Britain rules the waves

Waves of inflation that is - a disease Trudeau is importing to Canada in spades

The United Kingdom just reported inflation at 10.4%, the highest rate in 45 years. Inflation was virtually zero in early 2021. Today, Britons are experiencing food prices up 18% year over year. Talking heads on Bloomberg, MSNBC, CNBC and Business News Networks (mostly 30 something “experts” with MBA’s from progressive schools) keep pretending inflation will abate and arguing the U.S. Federal Reserve should at least pause its program of monetary tightening. Their motivation appears to be short term trading profits - the source of their fees and commissions.

I haven’t heard much from them about the dire situation in United Kingdom. It has been quite a few years since Britain suffered double digit inflation. When it last did, interest rates were forced to the 15% range to curb the damage. Inflation rose in the early 1970’s passing the 10% hurdle in 1972 which triggered the Bank of England to force interest rates to the 15% range, needed to slow inflation which peaked at 22.6% in 1975. Even 10-15% rates took years to bring down inflation which remained above 10% until 1991.

Failure to read the tea leaves accurately seems to underly many of today’s economic problems as the current generation of “financial advisors” and “economists” promote Modern Monetary Theory (MMT) and thought Quantitative Easing (QE) was a sensible way to stimulate economic growth and that governments could borrow liberally and scatter money throughout the economy as if they were “dropping it from helicopters” - an idea jokingly advanced by Ben Bernanke which earned him the handle “Helicopter Ben”.

Now the chickens are coming home to roost. The failure of Silicon Valley Bank (SVB) was the product of “woke” management who let the duration of their assets (largely “risk free” treasuries and mortgage-backed bonds with high credit ratings) get well out of line with the size of their demand deposits making a “run on the bank” almost invevitable and (as was the case) bringing down the bank. But you have to give them credit - they had their pronouns right.

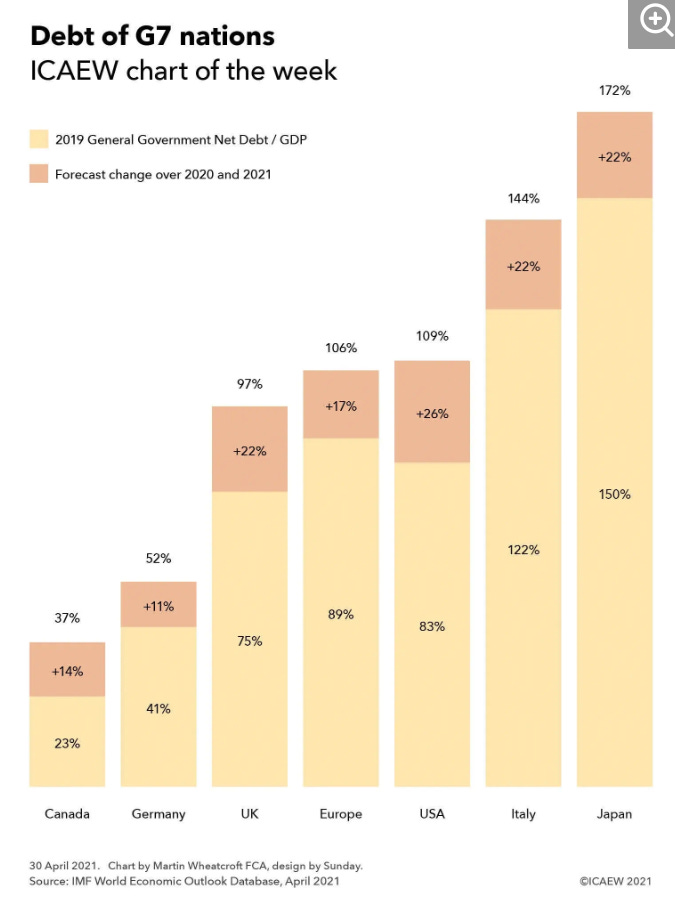

In pre-pandemic 2019, many G7 nations had debt levels expected to exceed GDP, with only Canada (a modest 37%) and Germany (52%) showing any evidence of restraint in borrowing.

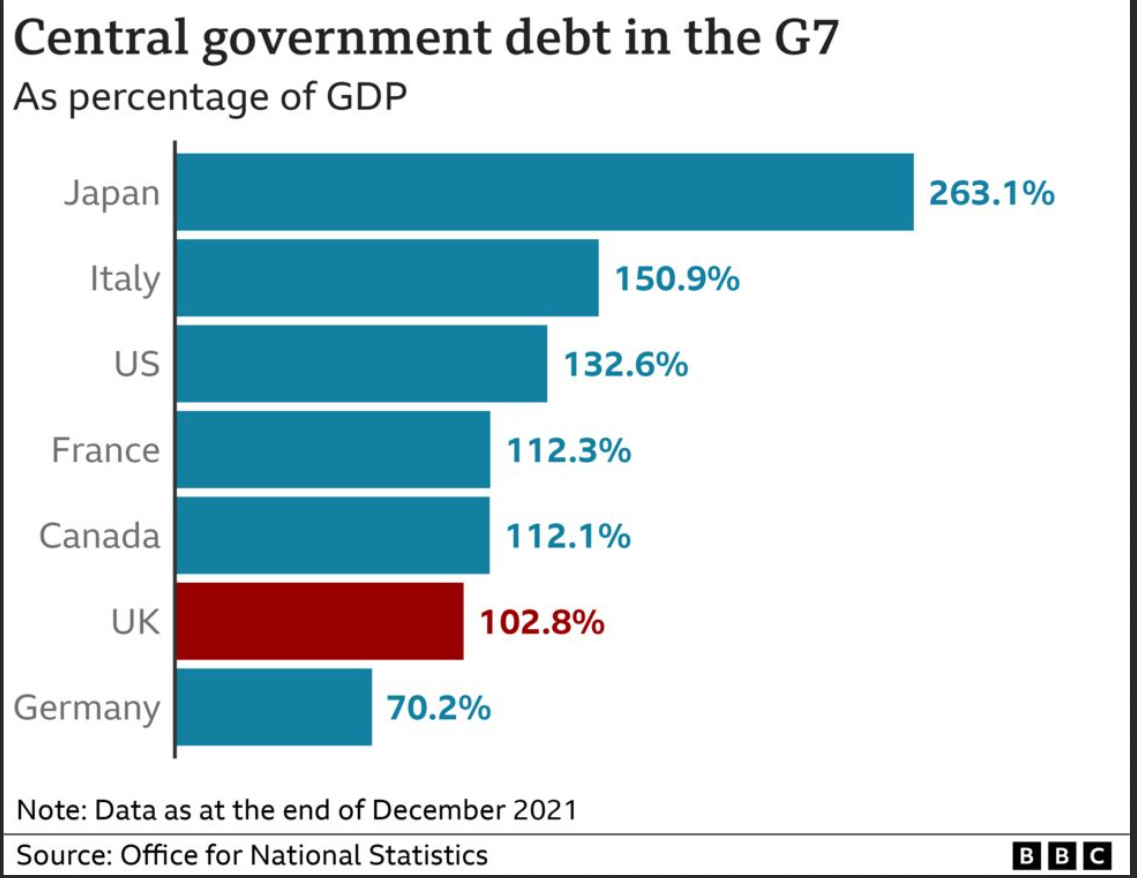

That pleasant outcome for Canada was short-lived with Justin Trudeau leading the Liberal government. By the end of 2021, Canada had leapfrogged United Kingdom and joined all G7 countries but Germany with debt to GDP over 100%.

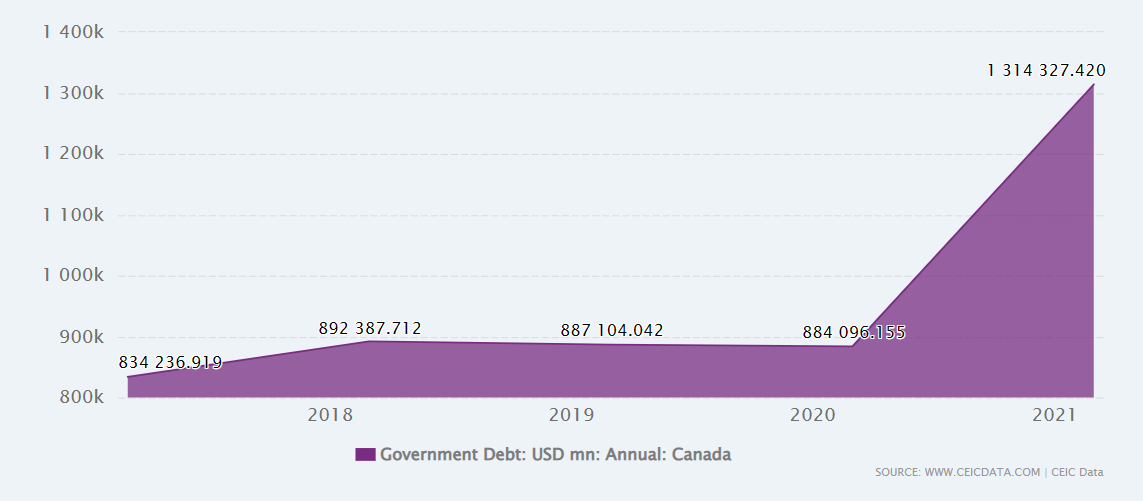

With the end of the pandemic in hand, one might have expected some level of restraint by the Trudeau Liberals. Good luck with that. Trudeau and his Minister of Finance Chrystia Freeland keep spending taxpayer money like drunken sailors pretending they are helping Canadians by ripping them off with higher taxes (including a senseless carbon tax) and giving them back a small portion of the money they taxed away while funding even more spending with more borrowing. In the period since the 2019 election, Trudeau’s government has piled on another US$430 billion in debt (almost $600 billion in Canadian funds).

Trudeau defended the borrowing with a line “our government borrowed so Canadians didn’t have to”. Really? Canadian household debt kept rising in the face of the rampant inflation created by Liberal government policies and by April 2022 exceeded $2.1 trillion or about $41,500 for every household, a situation that is getting worse as mortgage rates rise and rents border on unaffordable in most cities while wage increases lag inflation and consumers are forced to use their credit to survive.

A warm winter has taken some of the steam out of U.K. inflation as natural gas prices fell from nosebleed levels. Falling oil prices have contributed to an easing of Canadian inflation now running at just over 5% year over year. The immediate reaction of market “experts” is a desire to declare victory over inflation and encourage Tiff Macklem to pause interest rate increases “to see what happens”. We know what will happen - unless and until there is a supply response to the deepening energy shortage created by overtly stupid “climate change” policies the trend in energy prices will be upwards and inflation will resume immediately the global economy recovers from an expected recession. Borrowing more won’t reduce inflation.

The U.K. situation is precarious. The U.S. situation is not much better. The Biden administration keeps spending and borrowing, proposing tax increases on wealthy Americans, and squandering billions on “climate change” policy and programs that have zero chance of altering the course of nature.

As I see it, Europe in general and the United Kingdom in particular have entered a state where the sovereign balance sheets are unsustainable and the choice is between very high rates with a deep recession or softening monetary policy and runaway inflation, with both paths threatening economic collapse. Canada is in worse shape than the U.S. and will very likely follow Europe down the rabbit hole of unsustainable debt and intractable inflation.

I think the rubber will hit the road by June or July of this year, possibly just in time for the popular Pride parade. The celebration of diversity, equity and inclusion can “include” many more Canadians among those struggling to live below the poverty line.

It's tough to watch the disaster the Liberals have imposed on Canada continue. Lots of us trying to decide whether to stay and tough it out or move to somewhere down the economic scale but safer economically.