Arizona Sonoran is an undervalued copper play

Markets hate junior miners

Arizona Sonoran Copper Company (ASUC) is a small capitalization copper developer trading on the Toronto Stock Exchange at about CDN$1.36 a share. The company was subject of a discussion on BNN today where Jean-Francois Tardif, one of my favorite analysts, described the company’s shares as undervalued and reacting negatively to a Preliminary Economic Assessment (PEA) that returned only a 15% internal rate of return on development of the company’s Cactus deposit in Arizona. That estimated return is a victim of its assumptions, the primary one being a copper price of US$3.35 a pound. With respect to the authors of the PEA, neither they nor I know what future commodity prices will be for copper or any other world commodity.

What we do know is there is a substantial risk of a copper shortage as left wing governments promote electric vehicles (EV’s) that use about three times as much copper per vehicle as internal combustion engine (ICE) vehicles and the dreams of an electrified light vehicle market imply demand for copper that far exceeds supply. Shortages of both battery metals and copper will very likely stall the take up of EV’s but the pressure on copper prices won’t go away, since a great deal of copper is going to be needed to build out the upgraded grid needed to support even a modest growth in EV use.

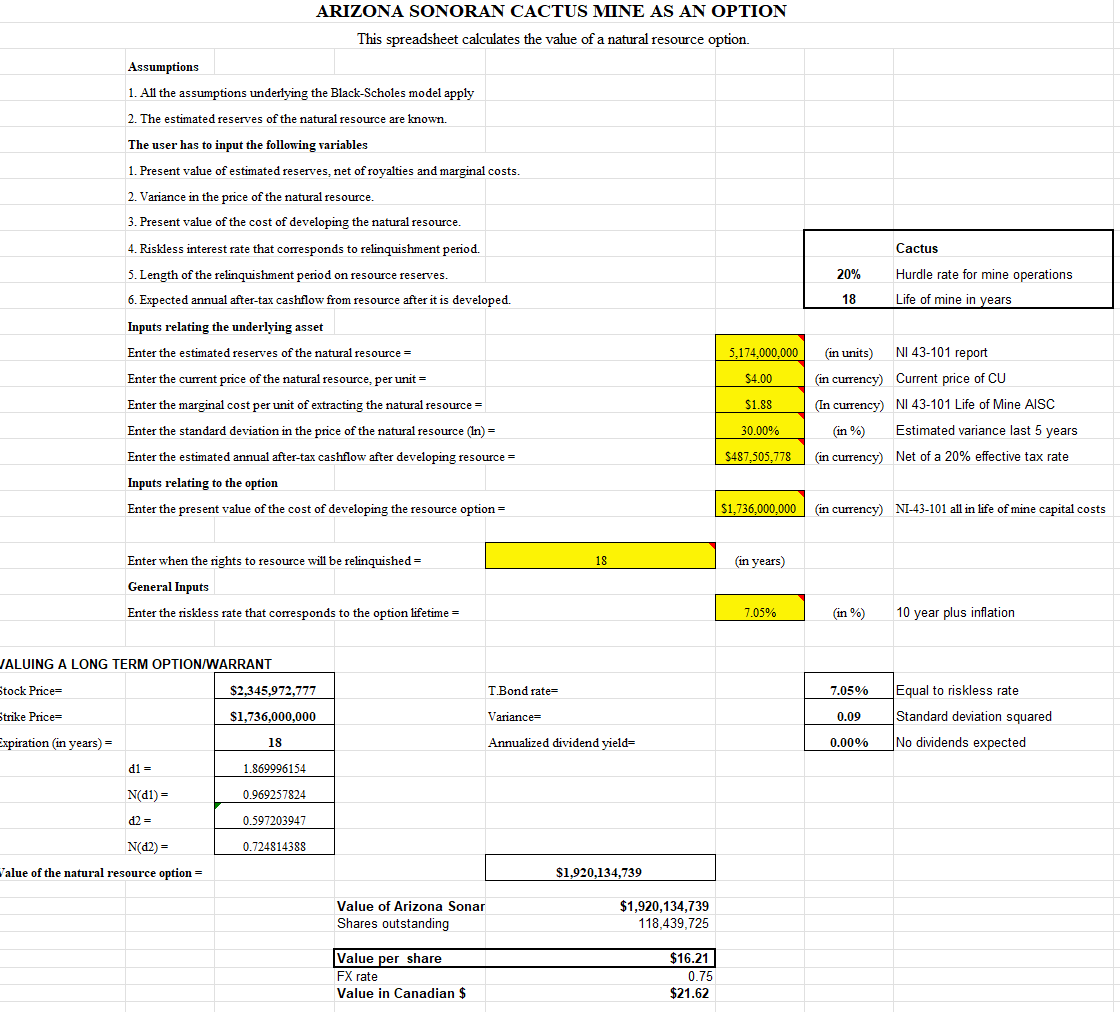

The most robust way to value a commodity based company’s reserves is a modified Black Scholes methodology which, instead of relying on a forecast of the commodity price, accepts that the commodity price is log normally distributed with a slight upward bias and is a stochastic approach to valuation.

In the case of Arizona Sonoran, a Black Scholes valuation using the capital and operating costs estimates in the NI 43-101 report prepared independently of the company returns a value of about CDN$20 a share for ACUS based on a 20% after tax hurdle rate for the mine once in production. While the PEA does not include estimated taxes, I have assumed an effective tax rate of 20% in Arizona, slightly less than the statutory 21% tax rate to reflect the tax shield from deduction of capital costs over the life of mine and related credits. There is a risk U.S. tax rates will rise to 28% if Biden is re-elected

The initial capital cost to develop the deposit into a producing mine is an estimated U.S. $124 million, well within the ability of the company to finance without massive dilution. If the company were to issue 50 million shares at CDN$1.30 or so, the share count would rise to ~170 million and the mine could be financed with debt or a streaming royalty. It is hard to imagine a scenario where future dilution to raise needed capital would reduce the estimated per share value below CDN$10.00 a share.

The analysis does not include any value for the estimated 2.2 billion pounds of inferred copper reserves, nor any benefit from the additional drilling underway. The company has a current cash balance of about CDN$10 million which is likely enough to get to the permitted stage.

Junior mines are fraught with risk, but Arizona is a mining friendly jurisdiction and the desire of all political parties to develop domestic sources of metals like copper suggest little sovereign risk. The real risks in these shares is failure to become permitted, capital cost over runs, or a collapse in copper prices once in production. Those are real risks, not imagined, and investors should be cautious. But in my opinion, a small position in Arizona Sonaran shares is a worthwhile speculation for long term appreciation. I agree with Jean-Francois Tardif’s conclusion these shares are undervalued.

Very detailed analysis here:

https://www.cruxinvestor.com/posts/analysts-notes-week-22