Facebook is now undervalued

OK, so it is called Meta Platforms but I hate that name and think the "metaverse" is silly

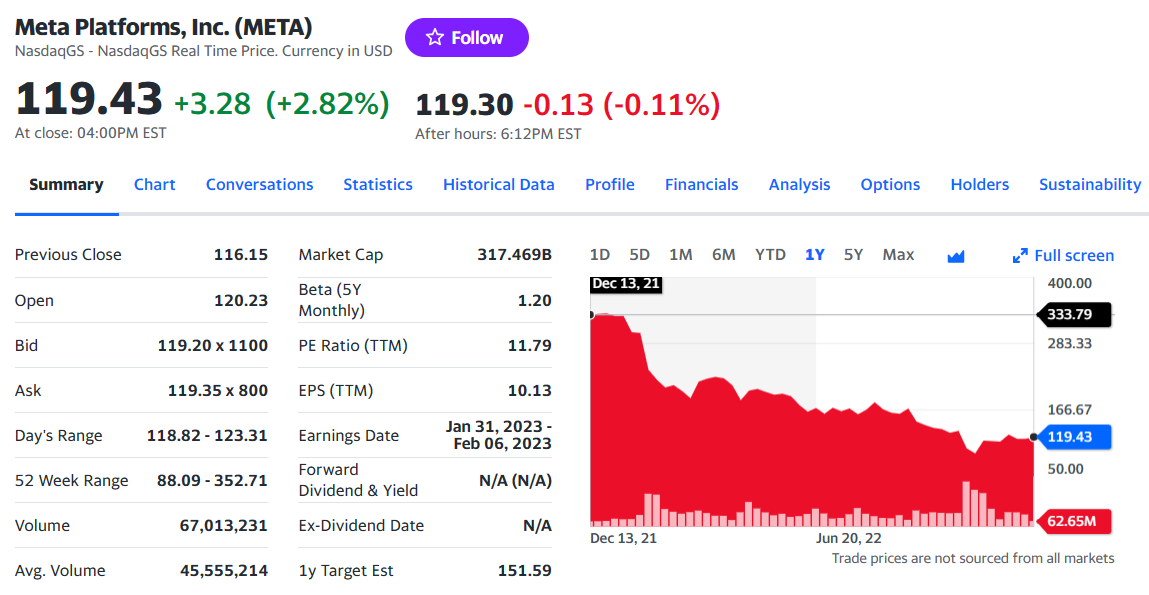

Facebook (META) shareholders took a bath this year with Zuckerberg leading the charge. META stock fell from over $330 a year ago to about $120 now, and the company now trades at close to ten times net income. The reason, Zuckerberg’s insane spending on his dream of creating the “metaverse”, a fictional virtual reality where his avatar might have a personality - something he seems to be missing in real life.

But Zuck may have had a “come to Jesus” epiphany when his fortune tumbled by over $100 billion. Sentiment towards META is improving with JP Morgan exhibiting a bullish tone this morning.

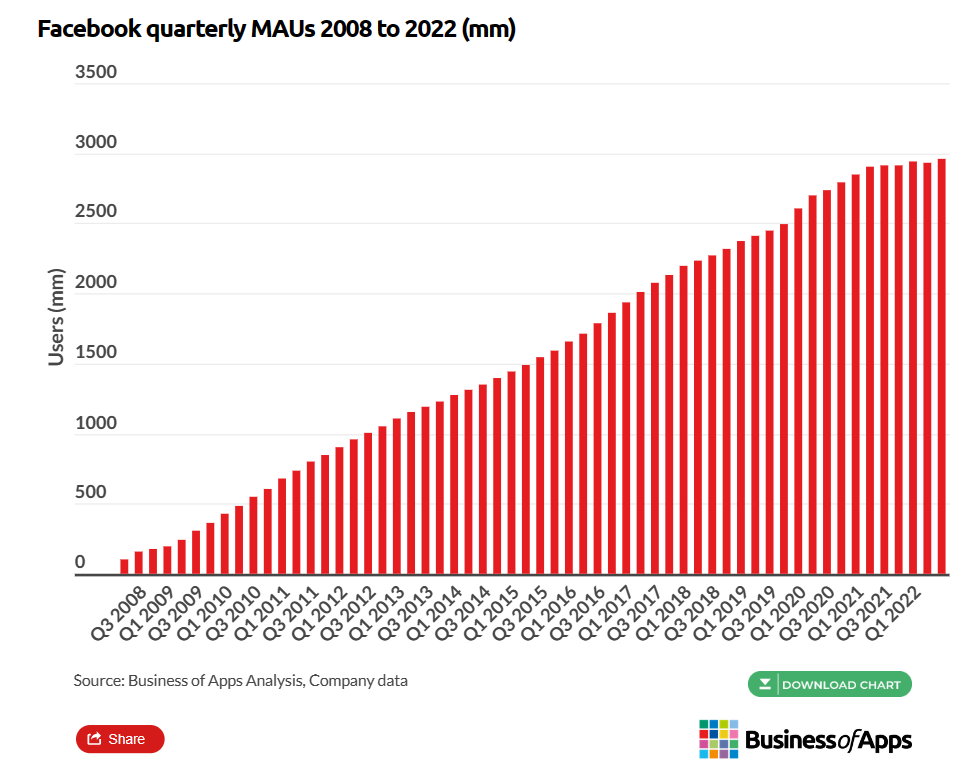

Facebook seems in no danger of losing a flood of users to rival Tik Tok and may be beneficiary of the legislative mood in United States with various states and Congress either issuing or mulling bans on Tik Tok. At the same time, the company is in the process of some long overdue headcount reduction with a freeze on hiring and an announced reduction in force of some 13,000 employees.

Online advertising seems under pressure these days suggesting META (like Google, Snap, Twitter and Amazon) may see some softness in revenue for a couple of quarters and it is that likelihood that creates opportunity for investors. If you are patient you might be able to buy a few shares of META at a price under $100 - about twice book value and at an enterprise value to EBITDA of somewhere around 6 times. My guess is Facebook will keep growing albeit more slowly now that its base approaches 3 billion monthly active users.

In any event, the stock today is relatively cheap and while technology based stocks are a volatile and hazardous space, META has no risk of failure and plenty of opportunity to improve profitability. All it would take to make the company shares find new buyers would be a nominal dividend - something like $8 per share (an annual cost of about $17 billion or 40% of expected cash flows in the $43 billion range).

Maybe Mark Zuckerberg will find the idea of regular cash flows that don’t require him to sell any of his ~400 million shares an attractive option. It would give him a few billion a year of walking around money and he could use some of it to buy a life - a real life, that is. Maybe he would invest in Twitter since under Musk Twitter might morph into a serious competitor for Facebook?

People should not buy at any price.

You go woke let them go broke.

Unless you support censorship.

stick with oil and gas equities, you're somewhat better at that