Birchcliff Energy (BIR.TO) and Peyto Exploration (PEY.TO) both released Q2 2024 results this week and the market swooned over Peyto’s results and had distemper over those of Birchcliff. The major difference between these two Deep Basin operators is the pace at which they are developing their extensive reserves and their policies regarding hedging the sale of output by using derivatives in futures markets. Peyto is making a lot of money through its hedges which are contributing to higher realized natural gas prices in a weak natural gas market and Birchcliff is making less on its so-called “basis hedges” which are effectively tying the price Birchcliff receives to prices at U.S. Hubs with no cap on the price if natural gas prices rise.

In a nutshell, from the point of view of the effect derivatives have on each company’s ability to benefit from higher natural gas prices, Birchcliff is essentially “unhedged” while Peyto is assured a reasonable price for its hedged natural gas but limited by a cap on the amount it can receive.

Investors in natural gas producers today prefer Peyto’s approach since for the time being the “hedges” are paying off. They seem oblivious to the $2 billion rival ARC Resources (ARX.TO) has lost on its “hedge book” over the past few years. The debate rages on.

As many readers know, I prefer Birchcliff’s policies. When prices are low they reduce capital to preserve their valuable reserves until stronger gas markets emerge, while Peyto continues to profitably exploit its reserves. Both companies are well run, and both strategies have some benefits and pose some risks. To some extent, the respective policies are geared to providing what shareholders (a mercurial lot at best) seem to want in the case of Peyto and what is best for the corporation itself in the long term in the case of Birchcliff. I need not remind readers that directors of public companies owe duties to the corporation, not to its shareholders.

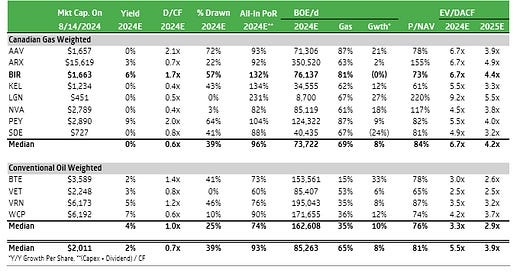

Comparing the companies on typical metrics is useful. Birchcliff has lower to debt to cash flow than Peyto (1.7 times versus 2.0 times) despite incessant bitching on X by investors complaining about Birchcliff’s debt of $470 million and ignoring the more than $1 billion debt carried by Peyto. Neither company has too much debt, both are capable of meeting all their obligations as they fall due, and the chatter about debt levels is noise.

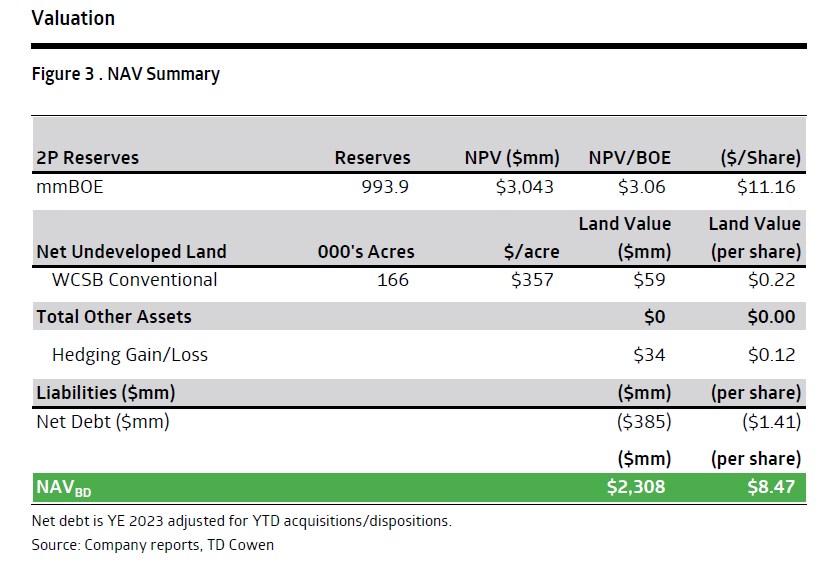

Both companies have extensive reserves in the Deep Basin, with Birchcliff’s reserves about 1 billion Boe and Peyto’s about 1.3 billion Boe (largely a result of the Repsol purchase which added materially). But Birchcliff trades at a discount to the value of those reserves with a trading price around $6.00 and a NPV of its reserves closer to $8.50, while Peyto trades at a price closer to its reserve value as estimated by TD Cowen at $18.01 per share. TD includes in that estimate $2.37 of “hedging gains” as an asset in case of Peyto, which assumes no rise in the price of natural gas which could turn that “asset” into a “liability” if the price of gas rises above the price cap inherent in Peyto’s hedge book.

I think it inappropriate to speculate on the future benefit or burden of a hedge book and, unlike TD, don’t put any value on the hedges. Ignoring those hedges, and the market is valuing Peyto quite close to its net asset value, but discounting Birchcliff by almost 30%.

Retail investors, at least those I see on X, seem terrified by volatility and incapable of calm and rational assessment of risk and return. They will pay a premium for stability in the share price of entities they hold but have no intention to sell. I don’t. In the long run, value wins out.

No surprise I am sure, but while I hold shares in both companies, I prefer Birchcliff and if we see an extended period where natural gas supplies lag demand and gas prices rise to over $10 a gigajoule, it will be starkly apparent why. At that price, I estimate Birchcliff cash flow at $1.3 billion and Peyto cash flow at $1.4 billion (capped by its hedges or it would be a few hundred million higher) and at a conventional multiple of 4 x EBITDA $BIR shares would be worth about $18 a share and Peyto shares about $23 a share and the gain on my Birchcliff shares would be about 200% and on my Peyto shares about 50%.

Will natural gas prices ever rise to $10 a gigajoule? Who knows. They have in the past. A useful reference point is that with a 6.1 to 1 ratio of oil to gas on a BTU basis, at $90 oil the BTU value of natural gas is almost $15 a gigajoule and, in essence, both fuels are selling BTU’s of energy. Parity is unlikely today but as demand for energy keeps rising and natural gas increasingly becomes the preferred fuel for electric power generation (particularly for hyper scale data centers) I see a convergence as possible within the next decade.

Possible, yes. Likely, no. Worth being exposed to - sure.

Wow, nice article, well laid out and very comprehensive!!