Charlie Munger: A legend passes

We can all learn from the wisdom of Charlie Munger, dead at 99

Berkshire Hathaway turned in a compound rate of return of over 20% in the past 58 years, about double the return on the Standard & Poor’s 500 for the period. The common sense investment approach of Warren Buffett and Charlie Munger produced that result. They didn’t use algorithms, didn’t rely on “investment advisors” or “portfolio managers” and didn’t base their decisions on sell-side analysts’ opinions. They just invested in profitable and growing companies at reasonable prices. No magic, no fanfare, no baseless promotion of the latest gimmick.

While Warren Buffett was the public face of Berkshire, Charlie Munger was his full partner and they relied on one another to get it right. Munger had a great sense of humour and many homespun adages, but when it came to investment, he put the successful approach succinctly. “The great investors are always very careful. They think things through. They take their time. They're calm. They're not in a hurry. They don't get excited. They just go after the facts, and they figure out the value. And that's what we try to do.”

Munger had choice words for crypto currencies. He likened the fad to “rat poison” and quipped that Bitcoin is not a security nor a commodity but is a gambling contract, and expected that all those who purchased Bitcoin would lose their money eventually. He was right about that, in my opinion. He summed it up saying:

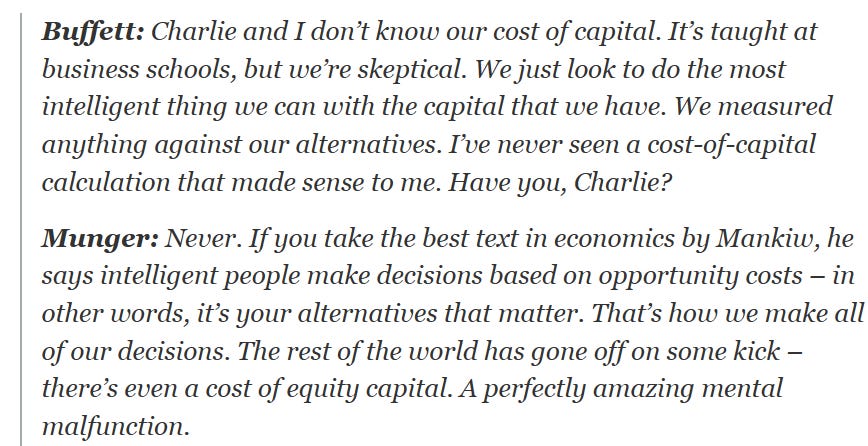

This exchange between Buffett and Munger deals a blow to the efficient market hypothesis and the capital asset pricing model, both theories garnering Nobel prizes for their authors.

I have written often about the modern portfolio theory, the efficient market hypothesis, and the three-factor capital asset pricing model and related theories developed by such luminaries as Nobel laureates Eugene Fama, Merton Miller, Franco Modigliani, Jame Merton, William Sharpe, and Myron Scholes which I have described as brilliant, elegant and wrong. These theories have formed the basis for the entire sell-side industry which is a parasite on investment returns sucking fees and commissions from the ultimate owners of businesses who they describe as “clients” but who are really “prey”. Buffett and Munger ignored them, and demonstrated that common sense and patience are the real underpinnings of successful investing.

Munger minced no words in describing the plethora of “theories”.

“Beta and modern portfolio theory and the like – none of it makes any sense to me. We’re trying to buy businesses with sustainable competitive advantages at a low, or even a fair, price.”

“How can professors spread this nonsense that a stock’s volatility is a measure of risk? I’ve been waiting for this craziness to end for decades. It’s been dented, but it’s still out there.”

“Warren once said to me, “I’m probably misjudging academia generally [in thinking so poorly of it] because the people that interact with me have bonkers theories.”

I will miss Charlie Munger. He was a breath of fresh air and an icon of the value of hard work, common sense and a long term investment perspective.

RIP

Very sad to lose such a legend. His wisdom will live on. Sleep well Mr Munger.