Canada's government debt is a looming disaster

Rising interest rates and stupid energy policies portend declining real incomes

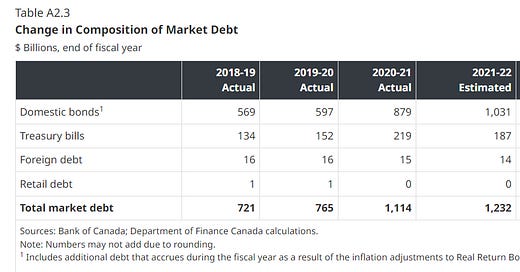

Canadian federal debt includes $1.3 trillion of bonds and treasury bills. Financing needs for 2022-23 amount to $435 billion.

The average duration of the debt is just over 5 years. The implication is that in addition to financing the growing deficit, some $600 billion of debt will need to be refinanced over the next five years. The current average interest rate on Canada’s debt is 1.4%. But rates have risen sharply and Canada’s 10-year bond rate is now over 3% and likely to rise further as the Bank of Canada tightens monetary policy to curb rampant inflation.

At 1.4%, interest on $1.3 trillion is $18 billion a year. At 3%, it rises to $38 billion. At 5% it becomes $65 billion. Canada will be very lucky if government bonds can be issued at rates of 5% or below for much longer, with inflation now about 8%. Bond buyers are not fools and committing to longer term bonds that pay less than the rate of inflation generally does not end well for bond investors.

The 2022 Federal budget is optimistic, showing debt charges rising to $43 billion by 2027. But revenues will grow as inflation persists and the projected revenues of $496 billion by 2026-27 may be conservative barring a major recession. The paradox is that a recession is needed to curb the rapidly rising rate of inflation and will cripple the projected growth in revenue for 2023-2024 while adding materially to the debt.

In a nutshell, Canada is in economic trouble and that trouble is entirely of its own making under the Trudeau Liberals. Inflation is the escape hatch for government mismanagement which essentially taxes the poorest in society (through inflated costs of living) while bringing down the cost of government debt in constant dollars despite the rise in nominal dollars. It seems likely that Trudeau wants inflation and the tepid actions by the Bank of Canada to fight inflation may have a political motive.

My own projections (OK, wild ass guesses but not entirely devoid of reality) show a more alarming picture. I have used a population figure of 35.1 million (as per Statistics Canada) but kept it constant throughout the projection, despite Statscan projection that population will rise from 35.1 million in 2021 to 35.8 million in 2026). The difference is not material.

This projection simply applies the real growth and inflation rates to existing program expenditures and includes no new programs. The projected public debt charges simply apply the rising interest rates to the calculated debt.

If I am correct (a long shot to be sure) Canadians will suffer years of declining real income while our leaders will be touting rising nominal income as a “success”. Nominal GDP per capita will rise but real GDP per capita will fall as inflation bites into the gains. Within five years, per capita income will have fallen about 30% and millions of Canadians will fall below the poverty line. This is Canada when a drama teacher and a journalist control the public purse.

History has some tough lessons - Canada has had periods of high and persistent inflation in the past and extreme actions were needed in less than 50 years ago to tame inflation, including wage and price controls and interesst rates of ~20% or so.

What makes the current bout of inflation likely to be intractable is that it is at its root caused by rising energy prices which, despite the protestations of Trudeau Liberals and Biden officials who blame the war in Ukraine, supply chain disruptions and gas station owners, the rising inflation can be traced to inane climate policies. The left wing climate nutters pretend CO2 is harmful and have enacted policies that have driven capital out of oil & gas industry creating a global shortage of fossil fuels. The nosebleed energy costs in Europe (natural gas at the equivalent of $200 to 300 a barrel oil) will find their way to North America before long unless our leaders abandon the climate change rhetoric, accept the laws of physics as correct, and urge development of oil & gas to reduce energy prices. Failing that, inflation will keep rising and we are in for a very rough ride.

I am not optimistic.

like/not like this report. Your sense of urgency is coming across clearly ... most of us share your lack of optimism. Where is John Galt?