are volatile and recession looms, so don’t rush to the conclusion that large gains from today’s CAD$2.40 a share price are certain. They aren’t, but in my opinion they are not only possible but on a balance of probabilities (in my opinion) likely. Rubellite shares traded in the CAD$5.00 range in mid-2022 and fell back to the current level owing to less than expected production growth during the first three quarters of 2022, demonstrating that investors fear losses more than they enjoy gains and over react to weak results (at least that is the conclusion of Nobel laureate Richard Thaler in his behavioral finance work).

I own 40,000 shares of Rubellite purchased at a bit less than today’s prices and expect to hold them for years. Rubellite is managed by Susan Riddell-Rose, the daugher of the late Clay Riddell and sister of Paramount Energy CEO James Riddell. She is married to Mike Rose, CEO of Tourmaline Oil (TOU.TO). Discussions over thanksgiving dinner or at family Christmas gatherings must be interesting with all that oil patch expertise in the room.

Family relationships aside, I think Ms. Riddell-Rose is a terrific manager and like the risk-reward profile of Rubellite. I would not be surprised to wake up in a decade (if I live another decade) to find my tiny investment in Rubellite was worth millions. Time will tell.

thankyou for the well written article as usual, yes the family dinners would certainly be a treat to hear.

Ive held RBY in the past and currently hold some PMT, both very cheap based on metrics imo, Susan holds at least 16 million shares of RBY and hard to tell how many of PMT, but the rights that have been issued are very dilutive. Neither company gets much attention, and the "spin off" of RBY from PMT was quite complicated. Initially that was why I got into it.. Its cheap, perhaps Q4 gets some interest.. Perhaps the talk around the dinner table is TOU and TPZ are better? I did see where Mike lets her use his drilling teams so maybe these small companies get good and timely completions :)