Enbridge or TC Energy? Or both?

These dividend titans remain undervalued

As rising rates push the world economy towards recession, wise investors keep a cash reserve to ensure they can add to their holdings at depressed prices should the market tank. But some investors (like me) depend on the income from their investments lacking any other source of reliable income. With my only pension income CAD$960 a month of Canada Pension Plan income, I live on my investments as does my ex-wife on hers. Passive income is important to both of us.

Between us, we hold relatively large positions in Enbridge (ENB.TO) and TC Energy (TRP.TO). Why? There are stocks with better dividends (e.g. BIR.TO, PEY.TO) and stocks that seem more deeply undervalued (e.g. MEG.TO, INTC).

The answer is prudence. Enbridge and TC Energy have a history of steady increases in annual dividends and have reliable businesses that weather recessions and external shocks with manageable impact. Both seem undervalued by the market.

For companies that have long histories and likely a long future of sustained increases in dividends, a reliable valuation model is also the simplest - the Gordon Dividend Valuation model. This model values a stock based on an estimate of the present value of future dividends using a required (or desired) rate of return.

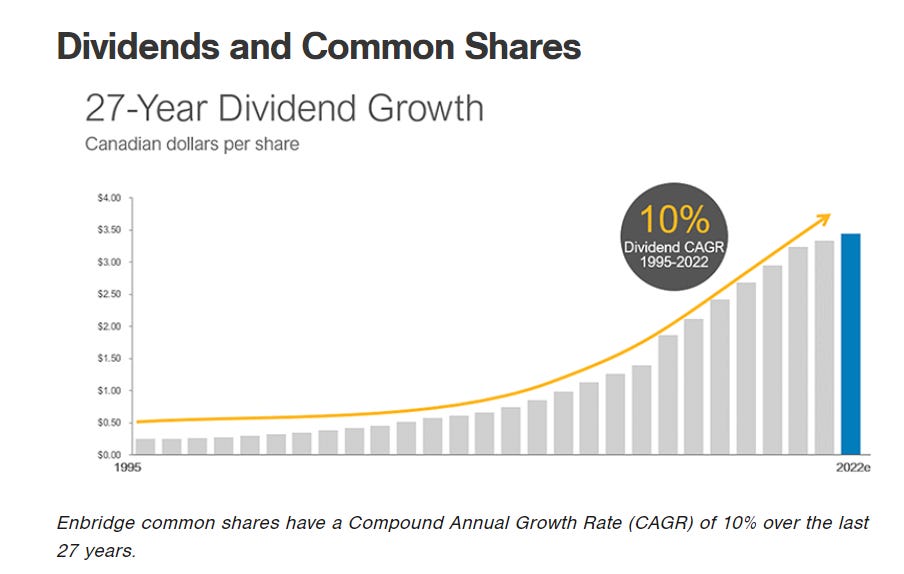

Both Enbridge and TC Energy on average raise their dividends regularly and dare I say predictably. The stock market averages like the Standard & Poor’s 500 have returned about 9.4% per year over the past 50 years. Enbridge has increased its dividend on average about 10% per year for the past 27 years.

I believe a reasonable forecast for Enbridge future dividends is growth at a rate of 5% to 7%. I will use 6% for this analysis and a base of the current annual dividend of CAD$3.55 per share (just announced). Based on the Gordon model, ENB shares are worth $3.55/(.094-.06= ~CAD$100 versus the current price of CAD$56.00, assuming you are satisfied with a market average rate of return. Obviously, the “value” is dependent on the assumptions and you can use your own. It seems clear to me that there is a good case that Enbridge stock is undervalued.

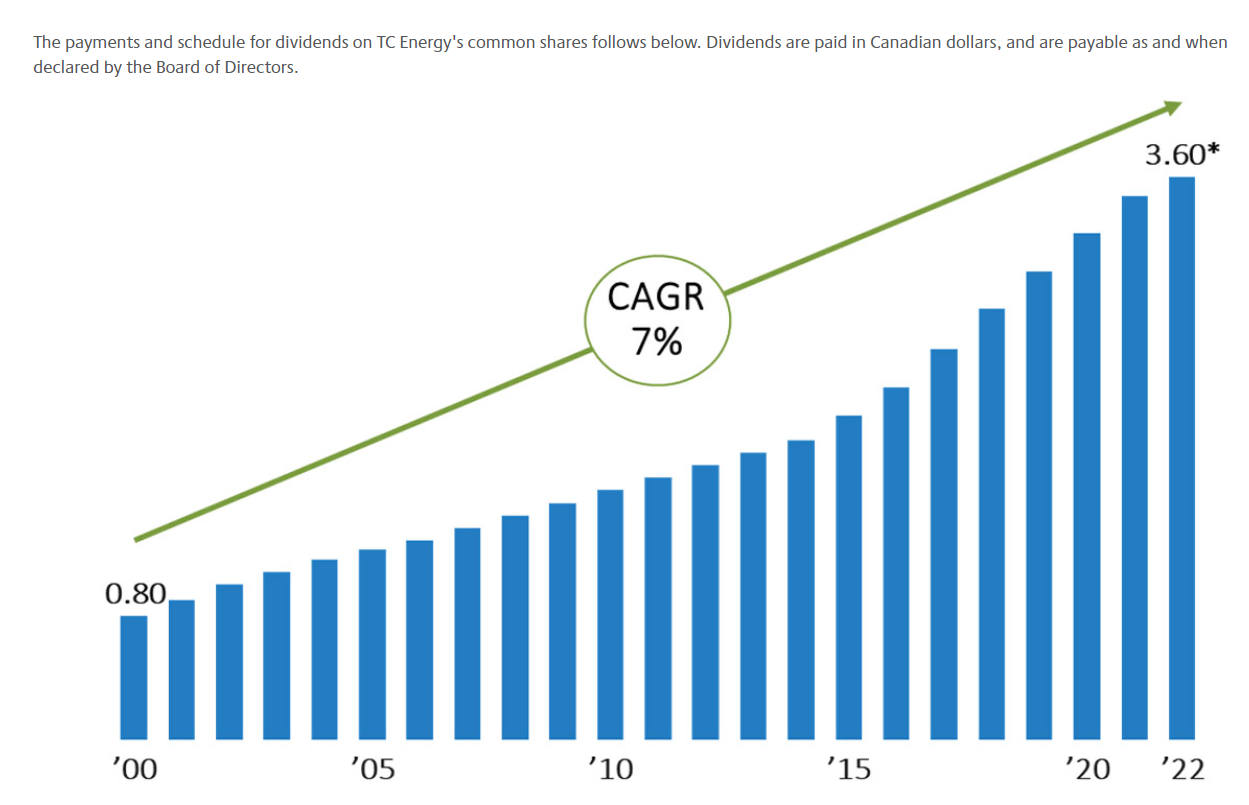

TC Energy has had a 7% average annual increase in its dividends for many years and currently pays CAD$3.60 a year.

Once again, I base my valuation of this dividend aristocrat on a future rate of dividend increases of 6% per year. Using the Gordon model TRP shares have an estimated value of $3.60(.094-.06)= ~$105.00 versus the current share price of CAD$66.00. Once again, there is a good case that TRP.TO shares are undervalued.

Valuation is as much an art as a science and the results reflect assumptions that may not be borne out in fact. Every investors needs to rely on their own judgment and make assumptions they are comfortable with. You pay your money and take your chances. Life has few guarantees.

But in my opinion, for whatever it is worth, I see investments in ENB.TO and TRP.TO as relatively low risk and a solid foundation for retirement income. To some extent, they are a bulwark against adversity.

No DEBT being considered at all on this valuation? I own ENB by the way. But their large debt should not be ignored, with higher interest rates, servicing debt gets more expensive and it has to be passed to the customers sooner or later. Also add that costs for newer pipelines are getting higher and higher, TMX extensions costs have already doubled iirc. As nat. gas production out of WCSB grows steadily in the next years both will be able to increase revenues steadily and both are great picks for stable and long term though,

What do you think of the new TC spinoff - South Bow? Is it worth loading up?