Fire at Texas LNG facility irrelevant to gas stocks

Market over react to short term outage

Nobel prize winning behavioural economist Richard Thaler observed that investors over react to bad news and under appreciate positive long term trends. That frailty of human nature leads to poor investment decisions. For the short term, the 2 Bcf/day of exports to Europe lost to the Freeport LNG facility fire results in 14 Bcf/week added injections into storage, a situation that could last until November-December when withdrawals typically begin as winter approaches. In that ~20 week period, all else being equal a total of 280 Bcf could find its way into storage over and above normal injections. That would still leave storage levels below last year’s levels going into winter. This Seeking Alpha article has it right.

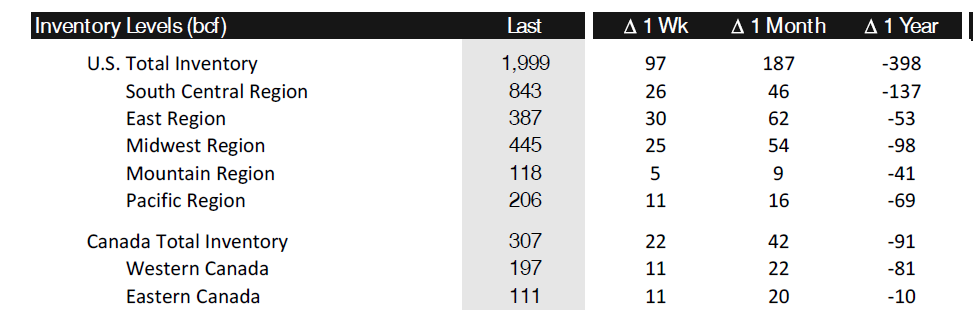

As of June 10, 2022 natural gas storage levels were 398 Bcf below last year in the United States and 91 Bcf below last year in Canada. Data are from TD Waterhouse report “The Gas Line”.

But all else is not equal. The idled LNG facility is expected to be at least partially back on line with 90 days and fully on line by winter according to Freeport LNG, the operator. At the same time, producers are unlikely to ramp up drilling during a period of short term surplus with prices falling 20% in just a couple of days. Those prices should stabilize as it becomes clear to investors that 2 Bcf/day is not going to tip the scales enough to flood the market with gas. Last week’s injection of 70 Bcf compares to the 2021 injection of 90 Bcf in the comparable week.

The unwarranted sell off of natural gas stocks provides an opportunity to add to positions like BIR.TO PEY.TO NVA.TO TOU.TO AAV.TO CNQ.TO and ARX.TO all of whom have strong balance sheets and plenty of free cash flow. By my estimation, based on a reference multiple of 4 X EBITDA, those companies are discounting a natural gas price of about CAD$5.00 or less. Gas prices today are north of US$7.00 at Henry Hub.

Second quarter results will be published in mid-August and should show terrific results fro the Canadian gas-based E&P group and likely see some dividend increases and expanded share repurchases.

I expect to add to my portfolio of natural gas weighted equities over the balance of the summer.

Clear eyed analysis. Thanks.

Agreed. This is just another example of Mr. Market wildly overreacting. As you write, now and possibly this summer should be good times to be picking up shares at a meaningful discount. I have stink bids in place and fingers crossed they get filled.