Bloomberg promotes the ESG scam on live TV

And publishes the same tripe on its subscription web site

Driving home from town today I listened to an interview on Bloomberg where the interviewee (I didn’t get his name but suspect it was Matthew Winkler) was dumping all over Texas and Florida for barring “woke” investment banks from underwriting their municipal bonds, which the interviewee said was costing taxpayers in those states a lot of money despite both states having AAA credit ratings, and commented that California can borrow 19 basis more cheaply lacking any such ban.

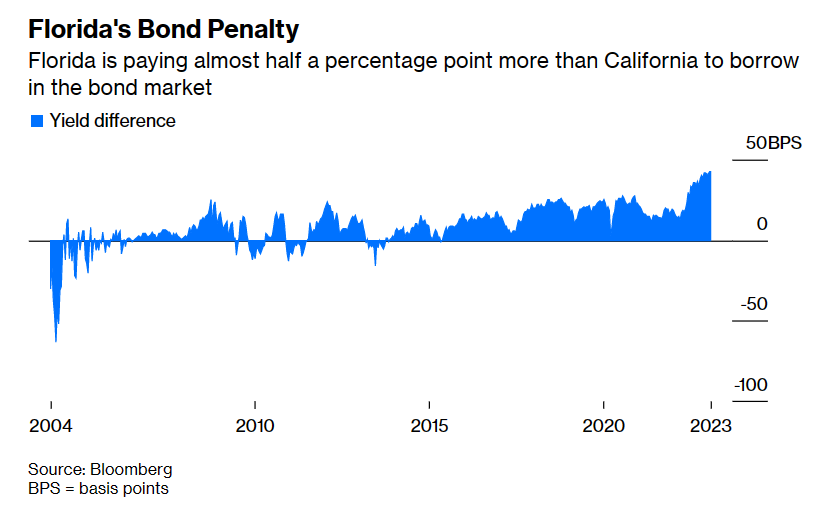

Sound convincing? The whole story is set out in this article published on Bloomberg Guess Who Loses After Florida and Texas Bar Wall Street ESG Banks? authored by Winkler. Winkler posts this chart showing the “penalty” being paid by Florida and Texas for what he implies is an ideological bias that harms taxpayers. In the TV interview, Winkler (if it was Winkler and not someone who just agrees with him) says among other things that “climate change” is a major threat to humanity. We have heard that aphysical nonsense far too often, and a collision with the laws of physics would help Winkler (or whoever agrees with him) and give them a dose of reality. Climate change may be happening but CO2 emissions have no material role, and the rhetoric is so pervasive even experts in finance are bamboozled by it.

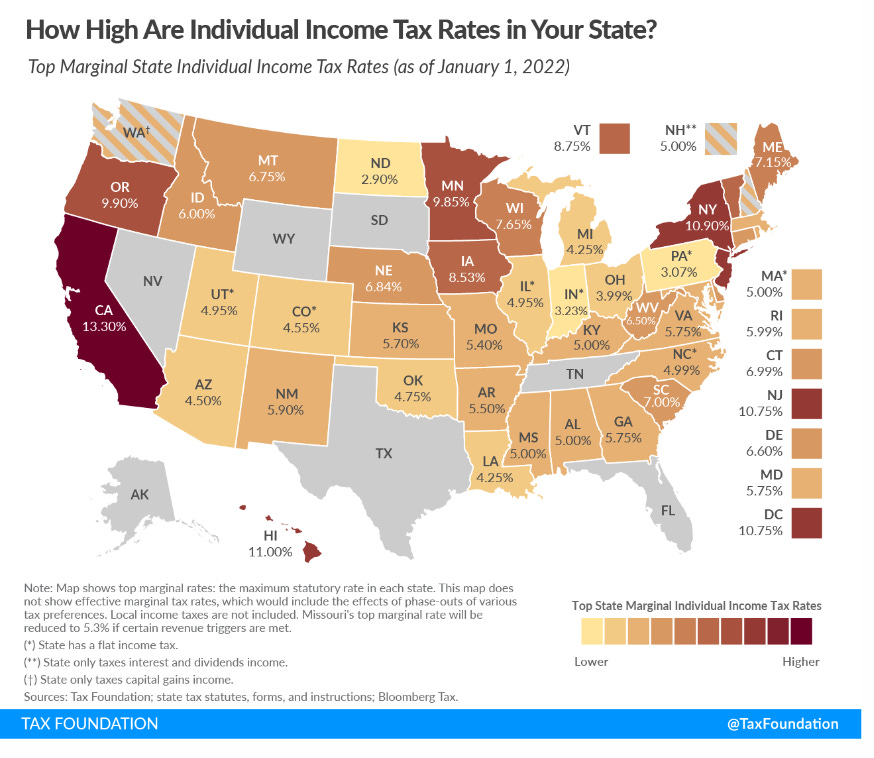

Like most of the trip flowing from the mouths of leftists, Winkler’s article calls for a bit more analysis. If the states are paying more for the money they raise issuing municipal bonds, bond holders are earning more. Municipal bonds are not exposed to state taxes in United States unless they are out-of-state bonds. Californians buying Texas or Florida municipal bonds get a higher yield (about 19 basis points) and may give that up in higher personal taxes, since there are challenges for Californians investing in out-of-state municipal bonds.

Bondholders who live in Texas or Florida not only benefit from the higher rates paid on municipal bonds issued by those high credit rated issuers but also pay no state taxes on bonds from any source since neither state imposes a state tax.

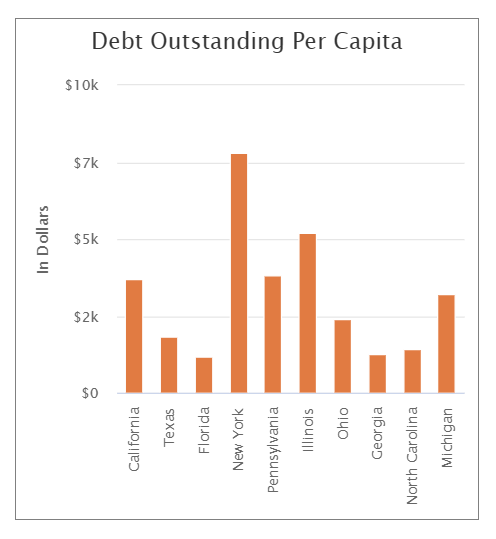

Texans and Floridians don’t mind the comparison to California a bit. California has twice the debt per capital of either Texas or California.

Texans own a lot of Texas’ debt (about $12,500 per citizen) and benefit from the higher yields. Florida’s state debt is $1,696 per capita and the 19 basis point “penalty” Winkler derides amounts to $3.22 per person. I don’t think Ron De Santis is losing any sleep worrying that Florida voters (many of whom benefit from the higher yield through the bonds they hold free from state taxes) will rebel over the $3.22. If any voters should be upset about the cost to taxpayers of state debt, it is not those living in Texas or Florida but those living in California, New York, Pennsylvania, Illinois or Michigan.

Winkler’s views (to which he is certainly entitled) are self-serving leftist tripe misrepresetned to promote a left-wing ideology. When he cites Larry Fink as an authority on ESG, he fails to mention that money managers promote ESG not out of any desire to improve society but because if it does lower costs of capital (the typical claim) that means higher share prices and its corollary lower returns to investors. Except to Fink, since his fees are based on assets under management and higher share prices mean higher fees for him and lower ongoing returns for his clients.

As famed market expert Awath Damodaran has said, ESG is a feel good scam. Bloomberg is a great source of financial news and its coverage of ESG is worthwhile, but promotion of ESG is harmful not only to investors but also to society.