I listened to Wednesday’s episode of Steve Paikin “The Agenda” where a panel of experts discussed whether Canada should increase taxes and one expert, Paul Hershaw, claimed increasing house prices have transferred wealth to older Canadians who aren’t paying their share of the services they now consume - largely health care and pensions. It is hard to imagine a more left-wing analysis of our society or a more distorted reality than that Hershaw claims now exists.

The first and most important point is that house prices have risen, not home values. A house is a house and its utility to its resident’s hasn’t changed with decades of inflation of home prices. Instead, it is the value of money that has fallen - a result of leftist policies of reckless borrowing, central bank policies of quantitative easing driving down interest rates and increasing the amount people can afford to pay for a home in turn driving home prices (since homes are in short supply) to nosebleed levels. Hershaw’s claim that an elderly woman living on $25,000 a year with a home worth $2 million is “wealthy” is particularly absurd given she has lived in that home for decades, scrimped and saved to clear it of debt, and would have to sell her home to pay any more taxes than she pays today. Hershaw should be horsewhipped for his lack of respect for older Canadians including his mother.

My family came to Canada two centuries ago and settled in Moose Creek, Ontario. When my grandmother died at 98 years of age in 1988, I purchased the family farm from her estate which sported a log home built in 1850. Her estate was at the time of her death worth $75,000 and I paid her estate that amount. After 138 years of inflation, the old farm was appraised at $75,000. Average annual “appreciation” in the price of the farm from 1790 to 1988 was about 2% per year, more or less the rate of inflation targeted by the Bank of Canada.

My ancestors worked that land, saved their meagre income, raised eight kids including my father, and paid off all debt by the time my grandmother had died. The idea (were she alive today) that Hershaw proposes - that she should pay more taxes in 2023, is a criminal idea that is tantamount to expropriation.

The shortage of affordable housing in Canada is all policy driven. Canada comprises over 2.5 billion acres of land, little of it developed. In a free market devoid of government interference homes would cost about 10% more than the cost of construction. Altus Group publishes annual reviews of construction costs and even in 2023 you can build a three bedroom 1,500 square foot home for less than $200 a square foot, or about $300,000. The policy driven shortage has made that home sell for about $800,000 to $1,200,000 depending on its location in Canada.

Older Canadians owe younger generations nothing. They fought in wars, developed Canada’s economy, built a national railroad, a transcanada highway, ports, airports, and major cities in every Province. In return, younger Canadians help elect progressive Liberals who have persuaded them there is a free lunch and they can get free education, free health care, retirement pensions, welfare, public transportation and high paying jobs merely for existing. They are soft, spoiled, and greedy by and large. It is time for them to grow up.

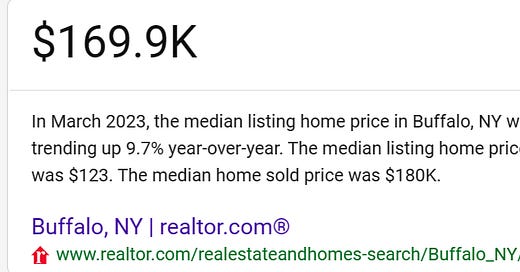

To reduce home prices, get rid of municipal and provincial permitting and limit regulation to building codes based on sound architecture and safety, and let the market work. In a few decades, house prices will come back to cost plus 10% profit, like it has everywhere on Earth where there are free markets when government gets out of the way. United States home prices are half of those in Canada in Buffalo or Fort Erie, a few miles from Canada, despite higher wages and benefits for necessary tradesmen. Material costs are in common. The difference is policy - free markets or Liberal gatekeepers? Elections let us decide.

The average home price in Buffalo, New York is the equivalent of CAD$225,000.

The average home price in Niagara on the Lake is more than double that. They are 55 kilometers apart.

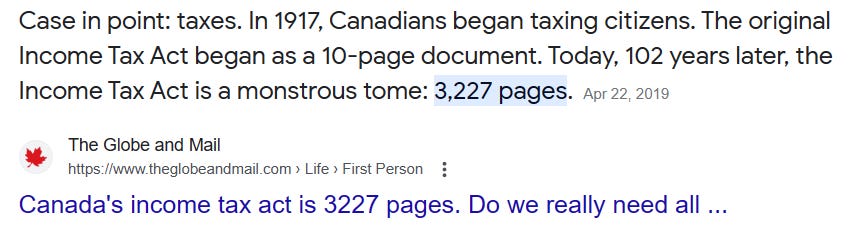

Paul Hershaw is spouting nonsense. We can solve Canada’s problems by kicking Trudeau and his Liberal entourage out of Ottawa, eliminating needless regulations, and revising the Income Tax Act from over 3,000 pages to 10 pages, about the size of the original tax act enacted as a “temporary measure” to pay for WWI. Stop taxing corporations who don’t pay but actually collect taxes and pass them on in price fueling even more inflation.

A one-page income tax act would read as follows:

All income is taxable regardless of source. Taxpayers with less than $50,000 of income pay no taxes. Those from $50,000 to $200,000 in taxes pay 30% of their income over $50,000 without deductions of any kind. Those with incomes over $150,000 pay 50% of the amount by which their incomes exceeds $150,000.

The data suggest this would work. Here they are:

20 million Canadians earn $50,000 per year or less and pay no taxes

8 million Canadians earn from $50,000 to $200,000 and pay an average of $40,000 in taxes for tax revenue of $320 billion,

1 million Canadians earn over $200,000 and pay an average of $80,000 a year in taxes for tax revenue of $80 billion

Total tax revenue of $400 billion under this scheme compares to total tax revenue in collected by CRA in 2021 of $316 billion.

Put an end to deficits and compel governments to live within their means. Get rid of a few hundred thousand civil servants with indexed pensions who contribute nothing to wealth creation.

It is time to put an end to “progressive Liberalism” which will bankrupt our country and target a Canada that will become a “home of the brave, land of the free”.

Let us vote common sense back into power and kick Trudeau out.

When they come after our houses surely to God even Canadians will wake up ... we need a counter surge against these utopians

I like this article! I sending it to twitter