If oil prices keep falling, who gets hurt the most?

Heavy oil producers seem the most exposed

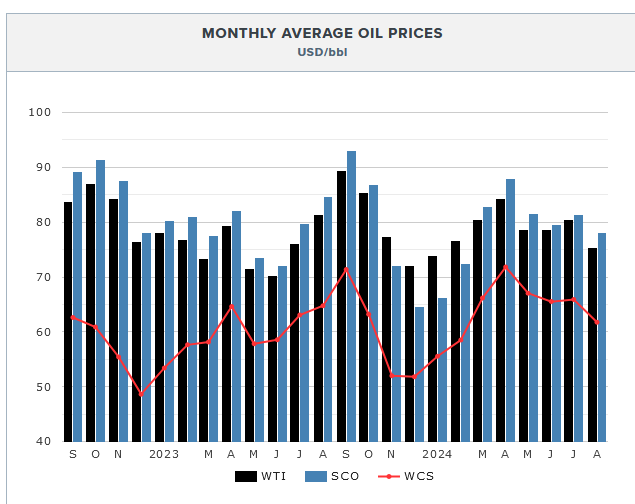

Oil prices in Canada remain above year ago levels but have been falling since May.

The Canadian oil industry is quite profitable at today’s prices, despite many investors reacting to the volatility in oil prices in recent weeks as if they were catastrophic. The chart above, in US dollars, shows how synthetic crude (SCO) from the oil sands trades at a premium to West Texas Intermediate (WTI) and Western Canada Select (WCS) still trading at about US$60 or in the high $70’s in Canadian funds. It is hardly time to despair, although admittedly the prices are a backward look of little value to forecasting where commodity prices will go. This article assumes they fall materially, and estimates who gets hurt and who benefits.

For the purposes of this article, I will assume WCS and Access Western Blend (AWB) at Canadian $50 a barrel, Canadian light oil at $60 a barrel, and SCO at $65 a barrel. I will assume natural gas prices for the next year average $3.50 per gigajoule in Canada expressed in Canadian funds, which, while higher than today, is consistent with seasonal trends and what is called “strip” prices, more or less, and Natural Gas Liquids at CDN$45 per boe. I use CDN$45 for Natural Gas Liquids (NGL) and assume condensate is priced like light oil. I have ignored hedge books, despite recognizing that some companies have robust hedge books and will be more or less insulated from lower prices.

The table below is an estimate of the intrinsic value of key Canadian producers based on those assumed commodity prices and using a modified Black-Scholes valuation approach, all expressed in Canadian dollars, compared to today’s trading prices.

The analysis is far from perfect. Saturn Oil (SOIL.TO) looks the worst but has a large portion of its production hedged. Several companies have hedge books that provide protection against lower oil prices, while others have natural gas hedges.

But the comparison is nevertheless useful.

What this sensitivity test discloses is that almost a dozen companies are systematically undervalued in the market, a few are fairly valued (plus or minus 10%), and ten are systematically over valued, all based on the assumption of the lower commodity prices set out above. One conclusion is that investors as a group don’t see a material risk of the assumed lower prices, a dangerous assumption in my opinion. Another conclusion is that many companies popular with Canadian investors have futures tied to WCS and AWB and its related grades and will suffer if heavy oil grades experience price pressures. A final conclusion is that producers with significant exposure to natural gas are already discounting prices higher than $3.50 a gigajoule in the case of stalwarts $TOU and $ARX ( for good reason, since their access to LNG markets provides higher prices than domestic) but don’t imply the same expectation for smaller players like those highlighted in green. Markets value liquidity, name recognition, track record of success, and many other factors and on balance are inefficient price discovery mechanisms. Those inefficiencies create the opportunity for disciplined investors, since in the fullness of time, value surfaces.

A final comment, more of a warning, is that this analysis assumes commodity prices below those existing today in the case of oil grades and above those existing today in the case of natural gas. The “values” should be used with caution since they are more of an indicator of direction and sensitivity than of intrinsic value.

Like all investors, valuation is just one consideration. My choices would not likely be yours. I own $BIR, $PEY, $BNE, $SDE, $WCP, $RBY, $SOIL.TO and $CJ.TO all of which I assess as having the best exposure to the combination of a cold winter, LNG start up in Kitimat (portending higher natural gas prices), the Clearwater heavy oil play (in the case of $RBY), and the robust hedge book and excellent Saskatchewan assets of $SOIL.TO.

What do you think about the theory that oil prices are being artificially suppressed in order to lower gasoline prices for American consumers prior to the election, and will stop being suppressed after the election?