Energy investors pray for a Harris win in November

A climate nutter in the White House portends much higher oil & gas prices

Harris pretends she won’t ban “fracking” but no one believes her. Trump claims he will “drill baby drill” and he will do just that. With about 6 million barrels of oil per day comprising the current over supply balance, the oil market is poised for much lower oil prices until enough drilling is idled to re-balance the market.

Trump’s policy choices will cause world inflation to abate, fuel economic growth over time, increase U.S. tax revenue as the economy expands (despite lower tax rates) and “make America great again” as the combination of selective tariffs, lower regulation of oil & gas, expansion of U.S. manufacturing and an eventual reduction in the massive U.S. deficits and household income in United States will resume its long-term growth and America will solidify its position as the world’s greatest economic power.Good news for America but, for at least a couple of years, a bath for oil & gas investors if Trump wins.

Harris will stifle oil & gas development, going back to her socialist roots and spouting more climate nonsense. The result will be higher prices for oil & gas, possibly much higher prices, and energy investors will rake in the chips. Her policies will fuel a resumption of high inflation, interest rates will have to rise again, her promise of “price controls” may become a necessity to keep inflation under control, and the U.S. will return to an era similar to the 1970-1980 period where inflation soared, energy prices crippled the economy, and households struggle to stay afloat. But energy investors will bathe in the limelight of high oil & gas prices and laugh all the way to the bank.

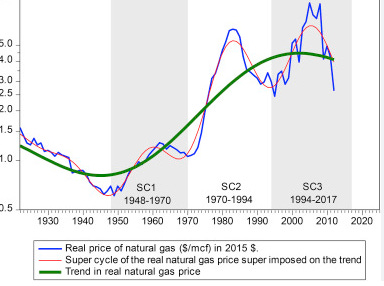

The rampant inflation in the 1975-1985 era arose from stupid fiscal and monetary policy and the formation of OPEC. Inflation made it all the way to the high teens, wage and price controls were enacted in Canada, and the prime rate went over 20%. But, from the summer of 1973 to the late 1980’s, the world price of oil rose from $25 a barrel to $150 a barrel and the price of natural gas rose in parallel.

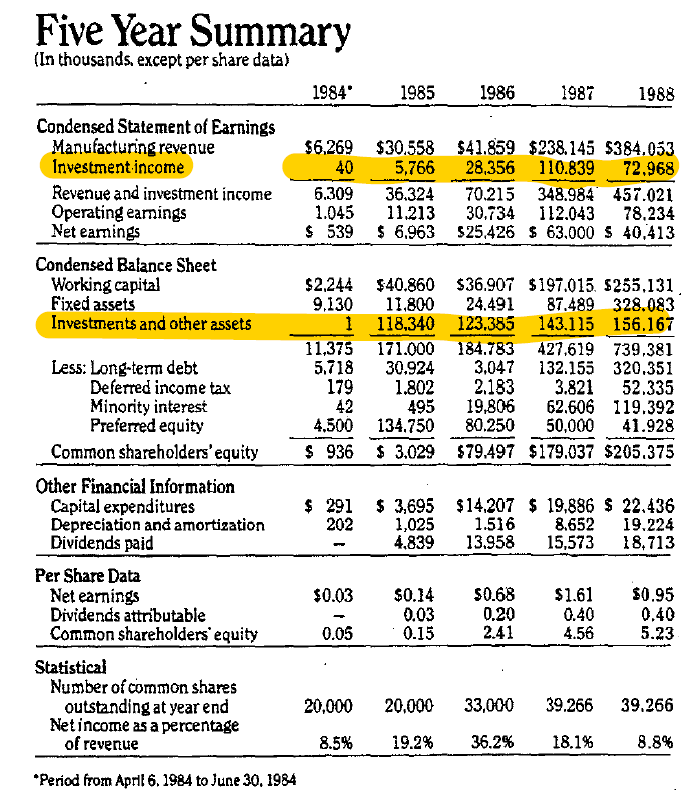

I founded The Enfield Corporation Limited (“Enfield”) in April 1984 and used its surplus cash to invest with a large portion of that money invested in oil & gas. The results were spectacular. Those investments earned over $200 million in a scant four year period from an initial base of just over $100 million, money that came from the sale of an interest in Enfield’s first factory for $30 million and an initial public offering in 1986. The stock market suffered a major sell-off in October 1987 but Enfield didn’t participate in the rout, making millions while brokers were jumping off tall buildings.

Book equity grew from $0.05 a share in 1984 to over $5.00 a share in 1988, a 100-fold increase. Market value of that equity was at least double book.

While I think Harris will be a disaster for America, I won’t need a crying towel if she is elected. Her inane policies will just add to my wealth.

That’s a very good strategy to counter inane government

But don’t forget her Marxist regime is going to tax unrealized capital gains

The better path is Make America Great Again

( and Healthy again ) by letting the invisible hand of capitalism provide an opportunity for all

to prosper; not just those with highly sophisticated

strategies to hedge inanity

Energy friendly policies are indeed bearish for oil/gas. But liberals are bearish for society.