History of The Enfield Corporation Limited

Reply to a question from the Canadian Oil Mafia

At a recent Twitter space hosted by the Canadian Oil Mafia, some listeners asked how I became involved in the oil & gas industry and I promised to provide a bit of background on The Enfield Corporation Limited (“Enfield”), a company I founded in April 1984 with $100,000 of my own money (for a 25% interest or 5 million shares at the time of the public issue) and venture capital support from Helix Investments Limited (“Helix”) who put up $100,000 for an equivalent 25% interest and $1,500,000 for preference shares and The Pagurian Corporation Limited (“Pagurian”) who put up $200,000 for 50% of the common equity and $3,000,000 for preferred. That funding, with $9 million of bank debt and a vendor take-back loan financed the $15 million purchase from GE Canada of a plant in Cobourg making plastic components. At the time, I was Vice President, Corporate Development of GE Canada and resigned to make the offer to buy the Cobourg factory.

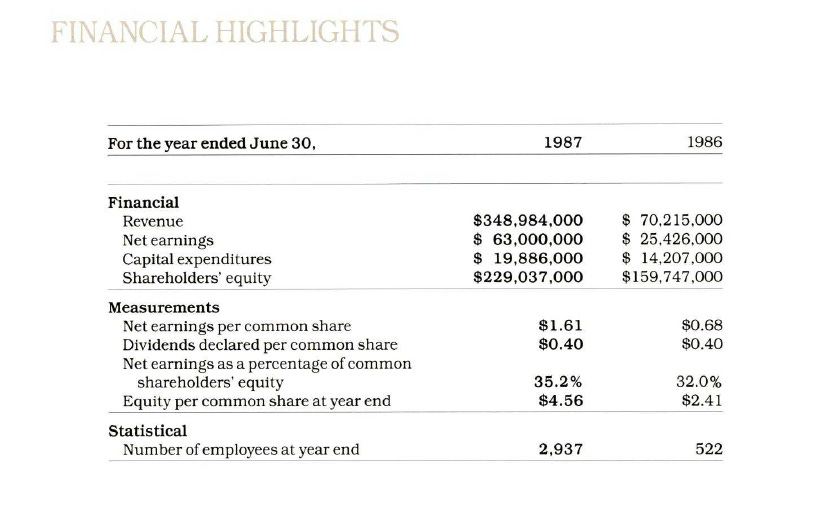

Enfield was profitable from day one and grew rapidly, largely by acquisition. The preferred shares were redeemed at par within 2 years of the company’s start. In the year ended June 30, 1987, Enfield earned $63 million after taxes making it one of the most profitable Canadian companies despite being only a bit more than 3 years old.

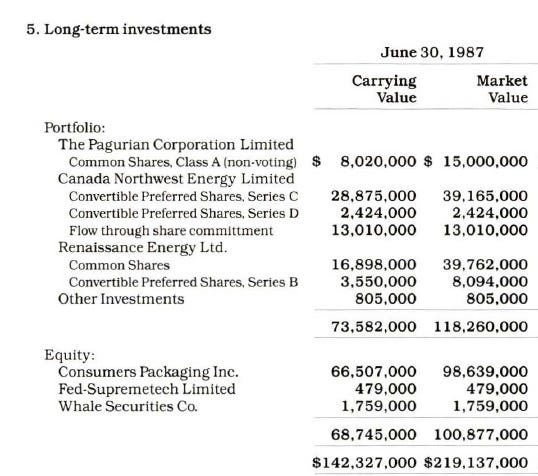

By that time, Enfield had gone public receiving a net $65 million from the issue of 6.5 million treasury shares and was trading on the Toronto Stock Exchange. Post IPO Enfield held a controlling interest in Federal Pioneer Limited, one of Canada’s largest electrical companies, and a major interest in Consumers Packaging, Inc., one of Canada’s two glass container manufacturers. Enfield began investing in oil & gas companies and by fiscal year end 1987 had major holdings in Renaissance Energy and Canada Northwest Energy. The following year, Enfield acquired 42% of Numac Oil & Gas Ltd., a company founded and led by legendary oilman Bill McGregor. Bill’s board included Vern Horte, also a legend in the Western Canadian Sedimentary Basin who is credited by many with the creation of the Canadian natural gas industry and served as President of TransCanada Pipelines.

Renaissance Energy was managed by Ron Greene and Clayton Woitas and was one of the most successful natural gas producers in Canada for several years. My exposure to Numac, Renaissance and Canada Northwest Energy was responsible for my enduring interest in the Canadian oil & gas industry. Enfield also provided $40 million in financing to Poco Petroleums, a company led by Allan Markin, another successful oil man who today is one of the largest individual shareholders of Canadian Natural Resources.

Enfield was taken over in 1989 and I was tossed out. By that time, Enfield had controlling interests in Consumers Glass, its only former competitor Dominion Glass, Federal Pioneer Limited, and some smaller companies, with consolidated assets approaching $1 billion and over 9,000 employees. Helix sold its 25% interest in 1988 for $42 million and Pagurian ultimately sold its 50% interest for substantially more. My company made a lot of money for my investors and for me.

I went on to create the modern Rexall Drug Store chain in 1991, selling it to Daryl Katz’s Katz Group in 1996 by which time it operated 36 drug stores, and I moved on to automotive parts where I spent the rest of my business career as CEO of Automodular Corporation and Chairman of Dominion Citrus Limited which, through Automodular, I controlled for many years.

Oil & gas remains a major area of investment interest for me.

Great Canadian success story!

Many thanks for sharing, Michael. One of Canada’s problems, and there are many, is we don’t promote and value entrepreneurs & risk takers like yourself. On the contrary, we are now pushing much needed capital out of the country & discouraging foreign investment as well