Chapter Seven: Efficient Investing in Inefficient Markets

Conclusion: How to beat the averages

Investors can outperform the market averages quite readily, although few have. Deluded by the belief that “performance” means higher stock prices and devoid of the fundamental understanding that higher stock prices compel lower returns, investors squander long term opportunity for the prospect (rarely realized) of short term gains. The market is populated with traders who think they are investors. They contribute to the growing number of “asset managers” who have become billionaires “managing” other people’s money while those who entrust their money to “asset managers” earn less than market averages.

Behavioural finance is a relatively new field of study, based more in psychology than in economics. Psychologists Daniel Kahnemann and Amos Tversky were among the earliest researchers who discovered that even brilliant graduate students made systematically wrong decisions based on how the the information they received was framed and psychologist B.F. Skinner developed the theory of “operant conditioning” which explains why people will wear adult diapers and sit for days on end at slot machines squandering their life savings hoping for a big payday while the Casino runs the “rake” and always comes out ahead. In stock markets, financial intermediaries run the Casino and benefit from the “rake”.

But some economists have demonstrated that certain investment approaches outperform market averages.

Buy shares in companies with low price-to-book value ratios:

In 1985, a study by Rosenberg, Reid and Lanstein found that companies with a low price-to-book value ratio outperformed the market indices over long periods of time. That finding was corroborated by later work by Chan, Hamao and Lakonishok in 1991, Fama and French in 1992; and, Capaul, Rowley and Sharpe in 1993.

Buy out of favour stocks

Richard Thaler, a behavioural economist, found that investors over react to negative news and under appreciate positive trends. He won the Nobel Prize in economics for that work, and demonstrated that a strategy of investing in the worst performing 30% of the S&P 500 and holding that position for at least three years produced returns that exceeded the return on the S&P 500 by a wide margin.

Buy and hold

As manager of the Fidelity Magellan Fund for 13 years, Peter Lynch turned in annual returns averaging over 29% per year. His strategy, well documented in his now famous book “One up on Wall Street” was simple. Invest in profitable companies you understand that are selling products or services you use, and hold those investments for long periods. The number of companies that have produced consistent long term growth in sales and profits is legion. Investing in any of Apple, Facebook, Google, Microsoft or Amazon at their initial public offering and keeping that holding until today would have turned a $10,000 investment into many millions in each case. Along the path, many “traders” sold when the shares had doubled or triple and missed out on gains that were orders of magnitude greater.

When you are fortunate enough to have an interest in a profitable and growing company and the share price has risen, don’t be tempted to sell. The opportunity cost may exceed the return you achieved, you will pay taxes on the sale most of the time, and you are burdened with finding another investment at least as good.

Legendary investors like Warren Buffett, Benjamin Graham, John Templeton and Stanley Druckenmiller have in common a long term perspective. They buy well and hold for long periods. Do the same.

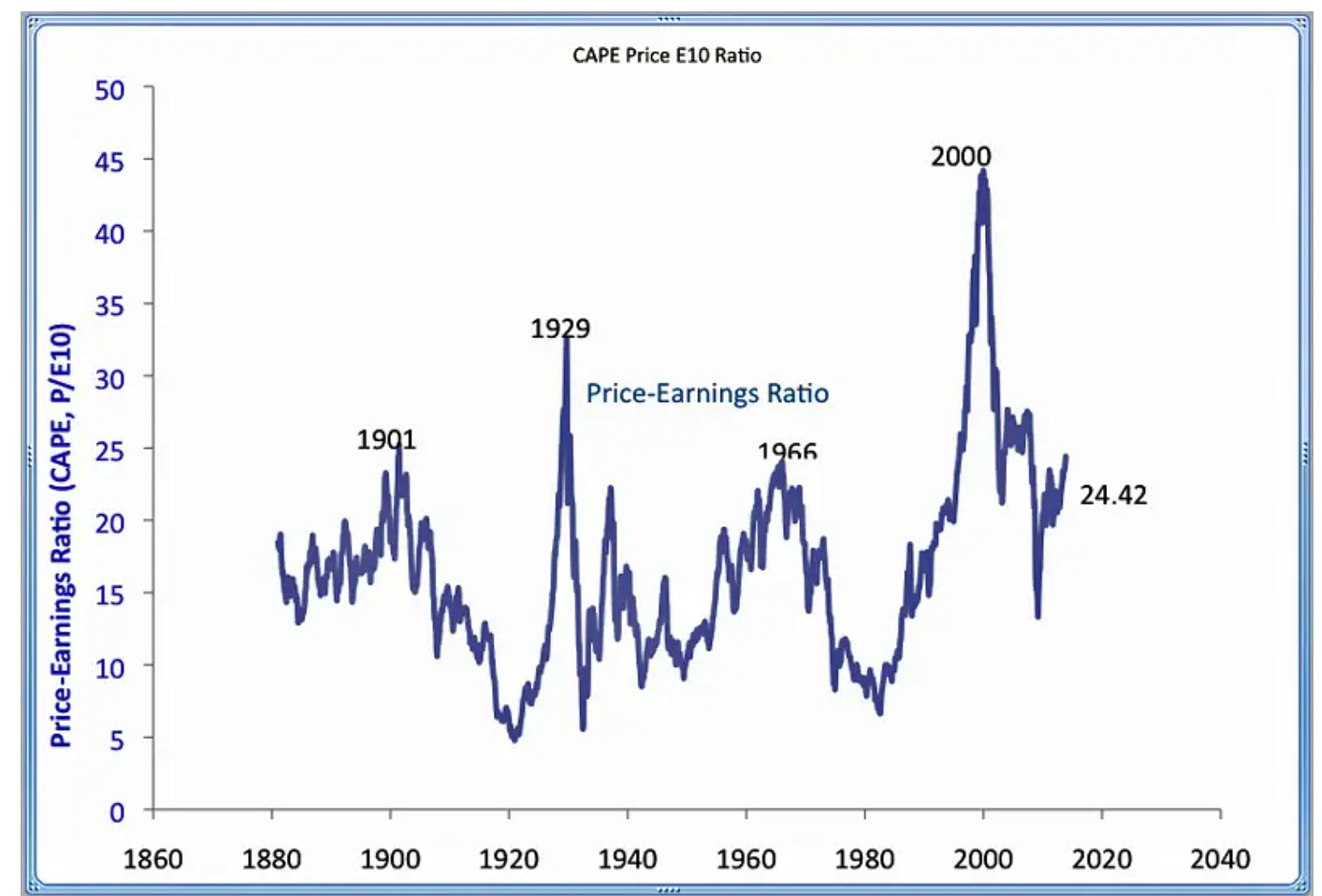

Invest when market indices are trading at very low cyclically adjusted price to earnings multiples

Nobel Prize winner Bob Shiller developed the cyclically adjusted price-earnings (CAPE) multiple to help investors assess whether markets as a whole are over or under valued. When that multiple is over twenty times, markets are over valued and when it is under ten they are undervalued, more or less. Timing the market turns is a mug’s game so rather than timing the market, reduce your holdings when the CAPE multiple is over 20 and add to holdings when it is below 15, and otherwise sit on your hands and wait while your investments pay you dividends. You don’t need to hit the tops or bottoms to produce better than average returns over the long term.

Take the time to do at least rough fundamental analysis of the underlying value of the companies you are considering for investments. Rough valuation is not complex.

For dividend paying companies in mature industries, the Gordon Growth model provides a pretty good shot at underlying value. For resource companies, a modified Black-Scholes approach treating reserves as a call option on future commodity prices is a robust way to get a handle on the range of possible outcomes and the risk of being dead wrong. For rapidly growing companies, a discounted cash flow model that incorporates a sensible assumption on how long the rapid growth will persist and assumes growth at the same rate as the economy thereafter can provide a solid starting point.

Avoid comparison valuations that presume all companies in the same industry should trade at the same multiples of earnings, cash flow, EBITDA or any other metric. Companies differ in so many ways these popular approaches are flawed. This methodology is frequently used by Chartered Business Valuators because they can charge fees for a trivial amount of effort, but the results so unreliable they can be safely ignored if not tested by other methods.

For companies with excess debt, a Black Scholes valuation that treats the equity as a call option on financial recovery with a strike price equal to the nominal value of the debt and a call duration equal to the time before the debt can be called works well, since companies with excess debt (even those that enter Chapter 11) may have a residual value for the equity that exceeds market prices by a wide margin.

In the next few chapters, I will give real life examples that demonstrate how I took advantage of these approaches and how you might do the same.

Great article.

Btw it is not easy at all to catch CAPE < 15. Lately, happened only during Covid in 2020.