Europe is near collapse. Canada and United States ignore the risks

Biden and Trudeau are so committed to climate hysteria they can't see the damage they are doing

The energy crisis in Europe is blamed by leftists on the Ukraine war but in reality it is a direct result of stupid policies based on fears of climate change grounded in a specious theory that CO2 emissions cause climate change. They don’t, and they can’t. But left wing politicians worldwide see climate fears as a rallying cry for the global authoritarian socialist government they aspire to create.

There may be a cure for mass mania but there is not a cure for stupidity.

Europe has already spent $1 trillion (700 billion Euros) on aid to citizens and businesses hurt by soaring energy costs.

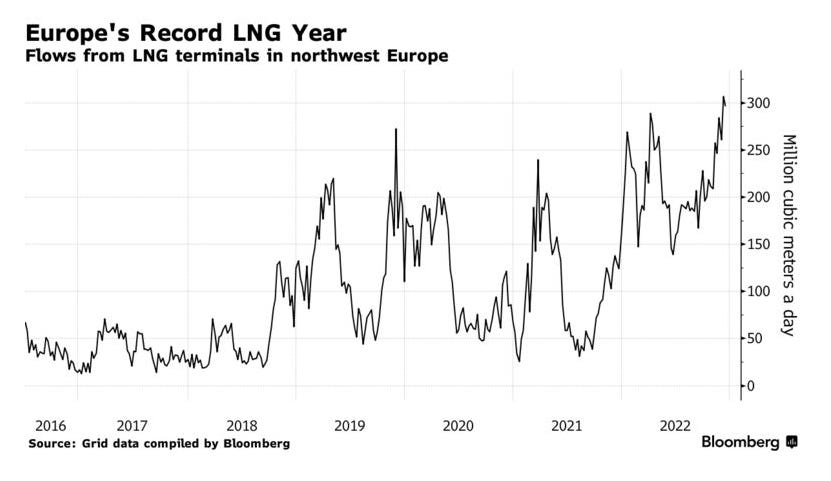

Imports of LNG at record levels are barely enough to keep the lights on and the shortage of fossil fuels, in particular natural gas, is getting worse - not better.

Begging for help, German leader Olaf Scholz asked Justin Trudeau to find ways to ship LNG to Europe from Canada. Trudeau refused saying there was “no business case for LNG” and offered non-existent hydrogen - Canada has no hydrogen production of any consequence and no means of shipping hydrogen to Europe any more than shipping LNG to Europe for the same reason - inane government policies. Leave aside the reality that Europe has no infrastructure to use hydrogen as a fuel for heating or transportation now nor will it have such infrastructure any time soon.

The International Energy Agency (IEA) sees Europe short 30 million cubic meters of natural gas for 2023 (now two weeks away) and proposed accelerated development of “renewables” to fill the gap. This study correctly assesses the shortage but the IEA can’t help but promote the left wing nonsense that “renewables” can provide the needed energy. Despite trillions of capital, so-called “renewables” still comprise only 22% of European energy production, and that includes nuclear.

In 2021, 76% of European energy came from fossil fuels. Europe’s total energy consumption powered by natural gas is 10,074 TwH.

7.36 cubic feet of natural gas are needed to produce 1 KwH of energy. 33 billion cubic meters is 33 x 35.31 (cubic feet per cubic meter) billion cubic feet and 33 x 35.31 x 7.36 billion cubic feet of natural gas is the size of the shortage expressed in cubic feet of natural gas. For those of you more familiar with Bcf, that is 8,576 Bcf (23.4 Bcf/day). Canada’s total production of natural gas is about 16 Bcf/day so the supply shortage is about 50% larger than Canada’s total natural gas production. In Justin Trudeau’s understanding of economics, a market opportunity 50% larger than total Canadian demand at prices as much as ten times higher than Canadian domestic prices fails as a “business case”. Clearly, Trudeau understands drama better than business or economics.

Biden is just like Trudeau, barely scratching the surface of the opportunity by promising to ship more LNG to Europe but doing little to promote increased natural gas production to meet that promise.

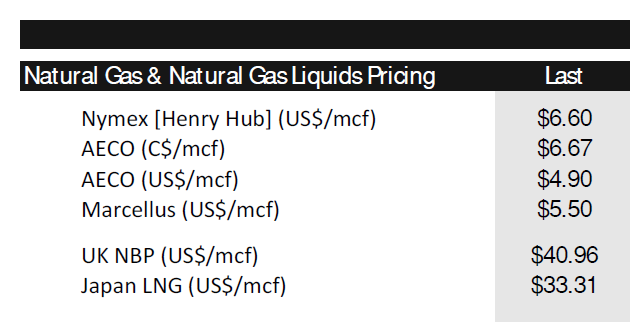

Without increased North American natural gas production increased shipments of LNG to Europe from North American will import European natural gas prices to the domestic North American market which should settle out between European prices less processing costs and freight to Europe (the net price of LNG shipped to Europe) and domestic North American prices. As of December 15, 2022, U.S. natural gas (Henry Hub) was selling for US$6.60/mcf and United Kingdom natural gas for US$40.96/mcf.

It will take time to build out LNG facilities in North America (Canada has yet to build one after 10 years of permitting and approvals but the Kitimat LNG facility should be onstream by 2024 or 2025) but U.S. facilities are also under construction. Within two or three years (the European shortage of natural gas will not abate any time soon) expect to see North American gas prices in the mid-teens per Mcf.

Who benefits? The best plays for strong natural gas markets are Canadian Natural Resources (CNQ), Tourmaline Oil (TOU), ARC Resources (ARX), Birchciff Energy (BIR), Peyto Exploration (PEY) and NuVista Energy (NVA) and a plethora of smaller producers. In my opinion, there is a better case for natural gas prices to rise than for oil since oil demand will be curbed by an expected recession and while this is also true for natural gas, the supply shortage for natural gas is deeper.

Europe’s economic demise will impact global economies and the expected recession will be deep and accompanied by persistent inflation driven by energy costs. Any short term reprieve will see a reprise as recovery fuels higher demand for fossil fuels and supply will remain constrained by leftist policies.

This is a good time in history to be long natural gas stocks.

In the perverse nature of left wing politics, the natural gas opportunity can be traced to climate stupidity and energy investors are the beneficiaries. Who would have thought?

"In my opinion, there is a better case for natural gas prices to rise than for oil since oil demand will be curbed by an expected recession and while this is also true for natural gas, the supply shortage for natural gas is deeper."

Would you mind sharing any forecast on global NG production growth? My understanding is that North American production growth is constrained (due to govt and corporate policies), but not sure about other production regions like middle east, Australia, etc.

Great article. Very well written. I live in Europe and I think here nobody is really realizing at the moment what kind of problem that we have.