Denison Mines is emerging as a long term winner

High grade deposits and a clean balance sheet point to gains

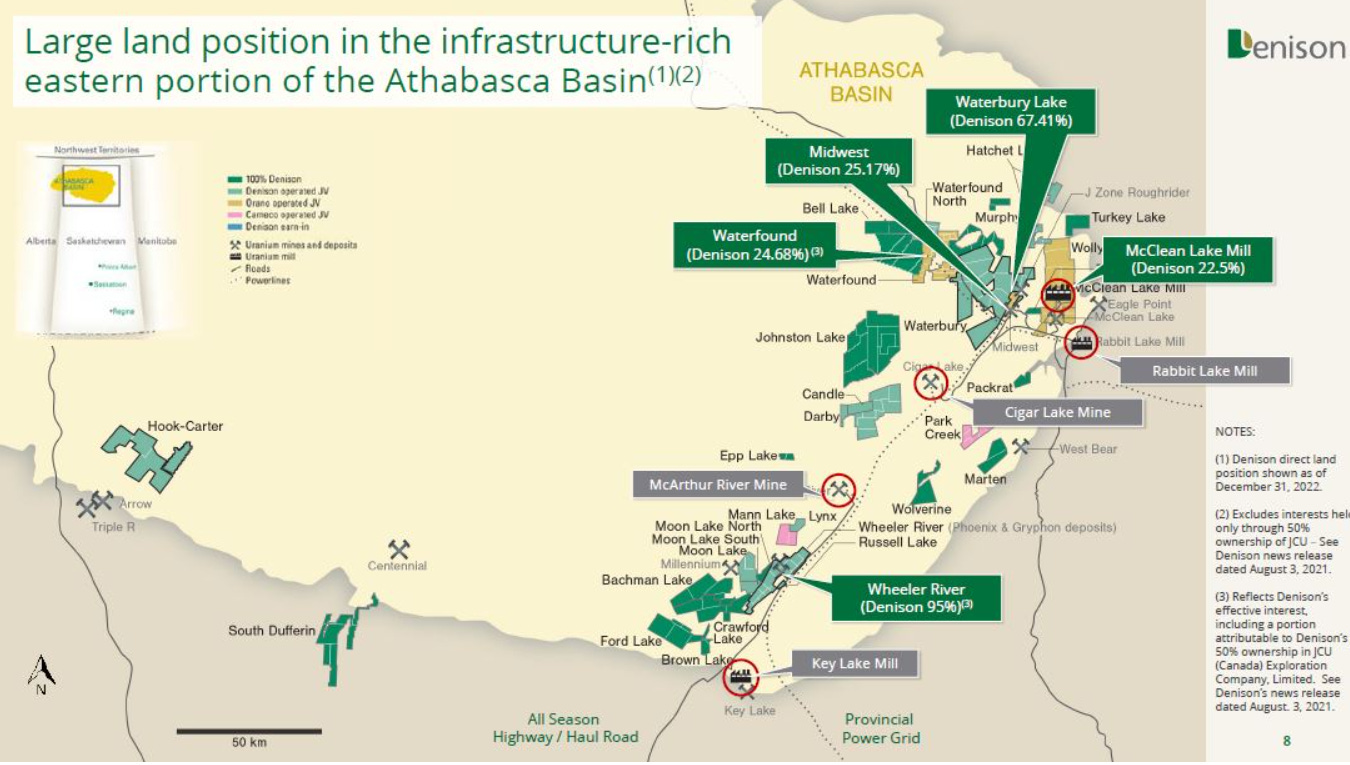

Like most mining stocks, the major determinant of long term profitability is the size and grade of the deposit. Denison Mines (DNN) has spent decades accumulating major positions in the prolific Athabasca basin uranium deposits with its flagship Wheeler River deposit (95% interest) among the best.

Denison’s Phoenix deposit hosts over 56 million pounds of U3O2 with an estimated operating cost of US$8.51 a pound according to the 2023 NI 43-101 technical report with an initial capital cost of US$419 million (pages 19-20) with another US$67 million needed to complete permitting of the mine and life of mine sustaining costs estimated at US$322 million. Uranium prices now approaching US$70 a pound make the deposit’s content worth somewhere around US$3.9 billion over the project’s projected 10-year mine life. IRR of over 80% makes this project highly likely to proceed if permitted.

The nearby Gryphon deposit contains another ~50 million pounds of U308 although estimated capital costs of over US$800 million and LOM operating costs estimated at US$834 million (~US$17 a pound (NI 43-101 report page 22-16) make this deposit of secondary importance with an IRR of 37%. Uranium prices have little friction since uranium as a reactor fuel is a small fraction of the cost of nuclear powered electricity, so shortages see prices rise sharply. Denison’s interest in other deposits in the Athabasca Basin add long term value.

Denison has ~840 million shares outstanding trading in U.S. markets at about US$1.55 a share for a market capitalization of about US$1.3 billion. The company has little debt, about US$47 million in cash and holds physical uranium valued at about US$185 million at the end of June 2023. Denison should be able to finance the start up of its Phoenix deposit without much share dilution and its subsequent expansions seem manageable from internally generated cash flow.

Given the risks of mining, the costly and painfully slow permitting processes in Liberal Canada, and the speculative nature of commodity prices, Denison seems fairly valued by the marketplace today. But if uranium prices keep rising and permits are forthcoming, the shares are deeply undervalued. It might be a good time to open a small position in Denison shares and maintain a watching brief of the uranium market and the company’s progress towards permitting a mine.

Certainly been around a long time, a name I remember from when I first started investing 40+ years ago, the days of Dome Pet and companies like Denison. Dome and smiling Jack no longer around, but Denison still kicking!! I hold a bit of U, had held some Denison in 2020/21 cant recall when I sold, likely early 21.