Bullish on oil? Temper your enthusiasm

The industry has a history of violent swings in profits

I have enjoyed many discussions with energy investors on Twitter and in Twitter spaces, and have been an investor in the energy industry since 1971. When commodity prices are rising, investor enthusiasm rises in parallel and when prices fall sharply, investors enthusiasm drops to the “jumping out of windows” levels typical of market crashes. Most investors just get it wrong. Most project a current environment will persist in perpetuity or at least until they can sell their holdings at a profit. That doesn’t always work out well. Those preferring a “buyback” to a dividend for some minor tax advantage (if their circumstances make capital gains less taxed than dividends, which would be minority of investors in Canada) are betting the company will continue to benefit from currently high commodity prices. That is more often a bad bet than a good one, as the BDO article referred to below should convince.

Old market adages offer some humor but are funny since they incorporate a snippet of truth.

“The only way to make a killing in the stock market is to shoot your broker” dates back to 1929 and was as funny then as now. Of course, it ignores the obvious which is to be the broker and not take the investment risk at all.

“If you want to make a small fortune in the market, start with a large fortune” is just as funny and closer to the truth. Most professional money managers underperform market averages yet charge a fee for managing your money and don’t seem to risk their own.

In February of this year, BDO published an energy CFO Survey and reported on the 2020 economic performance of the oil & gas industry. 68% of firms were unprofitable and bankruptcies totaled over $100 billion. That had a sobering effect on many investors who fled the space.

Not me. I purchased most of my current holdings in the 2019 through 2021 at fractions of today’s prices: CJ.TO at $2.22 on January 25, 2019; AAV.TO at $2.36 on February 15, 2019; PEY.TO at $1.14 on March 17, 2020; ARX.TO at $3.17 on March 16, 2020; BIR.TO at $0.68 on March 20, 2022; $WCP at $0.93 on March 20, 2020; ATH.TO at $0.11 on April 30, 2020; CPG.TO at $1.44 on April 3, 2020; MEG.TO at $3.03 on September 18, 2020; and, SDE.TO at $4.71 on December 5, 2021.

I treat my purchases like a stamp collector treats his stamps - I keep them for long periods. I have little interest in higher prices since that precludes me from increasing my holdings at low prices. I rarely sell, and when I do it is not because of a rise in prices but because of a change in my opinion of management’s decisions. I still hold PEY.TO WCP.TO BIR.TO CJ.TO and SDE.TO but sold ATH.TO and MEG.TO when they embraced the “buyback” fad and CPG.TO after the company decided to buy Shell’s Kaybob assets for close to $1 billion when the company already had a high debt level. I sold AAV.TO at $11 when the company committed to a carbon capture business which I believe will become a stranded asset when the specious “climate change” rhetoric fades into history; and, sold my ARX.TO for a $200,000 gain when I saw the damage their “hedging” strategy was doing to their opportunity despite their wise acquisiton of VII.TO.

The investors I follow on Twitter incessantly predict or hope for higher stock prices and exchange views as to why the price of a given company’s shares will surge, soar, spike or simply rise. Some, lacking valuation skills, claim the market is undervaluing a stock they hold since the company at that moment has free cash flow of 30%. Corus Entertainment has free cash flow of 45% yet CJR.B.TO shares have lost 80% of their trading price in just five years.

I have no idea why these investors believe a higher stock price will benefit them. Sure, they can sell their current holding for a gain, hopefully to a “greater fool”, and then what? Now they have cash and a tax liability and have to find another investment.

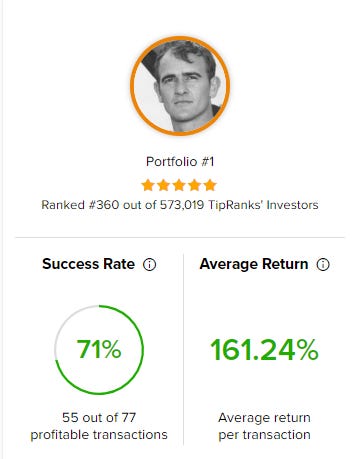

Tipranks keeps track of the price performance of stocks I listed on my Tipranks portfolio based on the assumption of one board lot for each stock. It is a useful indicator of “stock picking” success but little else, although the site also calculates the average return on those picks. My list ranks 360th out of 573,019 investors they track, somewhere close to the 100th percentile. Importantly, my stock selections are unsuccessful 29% of the time.

If I followed the apparent investment strategy of some of the investors I follow on Twitter, and focused on my “top pick” until I decided to realize a gain and then pick another stock, it would only be about five cycles until I was certain to have made a poor choice and suffered a loss. For statistics nerds like me, the joint probability of getting one choice wrong out of five choices is over 80% (1 - .71^5 = .82). If you remain fully invested, each successive roll of the dice is a larger bet and if you earned a whopping 161.24% gain each time you succeeded the loss on the wrong choice would be material, possibly enough to destroy all of the gains. Remember that 62% of oil & gas firms were unprofitable in 2020 as reported by BDO and many entered bankruptcy.

The secret to investment success is to avoid losses. Buy well, keep your investment until there is a compelling reason to sell, and enjoy the dividends the companies in which you hold share pay if they are profitable and share those profits with shareholders. My Birchcliff stock, purchased for CAD$0.68 a share announced it will now pay an annual dividend of CAD$0.80 per share starting now. My Cardinal Energy stock, purchased for CAD$2.22 a share, now pays a CAD$0.72 annual dividend. And, so on.

Be calm. Be rational. Be patient. If you are, you can build a portfolio that will provide lasting income. Good luck with your investments.

By my naive estimate oil sector as a whole is fairly valued at the moment.

Historically they say it was two times bigger %% of S&P than now - but this may mean just that S&P is twice overpriced and is poised to prolonged bear market.

Raising rates and the market being in kind of state of denial suggests we’re still in early stage of the bear.

random question, why do you use a picture of what i presume to be of yourself from 40-50 years ago?