Chapter Twelve: Efficient Investing in Inefficient Markets

Don't fear volatility, make it work for you

The complex nature of financial decisions is that they are often multivariate and the variables unpredictable. But some financial decisions need no complex analysis and the conclusions border on tautalogical.

Let me start with the claim I made in Chapter One - that higher share prices are inimical to investment success. Stated simply, if you can buy the same future earnings stream at a lower cost you are better off than if you paid a higher price. Buying a new Mercedes for $60,000 is better than paying $100,000 for the same vehicle. Buying your new home for $800,000 is better than buying the same home for $1 million. Buying a share in a company for a lower price is not different, it simply will produce a better return.

Many people who bought homes thirty years ago saw dramatic rises in their home price and gleefully sold only to find an alternative home cost just as much, so to “benefit” they had to downsize. Their home had not increased in “value”, money had decreased and in buying their new home they paid land transfer taxes and legal fees and made any necessary renovations. Did they really gain anything?

Sell shares in a profitable and growing company has a similar result - transaction fees and taxes eat up the “gain” and an investor is forced to find a better investment. “Buy and hold” profitable and growing companies tends to produce better results than “trading”.

With global energy supplies constrained by climate policies, energy prices have been firm and may remain relatively firm for many years with the ususal volatility as the global economy both expands and contracts and geopolitical factors operate to effect both supply and demand, the ongoing Ukraine war a recent example. Many oil and gas companies publish their own estimates of the returns on drilling for additional output to guide investors. When estimated returns are high, prices for the underlying stocks are likely to be high as well, so use caution. When estimated returns are low or suggest drilling will add to losses, energy stocks will typically be undervalued.

Dividends are a critical part of the return on energy companies unless (like Headwater, Rubellite or Tamarack Valley) they have sustained high returns on drilling even in low oil price environments.

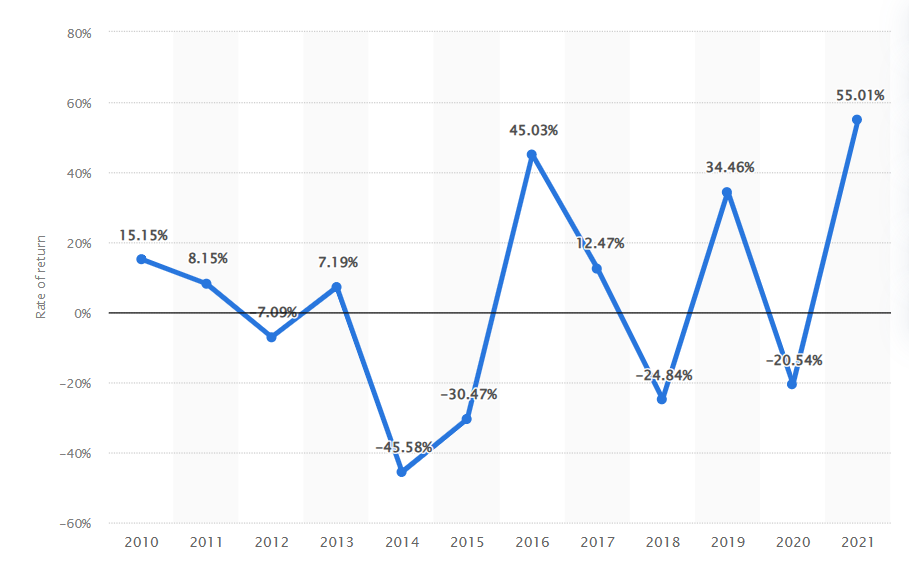

For the past decade, annual returns for the oil industry were volatile. $100 invested in oil stocks in 2009 would be worth have been worth $96 by the end of 2021 excluding dividends.

Anyone who expects future returns to be less volatile needs therapy, not financial education.

High volatility (often seen by investors as a proxy for “risk”) manifests itself in lower stock prices and higher premiums on stock options, a result predicted by Fischer Black, Myron Scholes and James Merton in their Nobel prize winning creation of the Black-Scholes model for valuing stock options. The same methodology can be used to value the reserves of resource companies, which are in effect a call option on future commodity prices. Reserves are more valuable as an option when volatility is high and commodity prices are low.

Mercer Capital, a professional valuation firm, offers a service to provide valuations to oil & gas companies based on their proven but undeveloped reserves using Black Scholes methodology modified to apply to the resources to be valued. I use a similar approach to value the energy companies I choose for investment.

It would be tedious to go through the various valuations I have completed which I update regularly and have only temporal value. We are in the early days of an economic decline which historically has seen lower oil & gas prices and lower energy stock prices. If that happens, many opportunities will present themselves. I will publish articles on deeply undervalued resource based companies from time to time arriving at my conclusion they are undervalued using a Black Scholes valuation approach. Good candidates for such valuation in a market rout are Cenovus, Canadian Natural Resources, Suncor, Athabasca, Tourmaline Oil, ARC Resources and Peyto Exploration all of which having large land holdings and inventory of undeveloped oil & gas. When the recession is at its depth and markets are full of tearful stories and margin calls, I will revisit this Chapter and publish others on the underlying value of the resources owned by these (and other) issuers.

In the meantime, smart money keeps dry powder and avoids calling a premature “bottom” when the macroeconomic environment seems far from any “bottom”.

Burying low is a key prerequisite for creating wealth. But it requires attention and work. Thus not for everyone.