Bonterra will develop Charlie Lake assets potentially eliminating all corporate debt

It could happen faster than investors think

In Q1 2024, Bonterra Energy (BNE.TO) made the decision to expand its land holdings by buying acreage in Charlie Lake for CDN$24.1 million, a decision Bonterra investors disliked selling down their holdings, apparently fearful the purchase was ill-timed and added to an already too large debt burden, at least by some accounts. I disagree. The expansion in Charlie Lake should pay off big time.

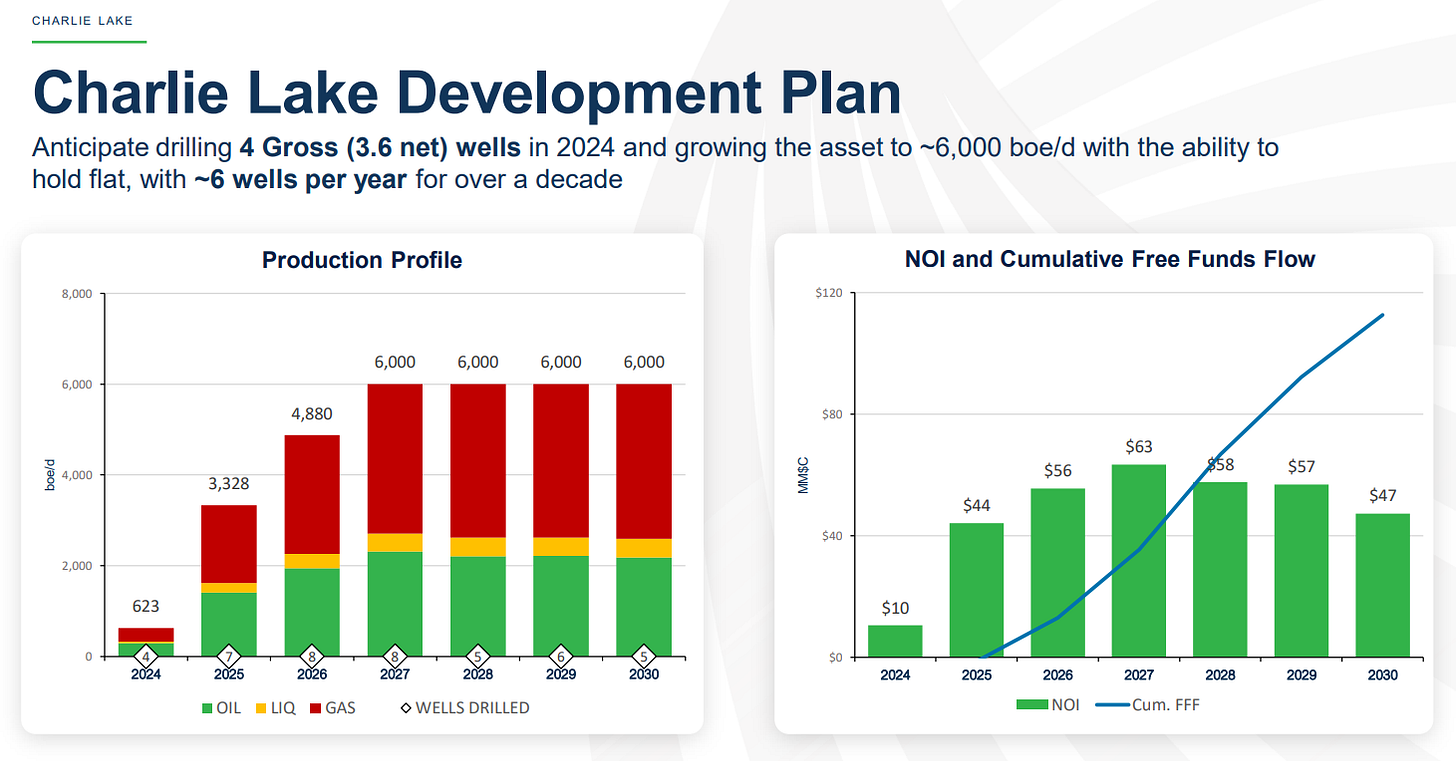

Bonterra’s plans for Charlie Lake see production from that liquids rich area grow to 6,000 barrels of oil equivalent (BOE) per day by 2027, throwing off significant free cash flow. Liquids content in Charlie Lake is expected at about 33% with most of that light oil.

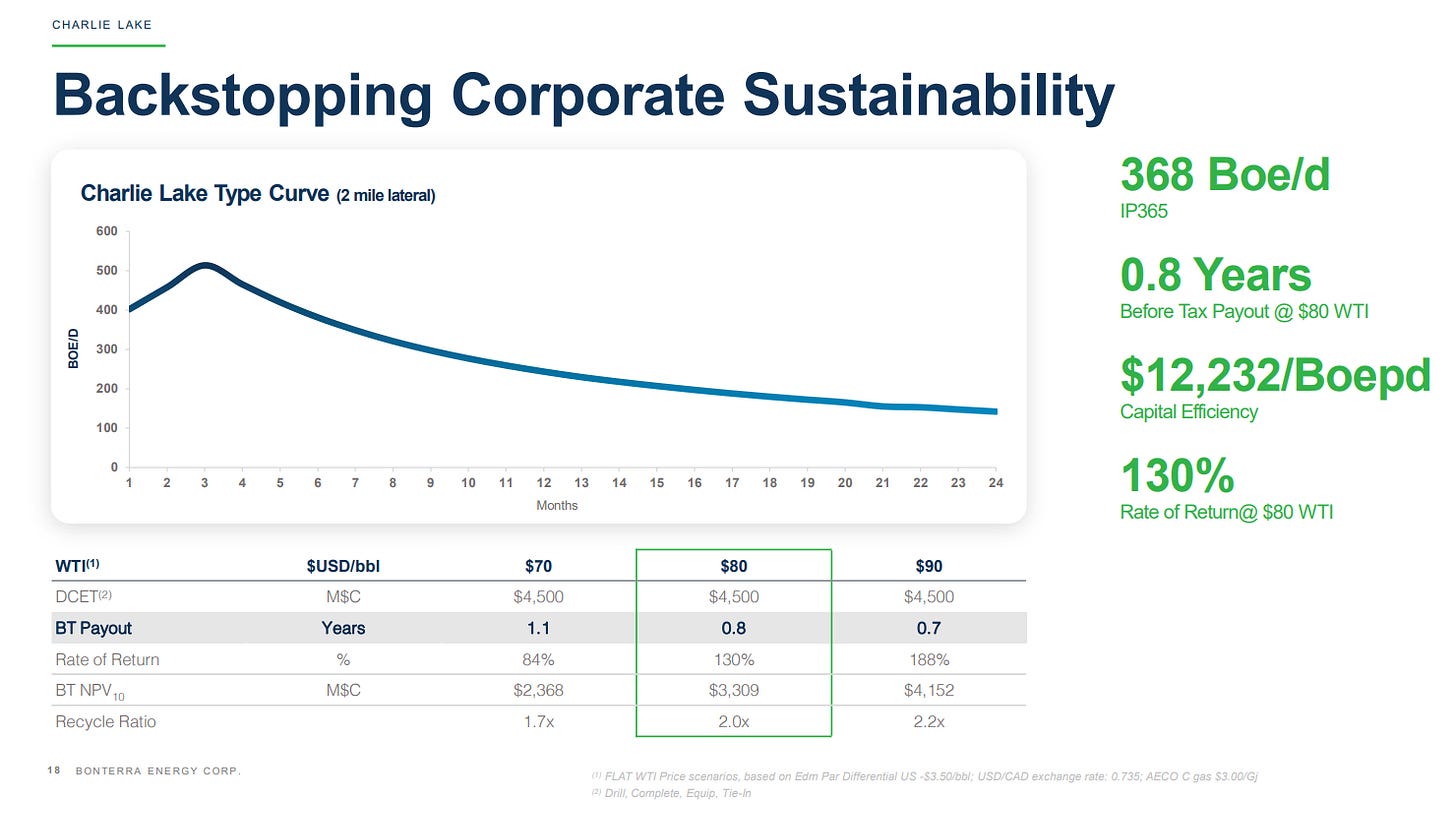

Charlie Lake wells are anticpated to cost Bonterra CDN$4.5 million each, produce on average 368 BOE/day, and pay out in 8 months. Capital efficiency Bonterra estimates at just of CDN$12,000 per flowing barrel. By 2030, free cash flow from Charlie Lake alone is projected to be almost enough to repay all Bonterra’s debt (currently at CDN$140 million, more or less).

Bonterra’s other assets should continue to operate as they have in recent years, generating free cash flows of their own.

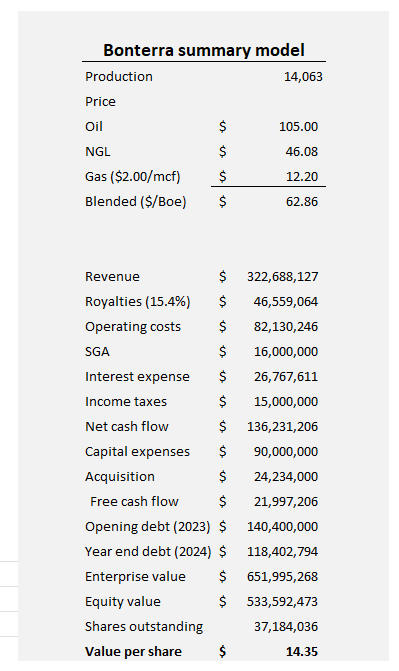

My simplified model of Bonterra based on its March 31, 2024 disclosure comes up with a current share value of CDN$14 or so.

By 2030, Bonterra output is (in my opinion) very likely to exceed 20,000 BOE/day and a debt free Bonterra with only about 37 million shares outstanding can be reasonably expected to produce CDN$240 million after tax cash flow and free cash flow over CDN$125 million, more than CDN$3.00 per Bonterra share. I expect most of that free cash flow will find its way to shareholders in the form of dividends, likely somewhere around CDN$2.40 per share or CDN$0.20 per month.

A debt-free Bonterra should command a free cash flow multiple of about ten times, putting a value on the shares in the CDN$30.00 range.

If gas prices firm up and light oil prices continue to run CDN$110 per barrel (as they are today) Bonterra’s trip to “debt free” status can take less than 3 years without any compromise on its planned growth.

Trading at about CDN$5.00 per share, Bonterra shares are among the most undervalued shares in the Western Canadian Sedimentary Basin. For that reason, I hold 50,000 shares.

I posted a link on Investor Village, energy investing thread, many industry veteran's and sharp folks interact there, might be worth your time to take a look..

https://www.investorvillage.com/groups.asp?mb=19168&mn=567858&pt=msg&mid=24958303

Looks good on paper, I imagine it’s the new directors baby, he is familiar with the area after being with Jeff at BIR for a long time…. Now all they need to do is deliver by 2030…

BONTERRA ENERGY CORP. ANNOUNCES APPOINTMENT OF NEW DIRECTOR

Bonterra Energy Corp. has appointed Dave Humphreys to the company's board of directors effective Aug. 21, 2023.