Canadian miners can look forward to robust markets

Leftist dreams of a rapid "transition" to so-called "green energy" are devoid of common sense

Listen to any speech by Justin Trudeau, Joe Biden, Steven Guilbeault, Jonathan Wilkinson, John Kerry or even Climate Barbie “Catherine McKenna” and hear them preach about how in one generation half the world’s cars will be electric vehicles (EV’s), fossil fuels will be history, and they will have saved the planet from catastrophic “warming” caused (in their view) by incremental and small increases in atmospheric levels of CO2. I have written often about how the anthropogenic global warmings (AGW) theory is all wet and I won’t bore readers with repetition. For the purposes of this piece, I will bite my tongue and assume they are right (a preposterous assumption, for certain).

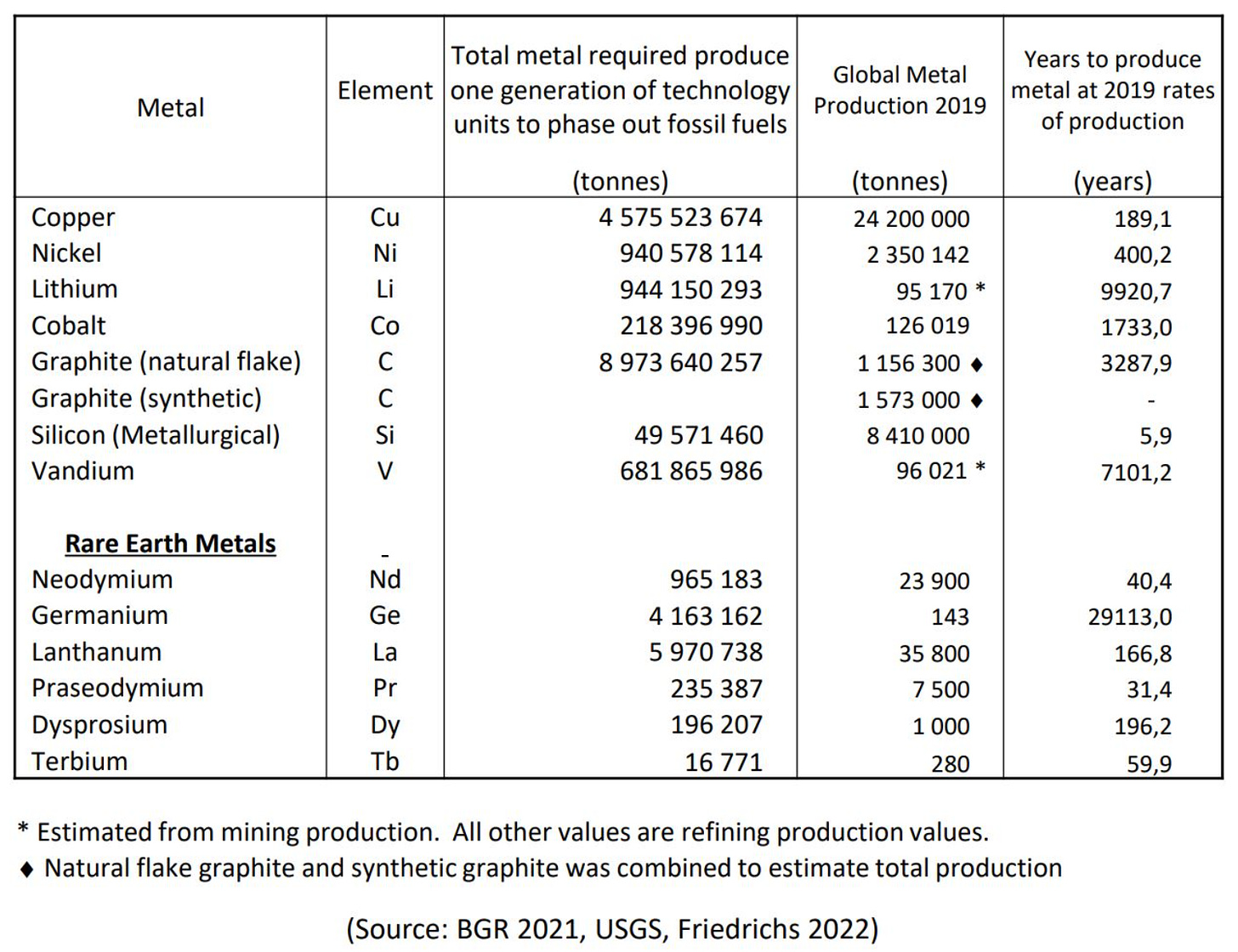

Building hundreds of millions of EV’s, expanding the electrical grid to accomodate higher loads, and building millions of acres of solar and wind farms will take metals. It does not take rocket science to demonstrate just how silly those dreams are in reality. Here is a comparison of the metal demanded to meet those aspirations with current mine output for key metals.

While copper and nickel are large markets already and well-supplied by existing mines, the lefist dreams will require 189 to 400 years of current production rates to be squeezed into a generation (20 to 30 years). In Canada, thanks to the Trudeau Impact Assessment Act, it takes 10 to 20 years to get a mine permitted and into production. Major deposits like Taseko Mines “Prospect” discovery and Northern Dynasty’s “Pebble” project have been mired down in approvals in Canada and U.S. or outright cancelled for eons, with billions of dollars squandered trying to get approval to build a mine. The massive Dumont nickel deposit in Quebec has been permitted for a few years already but there is yet to be a shovel in the ground to build the mine. Canada is a graveyard of domestic mining projects.

Elsewhere, in Peru, Ecuador, the Democratic Republic of the Congo and in a few other jurisdictions, there are new mines being built (often with Canadian owners like First Quantum, Lundin Mining or Ivanhoe) but their expected output is a drop in the bucket compared to the volumes needed to meet the “dream” of a timely “transition”.

That dynamic means well-managed Canadian miners will enjoy high metal prices for a long time and some projects will eventually get built even in Canada. Investors with the patience to hold undervalued miners (perhaps for decades) will be happy with the results if they live long enough to see them come to fruition. Good names to own are Capstone Copper, First Quantum, Hudson Bay Mining, Lundin Mining, Ivanhoe, Taseko and Western Copper. Mining is a tough industry but the payoff can be significant for patient money.

Stupid Liberal policies may damage Canada’s economy while benefiting investors with holdings in Canada’s miners with operations abroad or already in production domestically. Just make sure your money is on the right side of the street, and calm down - there is no “fast money” to be made, just good returns for patient investors.

While Taseko Mines has recently received approvals after years although I still wonder if it will go ahead in Arizona, its a no brainer, but there are many with no brains. Michael, in your calculations I can only think you forgot fairy dust as a key ingredient....

Seriously, the narrative has allowed 100's of billions to be spent each year with little oversight by western Govt and the fear agenda has moved the focus away from the terrible job most western Governments have been doing. I would say its been a huge success for the world elites...

The deplatforming of anyone not endorsing the narrative was seen recently, more obviously in big phama, but most choose to ignore and be fearful, interesting times...