Chapter Eleven: Hidden Gems - Bonterra Energy should emerge a winner

Exiting the debt penalty box with lots of underlying value

Bonterra Energy (BNE) is a small capitalization oil producer operating in the Cardium section of the Western Canadian Sedimentary Basin (WCSB). Over the past decade, Bonterra stock fell from over CAD$60 a share in 2014 to as low as CAD$0.75 in March of 2020, a victim of the collapse of oil prices at the outset of the pandemic and too much debt. Led until recently by legendary oil man George Fink, Bonterra set out to right the ship by ending its once generous dividend and applying its free cash flow to debt repayment.

Stung by losses, many investors shied away from the company despite its remarkable success in reducing financial leverage while steadily increasing production and lowering operating costs. It is impressive what solid management can accomplish when they focus on the real issues.

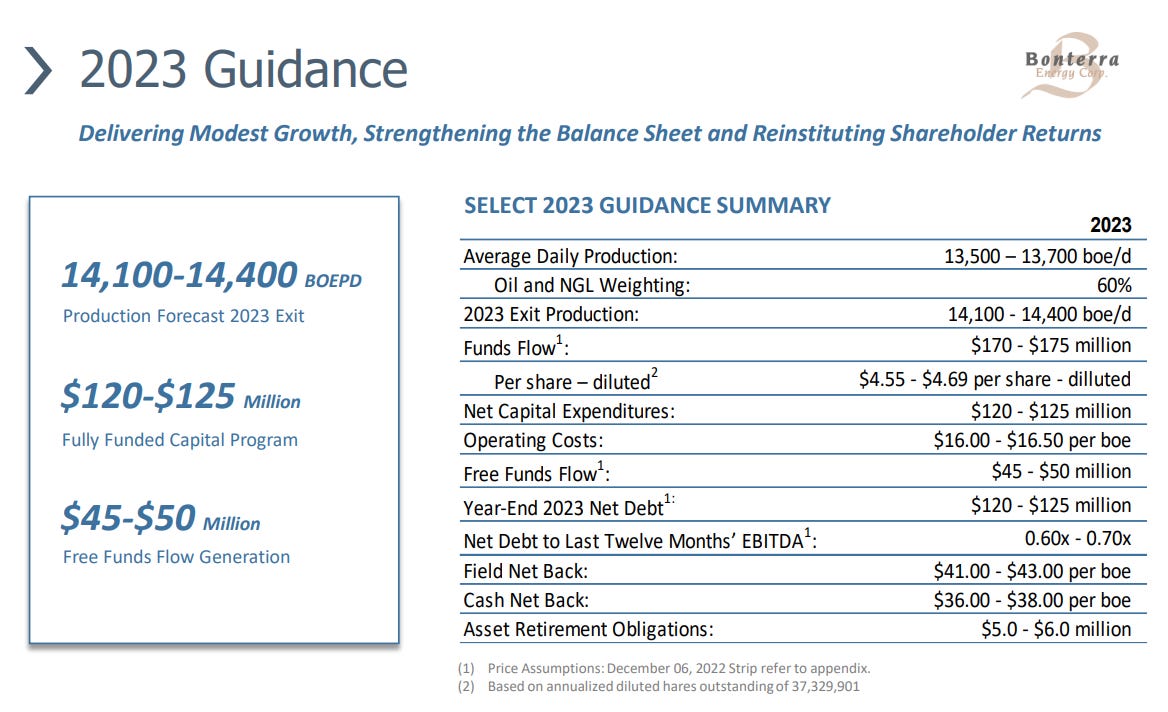

Bonterra debt is now down to less than one year’s cash flow and the company continues to generate free cash flow which management says will be applied to further debt reduction, but hinted that in 2024 the company may be in a position to resume dividend payments.

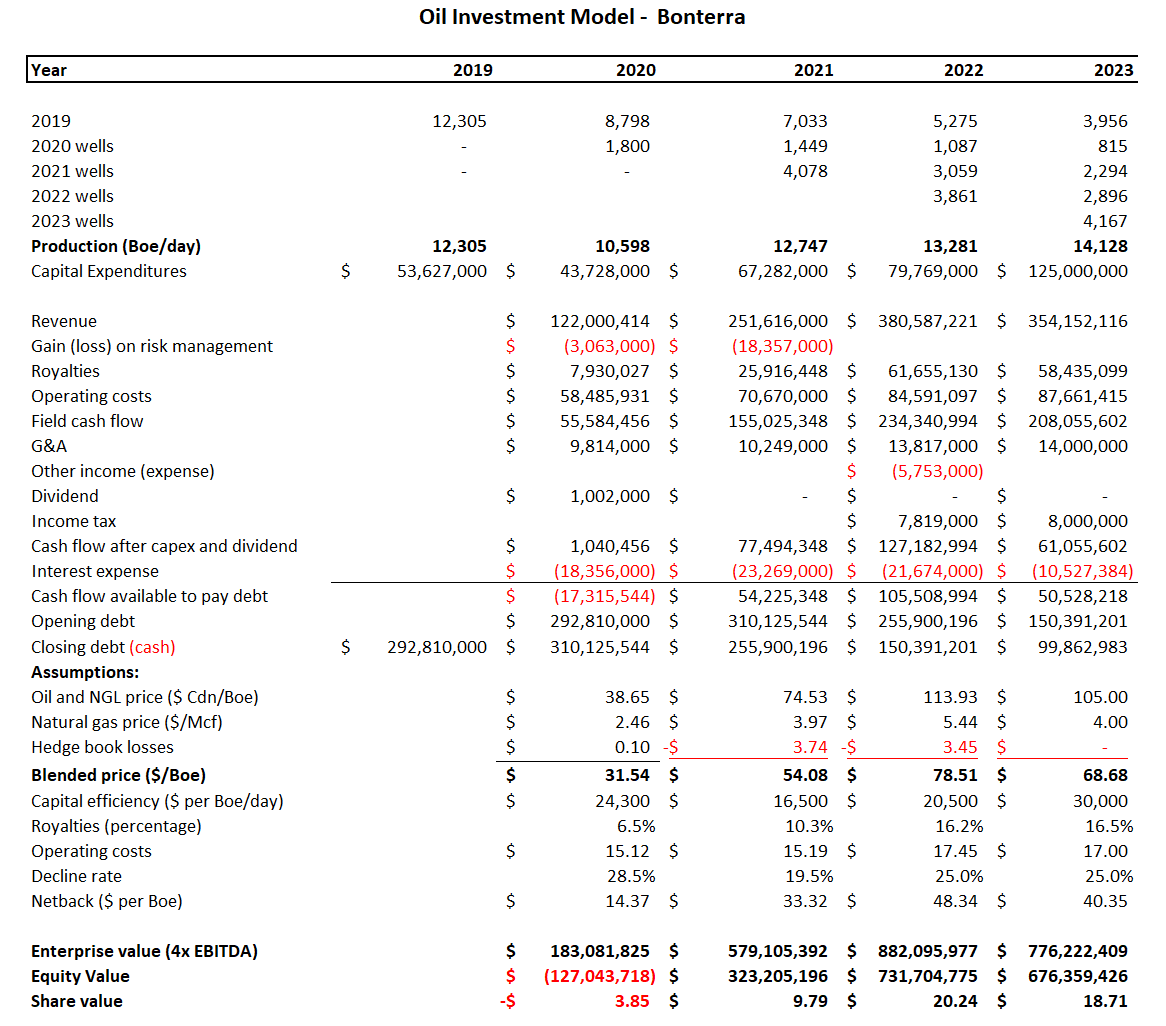

With only 36 million shares outstanding, Bonterra shares have high leverage to success on the current strategy to gradually increase output while reducing debt and living well within operating cash flows. I have modeled the company’s operations and see the underlying value today close to double the current share price.

Of course, like all exploration and production companies, Bonterra is vulnerable to a collapse of oil prices. For 2023, the company has in place a modest hedge book which protects against a major collapse. For 2023, the company’s guidance shows continued progress and the prospect of a resumed dividend by year end 2023 if debt falls as much as projected.

While I see a risk of recession worldwide as central banks keep ramping up interest rates to curb the inflation they created (along with reckless borrowing by many governments including U.S. and Canada), I see no evidence of an increased supply of oil and a deepending shortage of fossil fuels. On balance, the macroeconomic picture is in my opinion a tailwind for Bonterra.

Many investors pay little attention to reserves and focus on cash flows. I think both are worth attention. Bonterra’s reserves are valued (10% discount rate) at CAD$1.3 billion, about CAD$35 a Bonterra share. At less than CAD$10 a share in recent trading, BNE.TO shares look undervalued.

If oil prices remain at current levels or higher, I expect to see Bonterra pay a dividend in the CAD$1.00 per share range in 2024, and if commodity prices fall, to defer a dividend in favor of continuing to eliminate debt until prices firm. I like the odds and hold 35,000 shares.