How will U.S. tariffs affect inflation?

The left makes silly claims, the electorate buys into their crap

The United States is a trading nation, with $3.1 trillion of imports offset by $2.5 trillion of exports. American imports of consumer goods comprise $654 billion, of cars and trucks another $376 billion and of food and beverages $151 billion.

U.S. imports of crude oil and related products run about $200 billion annually. With a population of 330 million or so, imports per capita are roughly $9,400 or about $24,000 for an average family of 2.6 persons.

Donald Trump promotes a 10% across the board tariff on imports, but that tariff would affect only $805 billion of consumers goods and food related products (other than cars and trucks which I will deal with separately). If all of that consumer porduct tariff was passed onto consumers in price, it would raise prices by about $240 per capita had there been no tariffs on those goods already and if the suppliers were able to persuade consumers to pay the higher prices rather than absorb some of the tariff costs themselves to remain competitive with American suppliers.

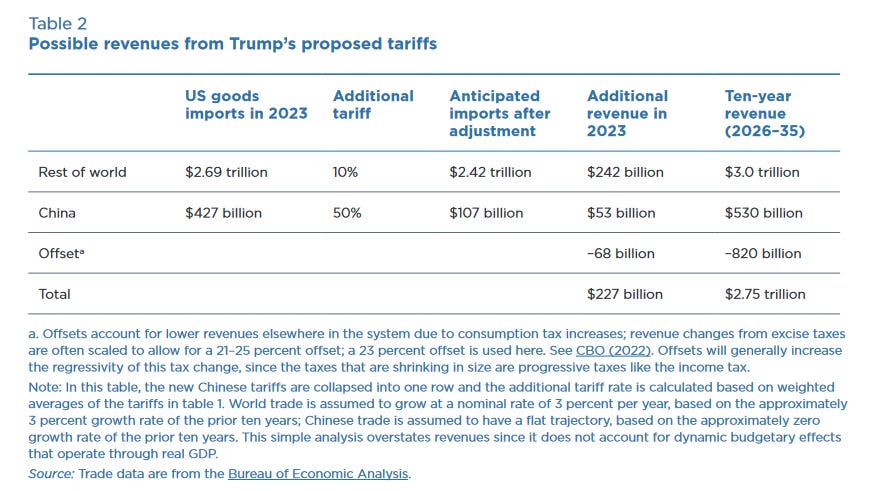

The Biden Administration published a report on the Trump tariffs, putting the revenue figure at $295 billion per year, offset by $68 billion per year of what the authors described as “offset” and explained in a footnote.

If all $227 billion were in effect a “tax” on those who buy the imported goods, the cost per household of 2.6 people is about $150 a month. Trump also proposes to allow deduction of social security taxes which run about $3,000 per taxpayer or $7,800 per household, and the tax benefit of this deduction at a an average 30% tax rate is $2,340 or a saving of $195 per month.

Most of Democrats criticisms of Trump’s proposed policies are tainted by the fallacy of composition - taking an individual policy out of context and ignoring the policy platform as a total system. One line item ignored is the drop in imports presumably replaced by domestic production, amounting to some $590 billion annually. GDP created per person employed in 2023 in the U.S. was about $150,000 so the implied rise in employment is $590,000,000,000 divided by $150,000 = roughly 4 million more people employed.

The howling that Trump’s tariff’s would be inflationary is similarly a tactical use of the fallacy of composition. Sure prices would rise in the first year of the tariffs but thereafter the tariffs are already embodied in the costs and no longer contribute to higher prices beyond the initial price rise caused by the added cost of the tariff.

Concerns about borrowing are legitimate but need context. First, the evidence is that the deficit will grow much faster and much higher in a Democrat led administration. There is no doubt that the Trump tax cuts will impact revenue, but it is unclear in which direction. If the tax cuts spur economic growth, the lower rates might result in higher revenues. Despite Democrat claims to contrary, the amount added to the deficit by Biden-Harris in three years far outpaced the rise during Trumps’ four year term.

The U.S. Tax Foundation finds that the Trump tax and tariff proposal will add $1.2 trillion to the deficit over ten years or $120 billion per year. America’s ability to carry that added debt will be enhanced by higher employment. Those four million jobs referred to above at a tax per employee of $15,000 amounts to $60 billion per year, more than enough to pay interest on the added debt and contribute to its orderly repayment.

A Harris government seems a likely outcome in November, although the race is so close it is dangerous to conclude she will win. But it is not dangerous to conclude that if she does win, the cost to America will be enormous and rank as a colossal missed opportunity. Trump may be the weaker debater but he is the stronger leader and best suited to right the American ship which is teetering into authoritarian socialism for the fist time since 1776.