Has the rubber hit the road for Canacol Energy?

Market smells failure, stock is tanking

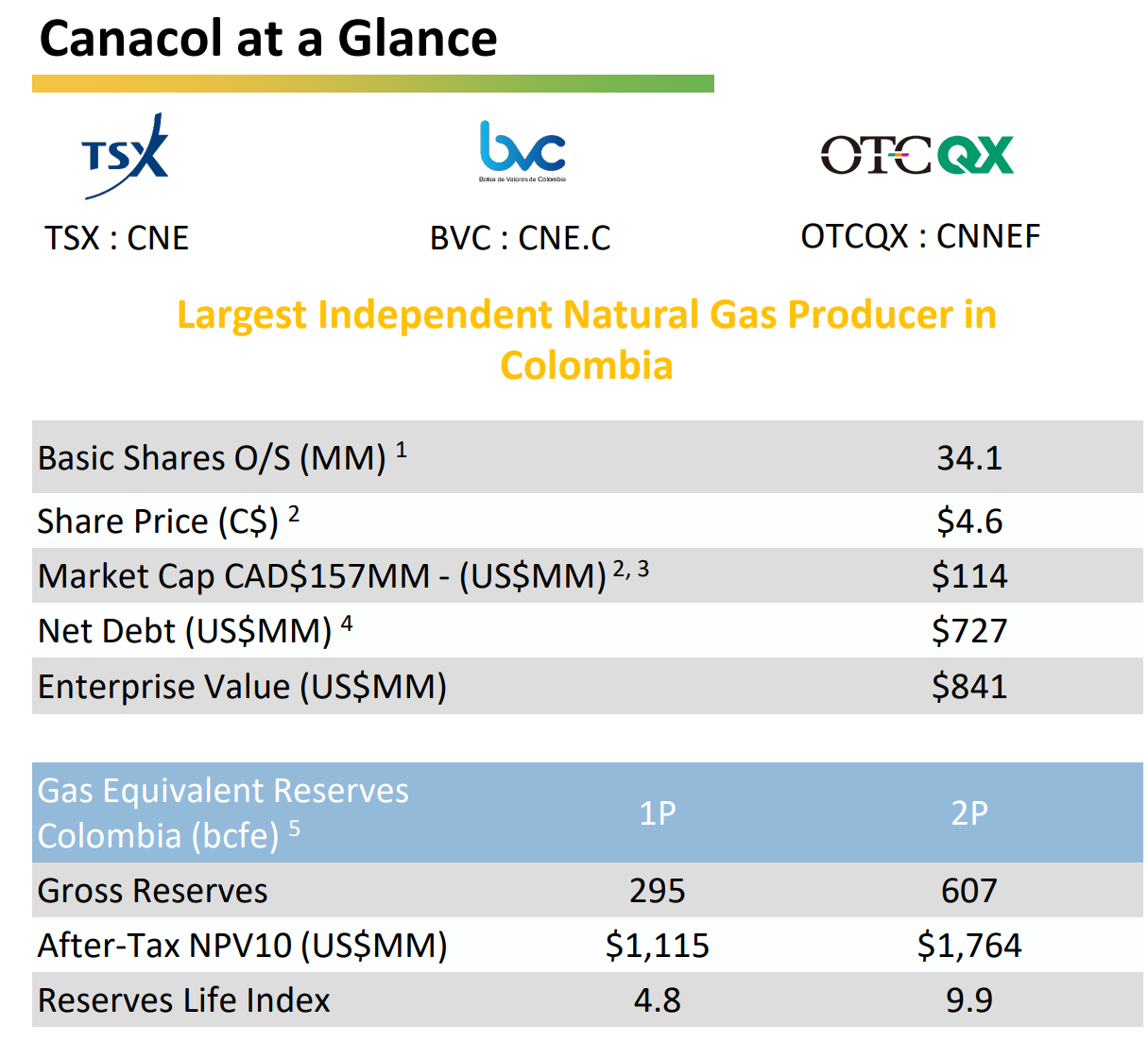

Canacol Energy (CNE.TO) is a Calgary based natural gas producer whose operations are domiciled in Colombia. The company has plenty of assets but too much debt. The result is a market capitalization of US$841 million comprising US$727 million debt and only US$114 million of equity at market. 2P Reserves have an NPV10 of US$1.8 billion. Something has to give.

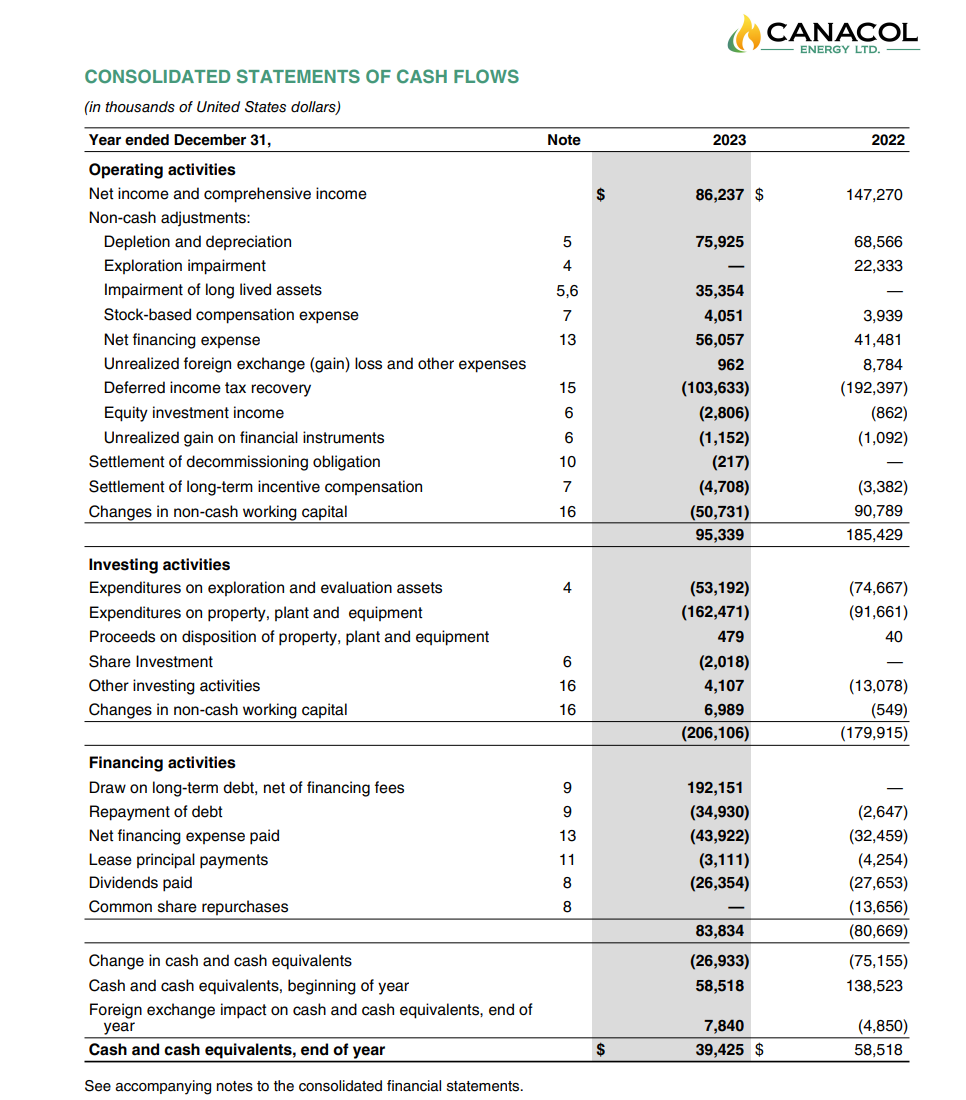

Audited 2023 results show a looming problem. While the company is profitable, cash flow of US$95 million falls well short of the US$216 million capital outlays and management, seemingly oblivious to the risks, paid out US$26 million in dividends during the year.

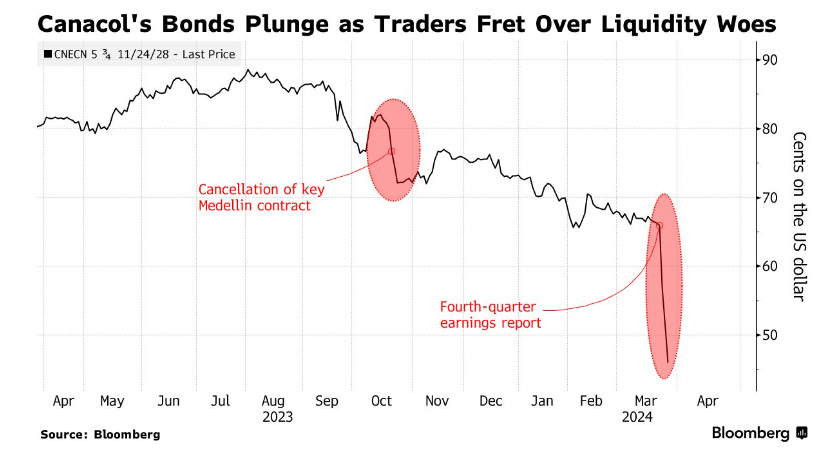

Bond investors don’t like the company’s paper. Publicly traded bonds change hands at a deep discount to par value but are not due until 2028.

With only 34 million shares outstanding, CNE.TO investors will make out like bandits if the company survives and eventually retires its debt. They will suffer losses if it does not.

This is a classical case of management relying too heavily on debt and betting on commodity prices that will ensure enough cash flow to meet all obligations as they fall due. Some companies with great assets took this path with disastrous results - Pengrowth was taken over at 5 cents a share; Lightstream investors suffered a total loss; Bonavista shareholders were cashed out at 5 cents a share; and, Chesapeake Energy went through a Chapter 11 restructuring. In fact, about 100 energy companies went bankrupt in 2020 when the [pandemic saw commodity prices drop dramatically.

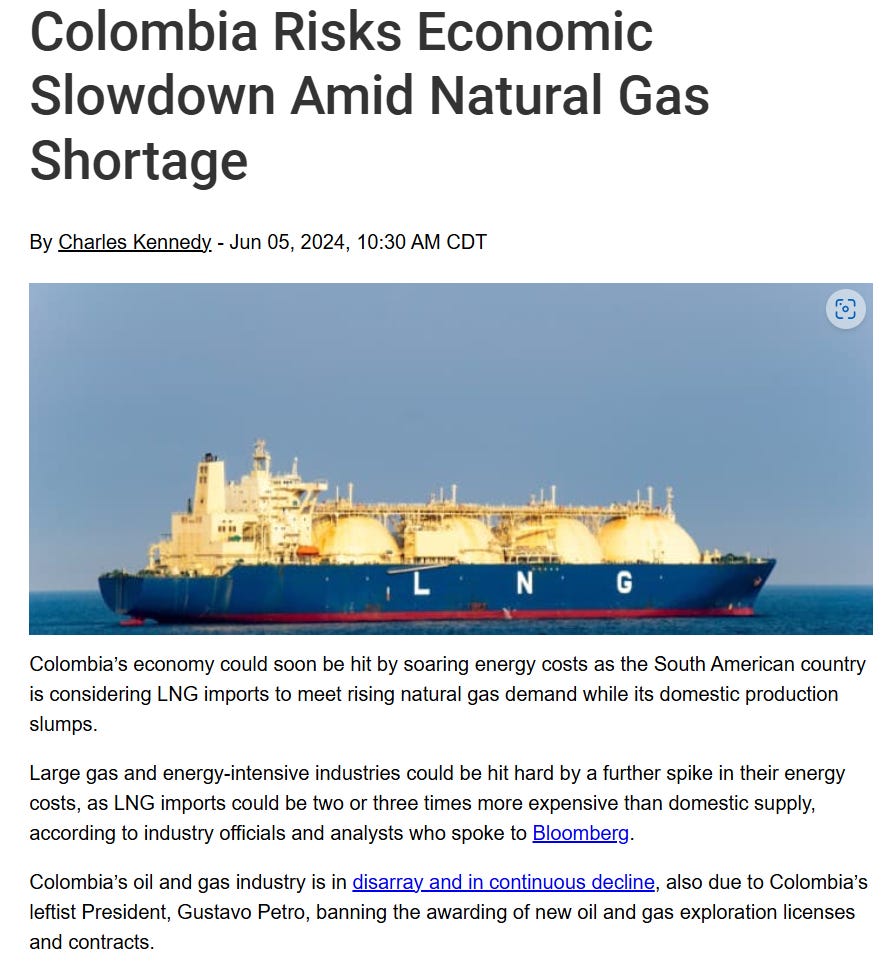

I think the best Canacol shareholders can hope for is the sale of some of the company’s assets, possibly to Colombian state owned Ecopetrol, although talks between these companies have been denied. There is an outside chance Colombian natural gas prices will rise dramatically and save the company, since Colombia has a severe shortage of natural gas and is looking to LNG to keep the economy afloat. The situation is dire with the leftist government stifling domestic production based on the flawed notion that fossil fuels cause climate change.

This is a good time to avoid exposure to Canacol. Taking a loss on the shares will offset capital gains on other energy companies and there are plenty of better bets with a lot less risk. But if you are a high roller, you can let it ride and see. On an asset basis the shares are likely worth about US$40 a share and even in a fire sale of assets, you might get US$20.

This one is too rich for my blood. I used to be a shareholders but sold my shares a while back, taking a loss.