Bogus claims of corporate greed divide society

Hard data simply don't support the leftist claims

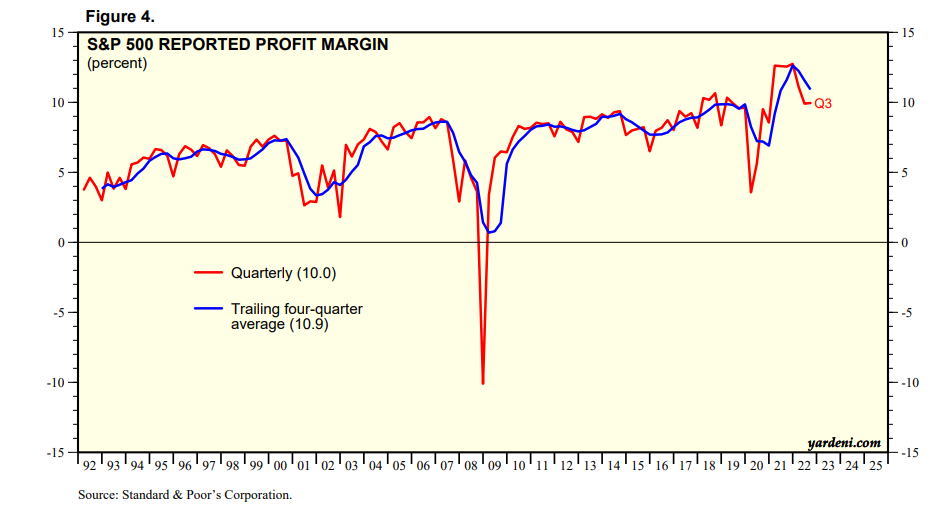

Yardeni Research (owned by Edward Yardeni, a famous name on Wall Street) is kind enough to report a great deal of statistical data on corporations one item of which is the after tax profit of the Standard & Poor’s 500, a good representation of corporate America. Net profit to sales figures demonstrate whether corporations benefit or suffer from changes to tax rates or whether it is their customers who receive the benefit of lower lower tax rates or bear the burden of higher rates. Yardeni’s recently published chart shows the ratio of net income to sales (as a percentage) going back to 1992.

Broadly speaking, macroeconomic conditions and policy decisions affect corporate profitability in addition to productivity, reinvestment rates, the level of interest rates and many other factors. Those factors affect different corporations differently - those without debt and large cash balances will show higher net income to sales in times of higher interest rates, for example, and those with large debts at floating rates will exhibit the opposite. Parsing out the factors affecting the corporate sector as a group is complex except in one instance - tax policy. When corporate tax rates are changed, there is an immediate and measurable impact on net income - or is there?

If companies merely collect taxes and pass them on to consumers, higher tax rates will barely nudge net income to sales, since sales will rise for the same level of profit, unless, of course, companies not only pass on the higher taxes but also raise prices to maintain profit ratios.

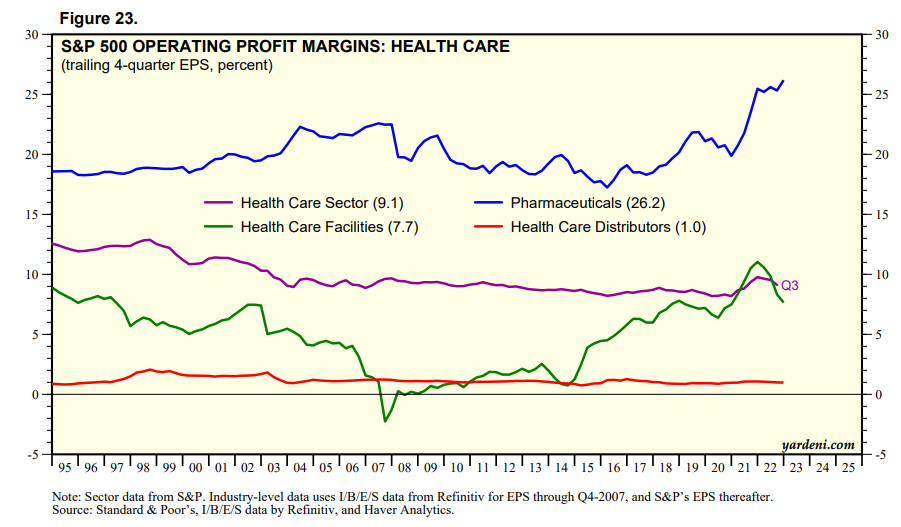

What is clear from the chart (with the exception of the period of the global financial crisis in 2008-2010, is that corporate profits for America’s largest companies averaged between 5% and 10% of sales, and that while profits have improved somewhat over 30 years profit ratios did not change much in the decade from 2011 to 2021. Post 2021, a sharp rise in corporate profits has taken place largely owing to the exceptional profits in the energy sector post-2020 and the extremely high profit ratios of pharmaceutical companies who made out like bandits during the pandemic.

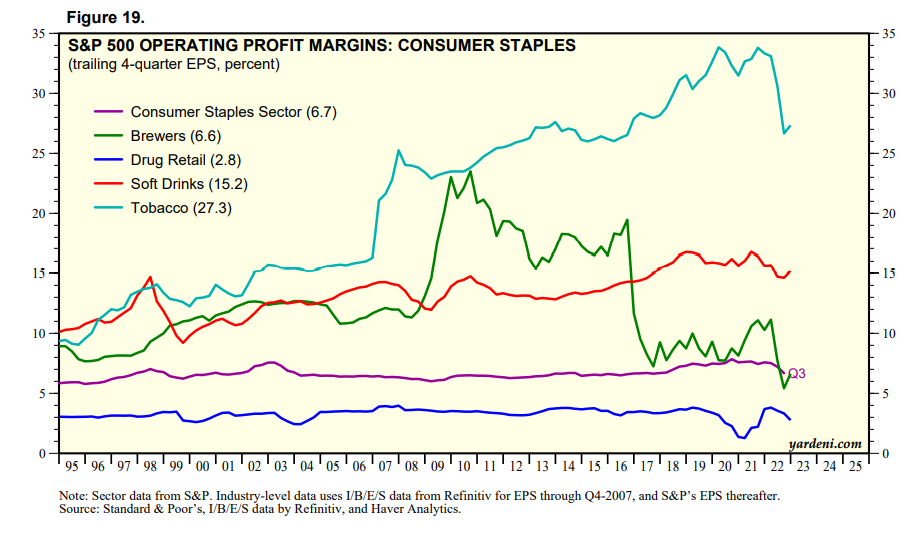

With the exception of tobacco, profitability of consumer staples providers has been flat or even declining. Consumer staples is the group of products everyone needs to buy every day, and the core of every household’s budget.

So what about the extreme rhetoric from Democrats like Elizabeth Warren and Bernie Sanders vilifying corporations for “corporate greed” and blaming inflation on “price gouging”? And the vociferous complaints that the Trump tax cuts were a give-away to wealthy corporations?

The Trump tax cuts were enacted late in 2017 and began to take effect in 2018. The profitability of companies providing consumer staples didn’t budge. It should be no surprise to anyone with a grade school understanding of arithmetic that the tax cuts were passed on to consumers by the suppliers of groceries, beer, OTC drugs and soft drinks. There is no evidence of corporate greed and if anything the tax cuts were disinflationary.

So where did the inflation crippling household budgets come from?

In a nutshell, inflation resulted from two factors - reckless spending by Democrats in Congress and the Biden administration and higher energy prices arising from literally stupid “climate policies” that have created shortages of fossil fuels and increased electricity costs by squandering taxpayer money on costly, inefficient and unreliable “renewables”. The $4 or $5 trillion of spending under Biden saw too many dollars chasing too few goods; the shortage of fossil fuels doubled oil & gas prices since Biden was elected in 2020; and, pharmaceutical companies benefitting from the vaccine mandates issued by the Biden administration enjoyed dramatic increases in profits at the expense of consumers. Egged on by Anthony Fauci the Biden administration urged millions to be vaccinated at taxpayer expense, and Big Pharma eschewed the promotion of safe, effective and inexpensive anti-viral and prophylactic medications like Hydroxychoroquine and Ivermectin. It is only now that random controlled studies are emerging that show Invermectin was (and is) an effective treatment for COVID patients.

America’s current problems - high inflation, rising interest rates, nosebleed housing costs, and high energy costs can all be traced to one cause - ill-conceived left wing policies emanating from a group that spends no time trying to understand how the laws of physics render the climate charade nonsensical or why profligate government spending of borrowed money can never lead to a happy ending. Instead, they revel in a fool’s paradise of apparent belief that they are helping people with policies that damage virtually everyone and will cause economic catastrophe for many.

The electorate can improve the situation by throwing out the Democrats in United States and the toxic Trudeau administration in Canada whose policies simply echoed the stupidity of the Biden policies. It is time to change horses.

Like your articles. But how can you talk inflation without mentioning the insane amount of money printing over the past 4-5 years?