Centerra Gold makes a molybdenum play

But Starcore has a better molydenum deposit that may attract a bid

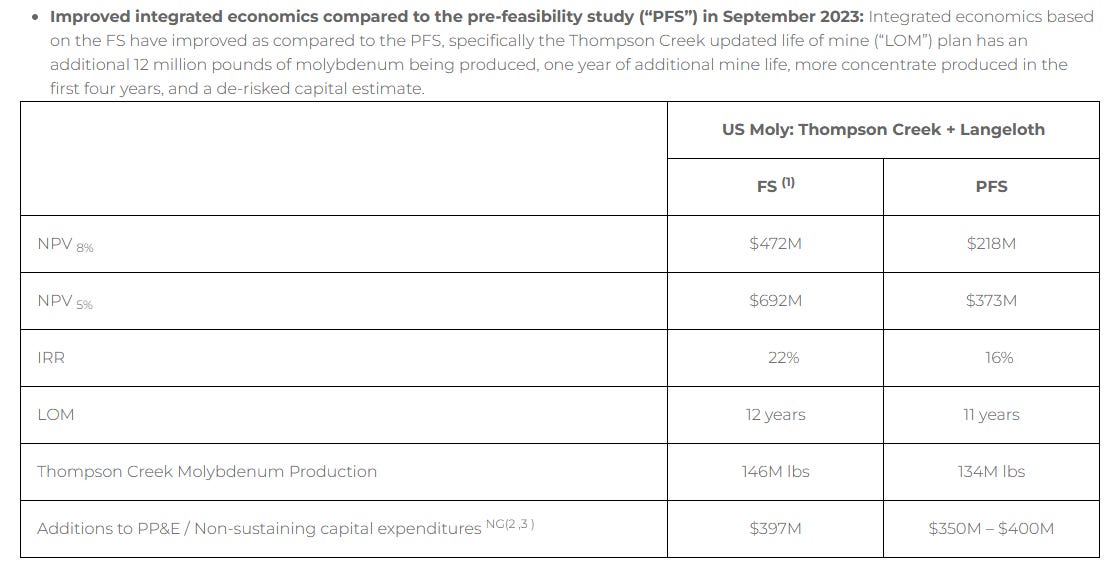

Centerra Gold’s somewhat dated acquisition of Thomson Creek brought with it not only Mount Milligan gold deposit but also the large molybdenum deposit once mined very profitably by Thomson Creek. On September 12, 2024, Centerra announced it was planning a restart of molydenum production at Thomson Creek and kicking it off with a NI 43-101 feasibility study and touting the robust economics of its Thomson Creek and Langeloth molybdenum deposits which can be exploited by spending about $800 million of capital expenditures at today’s molybdenum price.

It is a good plan and if Mb prices remain at or above today’s levels for the dozen or so years it will take to mine the deposits, it should add about $1 billion to the value of Centerra Gold. Centerra estimates the project would add about $50 million a year to cash flow and notes the project has a grade of .06% molybdenum.

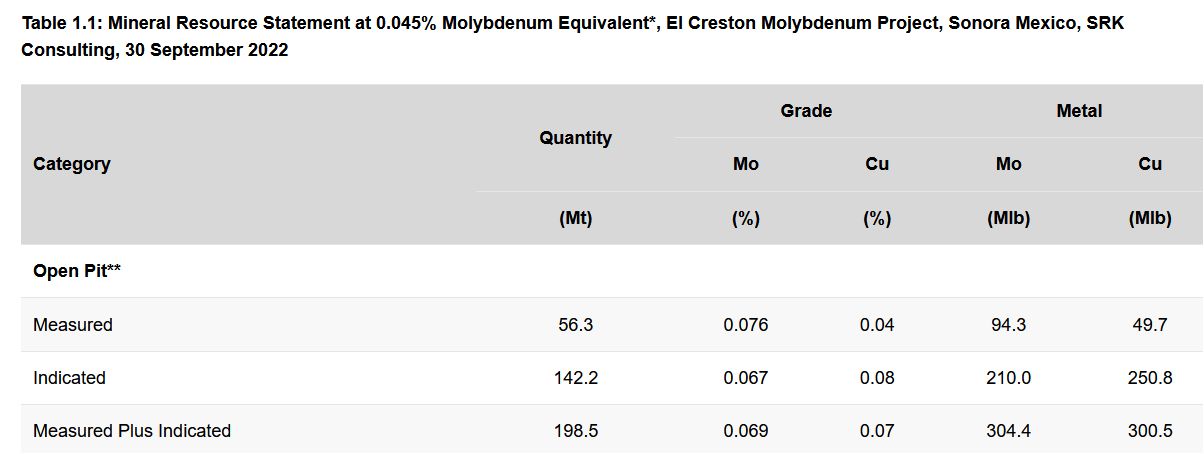

Starcore International owns the El Creston copper-molydenum deposit in Mexico which it purchased from the bankrupcy of Mercator Minerals. Starcore did some NI 43-101 work on the deposit in December 2022 and reported El Creston was host to 304 million pounds of Molybdenum at .07% grade and 300 million pounds of copper at a similar grade.

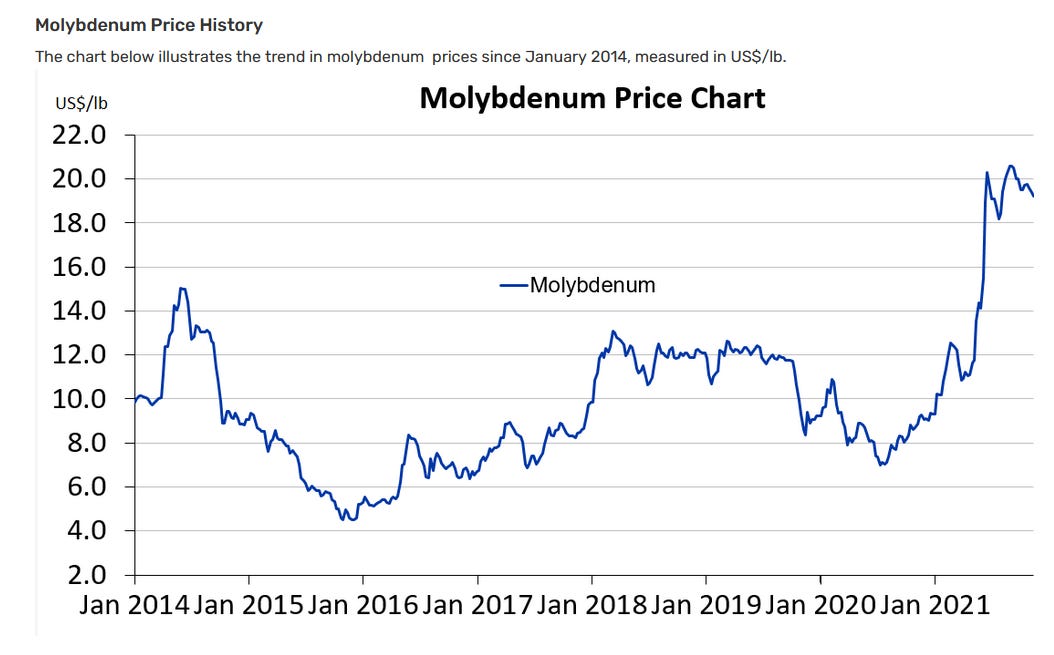

With a market capitalization of less than CDN$10 million, although debt free, Starcore has a tough row to hoe to complete a feasibility study of El Creston and fund the construction of a mine, but the deposit could be of interest to larger players like Centerra if it decides to make Molybdenum a significant part of its business. Moly prices had a tantalizing run up a few years ago but have since settled back to the US$10 a pound range which is more or less where Centerra has modeled its possible mines.

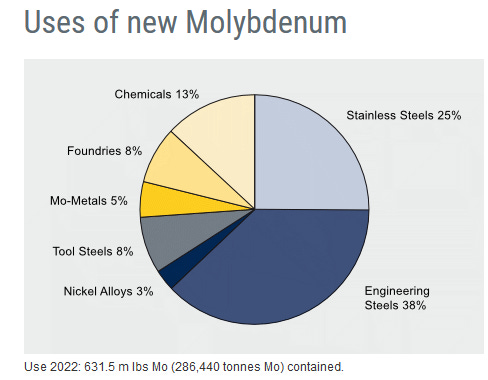

Molybdenum is used in hardened steels, stainless steel, some nickel alloys and tool steels and some chemicals and even fertilizers. China is the biggest market (no surprise given its massive steel industry). Molybdenum demand seems to spike during shooting wars where demand for armored vehicles adds to commercial uses (Moly is one of eight metals seen a important to national defense).

I think Centerra’s bet on Molybdenum will lead to a profitable project at its two North American deposits, but think there is an outsized chance Starcore’s El Creston deposit will become a takeover target. Mercator paid almost $200 million for the deposit before copper prices plunged and Mercator entered bankruptcy. Starcore bought the deposit for CDN$2 million and a bid for Starcore to acquire the deposit would find a welcome mat from shareholders since even a bid at half the price Mercator paid would be ten times Starcore’s current valuation.

Will it happen? Anyone’s guess but I have kept a few thousand shares of Starcore in my mining portfolio off and on for years, and Starcore’s profits from its tiny gold mine should keep it profitable while I wait. Starecore just reported a profitable first quarter in its fiscal 2025 operations with a cash balance of over $5 million and quarterly EBITDA of $1.7 million. Even without El Creston Starcore seems a bit undervalued to this old coot.