Bonterra Energy investors seem worried by the company's debt

But they shouldn't be too anxious

Bonterra Energy (BNE.TO) had a near death experience in 2020 when it had CDN$315,573,000 debt and commodity prices collapsed. The company has taken action to rebuilt its balance sheet at at December 31, 2003 debt had fallen to CDN$140,400,00. In Q1 2024, debt increased to CDN$176,360,000 owing primarily to the purchase of some Charlie Lake assets for CDN$23,900,000 and front end loading its 2024 capital budget of CDN$90 million to CDN$100 million.

The Charlie Lake purchase adds 300 barrels a day of oil output and increases reserves. Bonterra’s bank debt is a reserve based facility.

The structure of Bonterra debt is often ignored by investors who just react to any uptick in the amount owed out of fear the company would be vulnerable to a collapse in energy prices. That is a reasonable fear, but Bonterra is not exposed to much risk.

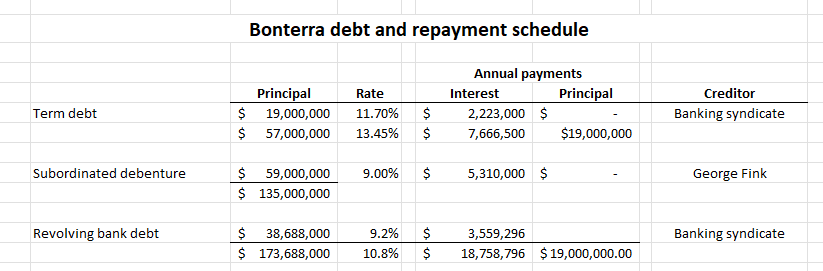

The debt comprises a term facility and a revolving line with the banking syndicate and $59 million of 9% convertible debentures owned by 12.9% shareholder and former CEO George Fink. For providing the funding, Fink received over 3 million options at CDN$7.75 a share on BNE stock.

At current commodity prices, Bonterra will have more than enough cash flow to fund its capital program and meet the $19 million principal payment on the term debt. If energy prices fall and cash flow is constrained, the reserves based CDN$110 million revolver has over CDN$70 million available and can be called upon.

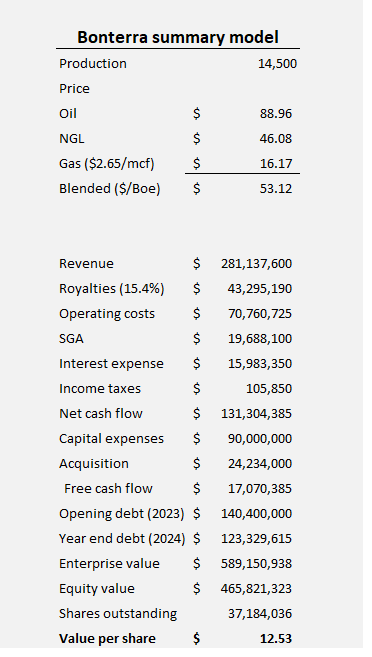

Bonterra expects full year 2024 output to average between 13,800 to 14,200 barrels of oil equivalent (boe) per day. That seems conservative given the Charlie Lake purchase adds 330 boe/day and 260 boe/day were shut in owing to cold weather in Q1 which reported quartely output of 14,189 boe/day so I think (while it makes sense for companies to low-ball expectations) 14,500 boe/day is more likely. Here is a simplified model of Bonterra’ full year results based on 14,500 boe/day and no change in commodity prices from Q1.

While lower energy prices are possible, particularly for natural gas during the summer months. Bonterra has hedged 40% of its oil output and 30% of its gas output at prices with a floor of US$60 for oil and CDN$2.04 for gas. That is enough protection to ensure Bonterra can meet its obligations with comprise to its capital program.

Bonterra today is in far better shape than it was in 2020. If a short term fall in energy prices drives the share price lower, I will add to my 50,000 share holding.