Comparative production economics defy many energy investors

Small wonder they make terrible investment decisions

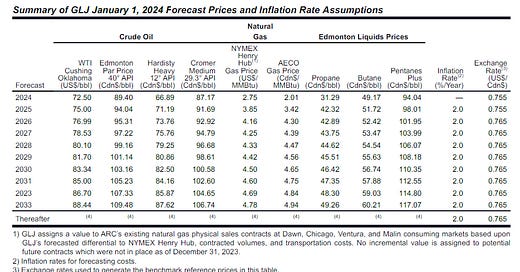

Sometimes it is useful to have reference point for discussion of oil & gas economics. The NI 53-101 reserve report mandated by Canadian securities laws and published by each producer is a good place to start. Here is table of assumed future oil & gas prices from the GLJ reserve report for ARC Resources as at December 2023. Note the report assume asymptotically rising prices for each commodity and assumes persistent inflation at 2% per year. Both assumptions tend to inflate the present value of the cash flows arising from exploitation of the published reserves.

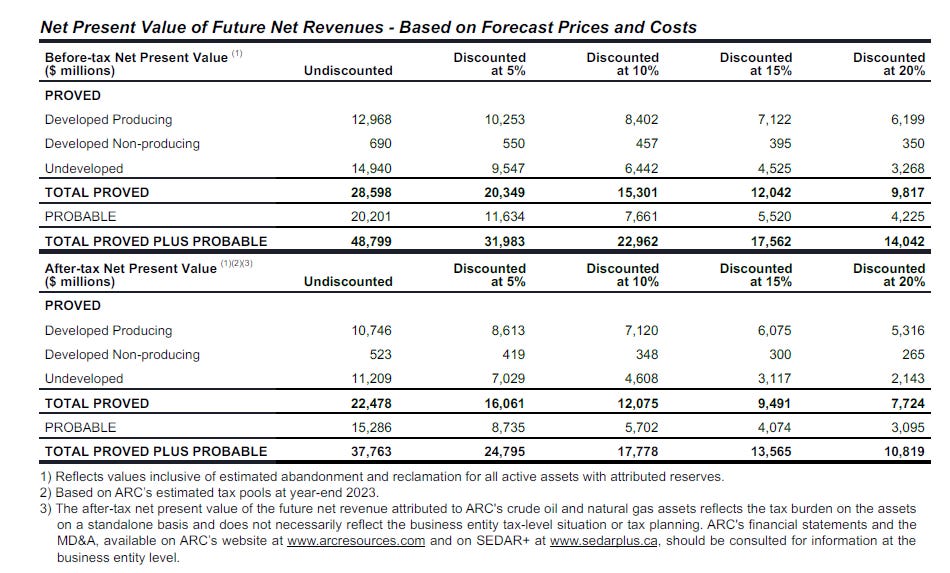

Notwithstanding, many energy investors like the estimates of the present value of established reserves as a proxy for the intrinsic value of the producer’s assets. In the case of ARC (ARX.TO) the report estimates the present value of the company’s reserves at a 10% after tax discount rate to be $17.8 billion and at a 15% rate to be $13.6 billion. With approximately 597 million shares outstanding, that works out to a per share value of between $23 and $30 per share. ARC had net debt of $1.3 billion at December 31, 2023. Adjusting for that debt, the value of an ARC share falls to $21 to $28 per share. The market trading price of ARX.TO shares is about $26.00, within that range. But if natural gas remained at the $2.01 per gigajoule figure the report carries for 2024, I estimate the value of ARX.TO shares falls to about $16.00 a share.

The market seems to imply that investors as a group think natural gas prices will rise. But not all investors. Kurt Molnar and I had a discussion on X that evidences a difference of views on the value of Birchcliff Energy.

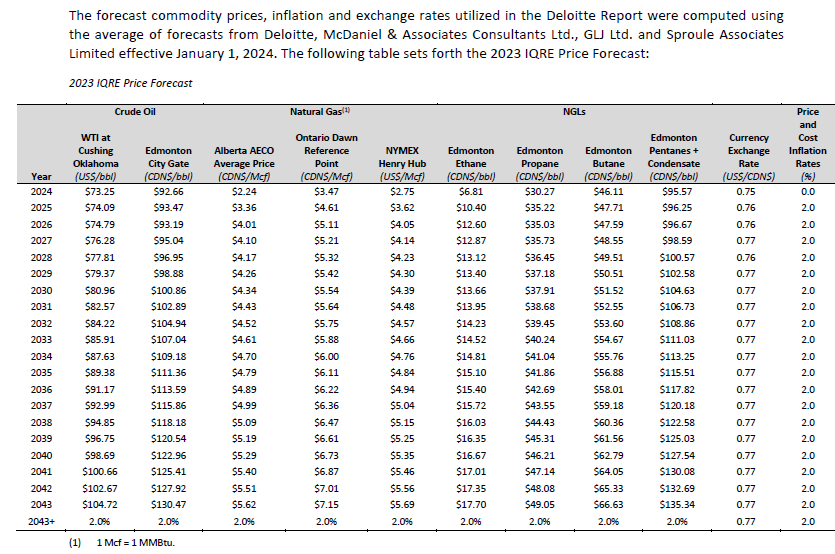

The January 1, 2024 reserve report prepared by McDaniel & Associates for Birchcliff uses a somewhat similar price forecast with an assumed 2% inflation rate and slightly higher natural gas prices than GLJ.

Based on those projections, whatever they are worth, McDaniels estimates the present value at a 10% discount rate of Birchcliff reserves is $6.8 billion. Birchcliff has 267 million shares outstanding and $372 million debt at year end 2023. Adjusted for debt, the NPV (10%) of Birchcliff reserves based on the McDaniel forecast is $24 per Birchcliff share. Those shares today trade in the $6 range.

I don’t buy either of the GLJ or McDaniel et. al. forecasts. I use a modified Black Scholes methodology to value energy company shares as a call option on future commodity prices. Using that methodology, I estimate the value of a Birchcliff share to be in the $11 range.

That estimate is quite a bit less than the NPV (10%) shown above largely because I use a 15% hurdle rate for ongoing investment in energy names owing to my view they are higher risk than market averages. Notwithstanding, and with respect to Mr. Molnar, I think Birchcliff shares are deeply undervalued and that investors disdain for paying dividends other than from free cash low is simply misplaced. Dividends are a financing decision, not an operating decision, and their payment is irrelevant to underlying value unless the payment imperils solvency which itself would be a violation of corporate law in Canada. Section 38 (3) of the Business Corporations Act, R.S.O. 1990 states in part:

The best investments decisions rely on in depth analysis of the underlying value of a corporation’s assets and a reasoned judgment about the prudence of its management and board. Mr. Molnar disagrees with the Birchcliff board and I suggest he should avoid the shares and perhaps refrain from criticizing decisions of a company in which he is not invested, if that is the case. I agree with Birchcliff leadership and will add.