Athabasca Energy - the poster boy for "buybacks"

Or not? I am still looking for evidence of a benefit.

At year end 2023, Athabasca reported shares outstanding of 574,412,564, over 6 million moer than at December 31, 2023 on a “weighted average basis”. This is after spending $158.6 million to buy back 44 million shares during 2023.

The actual year end count was 572, 352,204, a bit lower than the “weighted average” but still 42 million shares higher than the 530,844,591 shares outstanding at year end 2021 and only 14 million less than the year end 2022 figure. The $158.6 million outflow was mildly offset by $79 million received from stock options and warrants exercised.

Athabasca shareholders seem agog at the progress in “returning cash to shareholders” describing the Athabasca approach as the Buyback/efficiency/capex model which apparently “has been executed perfectly”.

Those shareholders received none of the $158 million except to the extent they sold all or a portion of the shares Athabasca repurchased. They seem to correlate the rise in Athabasca’s trading price with the “buybacks”.

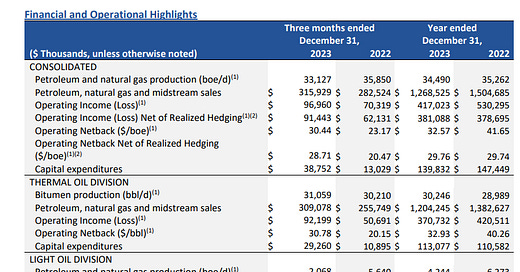

I am so old-fashioned I thought the rising share price might have had something to do with the dramatic improvement in operating cash flow arising from the firm oil price . . .

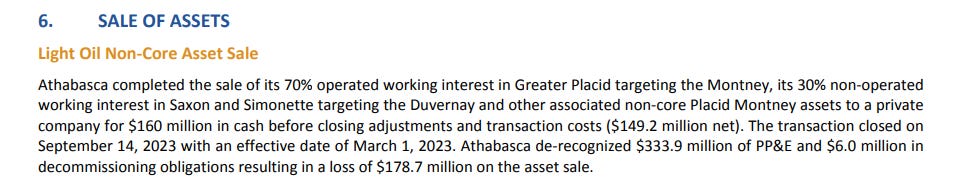

and the reduction in debt from sale of certain assets (at a loss). I still think selling assets at a loss is not a great outcome and points to some weaknesses in stewardship at some point.

But I guess is must have been the perfect execution of the buyback/efficiency/capex model.

My bad.

A 20-20 hindsight analysis leads me to a different conclusion. Had the total of about $217 million spent on buybacks been “returned to shareholders” as dividends, the resulting enterprise value would be the same (since the cash is gone in both cases) with the only “benefit” being fewer shares. The current share count is 557,589,915.

With the share price at about $5.00 the enterprise value today is about $5.00 x 557,589,575 = $2,787,949,575. Dividing by the 586,489,001 shares at year end 2022 gives $4.75 a share but, of course, all shareholders would have received a dividend of $217 million or $0.36 per share for a total of about $5.00 after-taxes (31% tax rate giving effect to the dividend tax credit and the highest marginal rate).

Maybe it will all work out well, or maybe commodity prices will tank and it won’t. That is in common with a dividend or buyback strategy.

But if commodity prices do tank, Athabasca investors cheering buybacks will lose their shirts and those that prefer dividends (had Athabasca gone that route) would still have the dividends to reinvest at the lower trading prices if they liked the story.

Tell me again about the benefits of the buybacks? If you kept your shares you didn’t get any of the money and to realize a benefit you have to sell your shares and deal with the capital gains tax, which if you had a sizeable position, triggered a 66% inclusion rate.

The constant dilution of so many companies shares drives me crazy. I get the compensation aspect but the common share holder gets the short end of the stick on these massive options and warrants packages. If they want big bonuses run the business painfully efficient and collect higher salaries from the proceeds. Great article, the buy backs sound great in theory until you put the actual numbers out there!

read these two for input:

1) shares outstanding - look at the 5 yr chart: https://ycharts.com/companies/ATH.TO/shares_outstanding

2) Oct 2021 convertible debt financing: https://www.atha.com/uploads/Athabasca_Closes_US350_million_Senior_Secured_Notes_Refinancing_10-25-2021.pdf