Alexandra Ocasio-Cortez (AOC) is one of the so-called “Squad” who rants about “income inequality” and “corporate greed” promoting extreme measures to “tax the rich” to pay for a redistribution of wealth from those who have created it to those who have not. Senator Bernie Sanders (Sanders) is a similarly loud voice incessantly calling out “corporate greed” and demanding the rich “pay their fair share”. What exactly is the “fair share” someone who has earned wealth should pay to someone who has not?

Since the election of Joe Biden in 2020 the far left wing of the Democratic Party has been flexing its muscles and promoting drastic increases in taxation on the richest Americans to provide funding for a plethora of freebies for ordinary Americans - things like paid day care; paid days off; universal health care; bailouts of so-called “Blue States” that have overspent their budgets; and, a massive expenditure on “climate change” called the Green New Deal (GND). The targets of this attack are easy to identify and include the founders of some of the most successful American companies.

It is interesting to see who some of these titans of industry are and what comprises a large portion of the “wealth” the left wishes to tax. Here is a snapshot of seven of them whose wealth includes the trading value of the shares of companies they founded which approaches $1 trillion for their holdings.

Given the vitriol underlying the attack on these wealthy people, it is easy to overlook the value they have created for American society. As a starting point, their companies today employ over 3.5 million Americans, or about one in 50 of all Americans with jobs. Those employees pay taxes and I estimate the taxes they pay is on the order of $70 billion annually (about $20,000 per year per employee). The claim that the “rich don’t pay their fair share” seems hollow when seen in the context of the tax revenue from the jobs they have created, which is in addition to the taxes they pay personally.

The so-called “wealth” of these individuals is a market phenomenon, not cash in some bank account. The bulk of that “wealth” comprises the trading price of the shares of the companies they founded multiplied by the number of shares they own. Taxing that wealth compels these successful entrepreneurs to sell shares, driving down the market price of the respective stock and reducing the “wealth” AOC and Sanders see as the goose that lays the golden eggs. How long before that forced selling eliminates the wealth the left seeks to tax?

One of the benefits of wealth is the ability to move to a different jurisdiction. Tax havens exist across the globe from Bermuda to the Cayman Islands to Costa Rica and The Bahamas. One sure way to encourage the handful of people who make the greatest contributions to the success of the Republic to leave is to punish them for their success. Wealth taxes have been attempted in several countries only to later be repealed for what should be obvious reasons - they are costly to administer; generate relatively little revenue; and, see a flight of capital from the jurisdiction where imposed. The history of these foolish attempts to “tax the rich” is well documented.

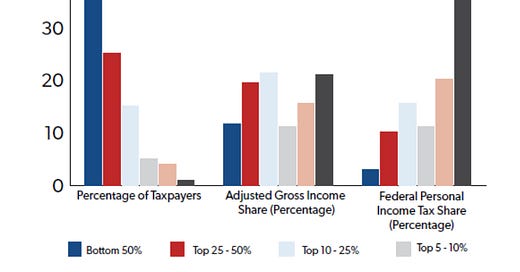

The pretense that the rich do not pay taxes is politically attractive but demonstrably untrue. The top 1% of American taxpayers pay 40% of all taxes collected, and the top 25% pay 87% according to the National Taxpayers Union Foundation. The bottom 50% pay less than 5% of all taxes.

It is interesting to see leading Democrats like Nancy Pelosi jump on the “tax the rich” bandwagon when you see where her own “wealth” comes from and it is not from her salary as a public servant. Pelosi and her husband enjoy remarkable success in the stock market, with their portfolios dramatically outperforming the rates of returns on Amazon.com, Tesla or Microsoft over the past 10 years.

Pelosi’s success in “stock picking” might have something to do with her ability to know what legislation Congress contemplates passing before the investing public, and choose investments that stand to benefit. For example, any investigation might expose that her husband may have purchased Tesla shares only a few days before a federal government subsidy of Tesla’s was announced. Insider trading is like shooting ducks in a barrel and a 2.4 million percentage rate of return looks a lot like ducks in a barrel to me.

Pelosi is worth an estimated $120 million, and it is unlikely that comprises savings from her $223,000 annual salary. Her husband’s timing on recent investments such as Google was impeccably timed in relation to a vote on reigning in Big Tech. It does not take a rocket scientist to conclude the possibility of inside information underlay the timing of several of his investment successes.

AOC was a bartender before becoming a Congresswoman, and he attendance at the Met Gala (ticket price over $30,000) wearing a dress with the label “Tax The Rich” in blood red sewn on is conclusive evidence of envy if not outright hypocrisy. The left’s attack on rich Americans is more an attack on success than any attempt to narrow the growing income inequality in America. The motive for such an attack is envy, not fairness.

America has long been the land of opportunity. Democrats want to put and end to that and it make it the land of diminished freedoms, more government controls over every aspect of life, and, a society based on welfare rather than effort and merit. A robust social safety net already exists and can be improved, but the destruction of the institutions that have been the foundation of American since Independence Day cannot improve the well being of anyone except the left wing leaders who seek that outcome.

Envy is one of Biblical “Seven Deadly Sins”. It should not be part of the American government’s institutions.