Hammond Power Systems will benefit from the demands of the grid

This Guelph based company is a gem

Electricity transmission depends on some vital components to move power at high voltage across many miles and then step down the voltage to usable levels as it reaches industry and household applications. A vital part of the “grid” comprises transformers, including large power transformers you typically see in fenced off areas owned by electric utilities and pad mount and pole mount transformers hanging from telephone poles and mounted on concrete pads along your street.

Power transformers in United States now have an average age of 40 years, and most of them have a 40 year life plus or minus a couple of years. According to the Department of Energy over 90% of the electricity consumed in the United States passes through a power transformer. It is worth taking a moment to think about the structure of the grid.

According to the Wall Street Journal, utilities are waiting years for power transformers and months for smaller transformers and paying four to five times as much as was typical a few years ago if they can get them at all.

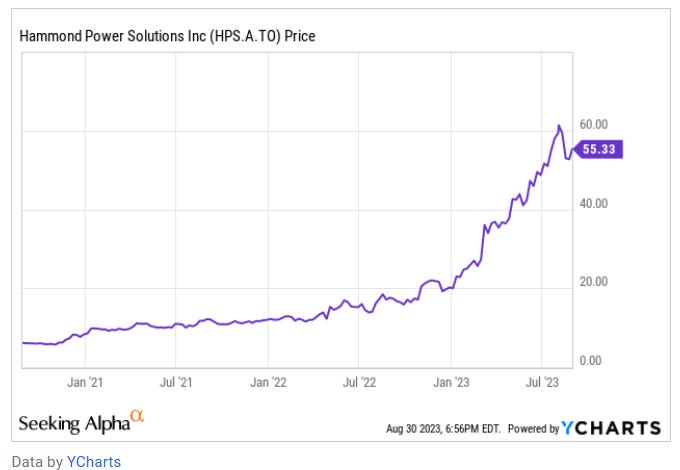

Shortages benefit suppliers. One supplier who is benefitting is Hammond Power Solutions, a Guelph, Ontario based company about 100 years old, whose stock has soared in recent years. Trading under the symbol HPS.A, the stock has been on a roll. Today, it has about doubled since the chart below was published in an article on Seeking Alpha, and trades at CDN$106 a share today. In the last four years, the stock is up tenfold.

Is it too late to buy into this story? With a market capitalization of CDN$1 billion, this is a small company in a big market. With only ~9 million shares outstanding, the shares can be volatile and trade “by appointment” - i.e. not very liquid. But with a price to earnings multiple of about 22 times, the shares seem fairly valued. Hammond has operations worldwide from seven facilities including one in Mexico and two in the United States.

Hammond is net debt free (cash considerably greater than debt) and pays a small dividend of CDN$1.1 per year. Hammond is the largest supplier of dry type transfomers in the U.S. market (larger than Siemens, GE, Schneider Electric or Asea Brown Boveri) and that $1.4 billion market is growing at an estimated 7% annually and expected to keep growing for an extended period.

2023 earnings per share of $4.68 should more than double in the next five years in my opinion, benefiting from both market unit growth and pricing power which I foresee providing a compound annual growth in earnings in the range of 20% per year and bring per share earnings to the CDN$12 range by 2030. A typical 16-17 times market multiple on those earnings would see the stock at close to CDN$200 per share.

Hammond is an established company not exposed to a high degree of risk in its market. With tailwinds arising from the need to replace existing stock of transformers while supplying enough new installations to support expected growth in the grid, Hammond looks like a reasonable long term hold.