Boom or bust? Tiny MCF Energy should make a few headlines this year

A gusher will see the stock soar; a dry hole will see it fail

The founders of Bankers Petroleum have a new pet project, MCF Energy, a micro-captialization company listed on the Toronto Venture Exchange and operating in Europe.

Some historical and current well tests show promise. Here is a summary of the Kinsau-1 test. well.

Kinsau had two further holes drilled in 1983-85 and showed 24.7 mmcf/day of output on a test well. MCF holds a 20% interest in the program to re-enter the 1983 well and is carried for drilling costs up to 5 million Euros. Does it have any value? Who knows.

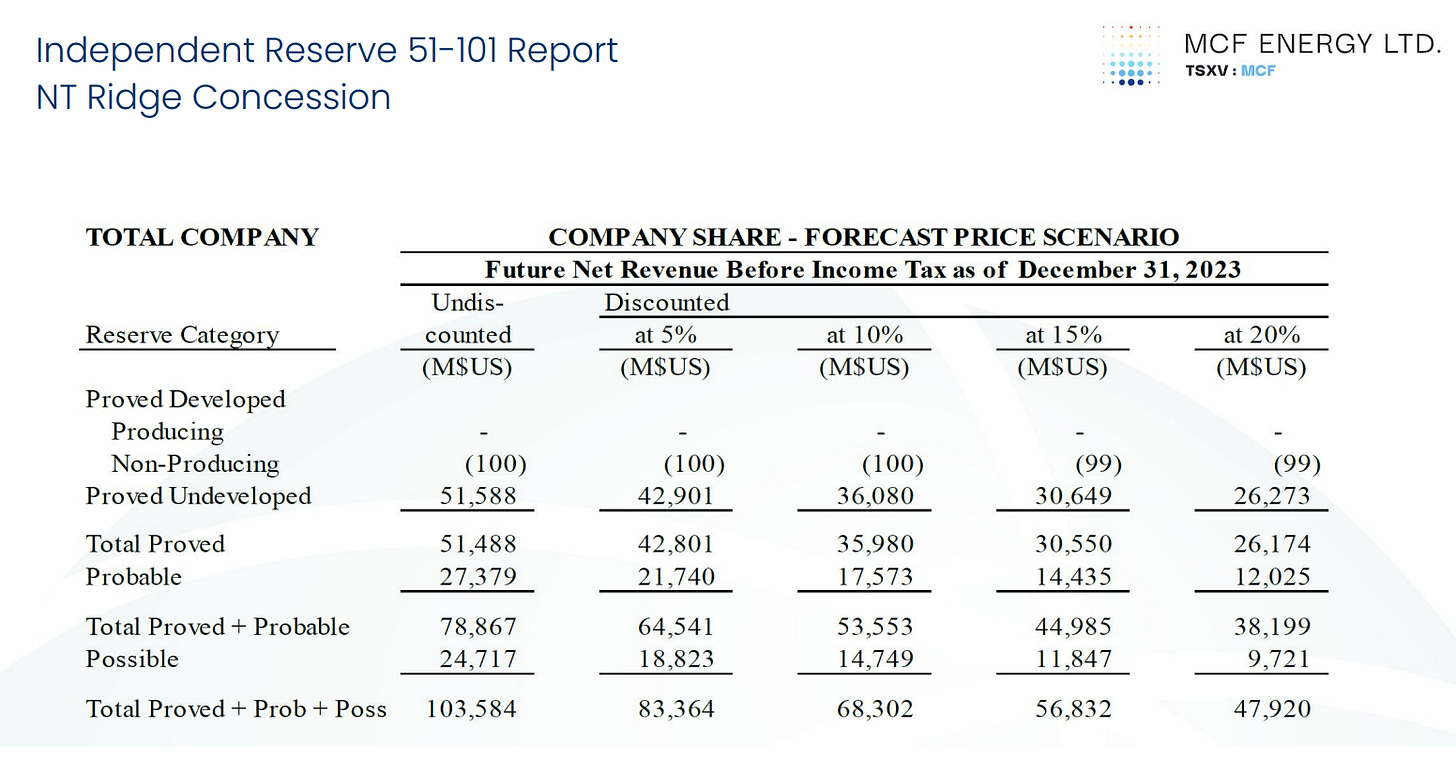

MCF holds a North Sea concession labeled NT Ridge. A NI 53-101 report for this holding shows 11.9 Bcf of reserves with a NPV10 value of US$53.3 million. MCF plans to begin production from this area sometime this year and to continue drilling up the resource. That could be quite a chore given MCF’s balance sheet is pretty thin.

MCF has other European concessions in Germany and the Czech Republic. What it doesn’t have is much money. At CDN$0.14 per share, the 244 million shares outstanding have a trading value of only about CDN$35 million. With only $CDN2.2 million cash at March 31, 2024 and a working capital deficit of several million the real question is whether MCF can survive long enough to see the benefit of portoflio of assets it has assembled.

The balance sheet is vulnerable, with the royalty payments the key. I don’t know when they are due or what happens if payment is delayed, but an insolvency can’t be ruled out. A lot depends on when the company first gets cash flow from is Czech assets or from NT Ridge, or whether it can raise new capital from its founders.

This is definitely a “business man’s risk” with a total loss on the one hand (which seems the more likely outcome) or a massive (in relation to the $0.14 share price) gain of five to ten times current trading prices, possibly more.

It will be fun to see how this unfolds. Me, I bought 250,000 shares just in case it works out.

I had a small position about a 2 years ago but exited, my thinking at the time, high European prices and the large holder Frank Giustra is a well known and successful promotor..