Declining equity risk premiums point to a market bubble

Higher interest rates normally cause stock prices to fall but they remain firm

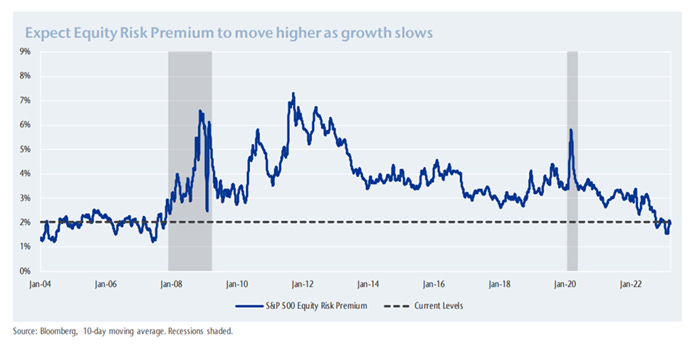

It is classical financial theory that investors seek higher returns from equities than from debt instruments to compensate for higher risk. Risk premiums on equities compared to interest rates on low risk treasuries (which many use as a proxy for a risk-free rate of return) provide useful insight into market sentiment. Very high risk premiums often portend extraordinary opportunity since periods of very high risk are not only rare but also typically short-lived. Investors benefit from lower stock prices if the low prices are unrelated to the wealth creating operations carried out by the issuers of the stock. Periods when investors succumb to “irrational exuberance” manifest themselves in low risk premiums.

Equity risk premiums today are low, very low, at about 2 percentage points using the conventional measure. This definition of “equity risk premium” is earnings yield less short term treasury yields.

A better definition of the risk free rate is the intrinsic risk-free rate equal to inflation plus real growth. Any rate less than this has a built-in loss of value since it will produce a return less than real economic growth. With inflation at ~5% and real economic growth in the 2-3% range, the intrinsic risk free rate is 7-9% and the equity risk premium is negative. When risky securities are being valued without compensation for risk, the market is decidely overvalued and vulnerable to a decline.

The talking heads on Bloomberg, CNBC, BNN and other financial media promote momentum, for example asserting that now that Apple (AAPL) has a reached a market valuation of $3 trillion, an increase to $4 trillion is in sight. Apple trades at about 30 times earnings, about 50 times book value, and about 20 times cash flow. It is a great company and I have no doubt will turn in growing profits for many years as it shifts from a device vendor to a services company. But the market’s enthusiasm for the name carries risks.

Common sense argues for caution. The market value of all publicly traded American companies ended 2022 at about $40 trillion. Apple employs approximately 165,000 people. The U.S. workforce totals about one thousand times that number at 158 million. Is it likely that a company employing about one in one thousand workers will reach a value equal to 10% of the market value of all American companies? Maybe, but caution is warranted.

Intrinsic Risk Free Rates have been negative only a few times in market history. None of them ended well for bullish investors.

No ratio is a perfect predictor of economic activity or stock market moves. The scale on this chart compresses many years and can be confusing. But here are the data:

1953 - Market declined by 1%

1973 - Market declined by 14.7%

1974 - Market declined by 26.5%

1991 - Market declined by 3%

2008 - Market declined by 37%

2022 - Market declined by 18%

These were six of the highest market routs in the past 75 years and in each case the intrinsic real rate of return was negative on the eve of the decline. No one can tell what exogenous factors will have an impact on investor sentiment - the oil embargo of the 1970’s was not foreseen nor was the Lehman bankruptcy nor was the outbreak of COVID 19. But those events were not causes, they were triggers. The cause of the widespread losses was simply that investors lacked caution and let optimism prevail over common sense, bidding up share prices to levels not supported by the underlying wealth creating activities of the issuers whose shares they traded.

In my opinion, this is a time for caution. There are many possible (but unlikely) events which could trigger the next major sell-off and they include the use of a tactical nuclear weapon in Ukraine, the invasion of Taiwan by China, or the unexpected death of a world leader in the realm of geopolitics, or the failure of a major financial institution in a large economy. As Yogi Berra said, it is diffcult to make predictions, especially about the future.

Brilliant. Outstanding commentary. Should be required reading for everyone aged 10 and up. Sharing.